Question

A company has 10 000 ordinary shares and 10 000 10% R2 preference shares in issue throughout 2023. The profit after tax is R100

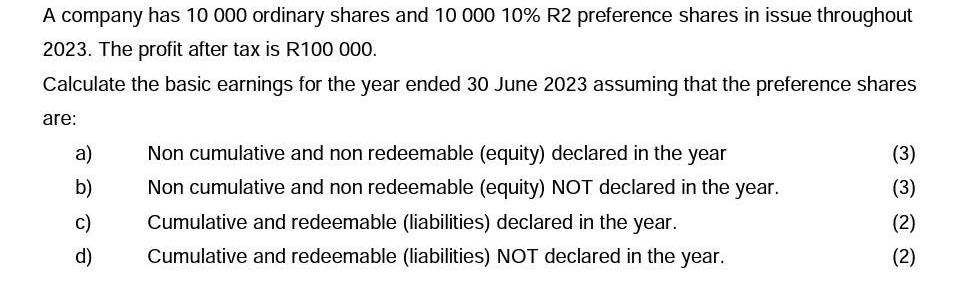

A company has 10 000 ordinary shares and 10 000 10% R2 preference shares in issue throughout 2023. The profit after tax is R100 000. Calculate the basic earnings for the year ended 30 June 2023 assuming that the preference shares are: a) b) C) d) Non cumulative and non redeemable (equity) declared in the year Non cumulative and non redeemable (equity) NOT declared in the year. Cumulative and redeemable (liabilities) declared in the year. Cumulative and redeemable (liabilities) NOT declared in the year. (3) (3) (2) (2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Basic Earnings Per Share BEPS is calculated by dividing the profit after tax by the weighted average number of shares outstanding during the period Fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Craig Deegan

9th Edition

1743767382, 9781743767382

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App