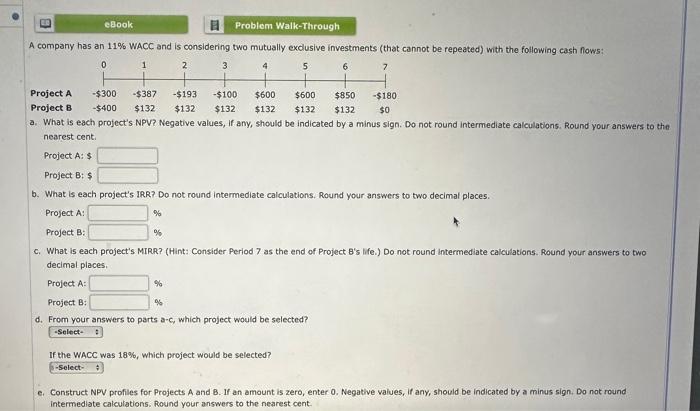

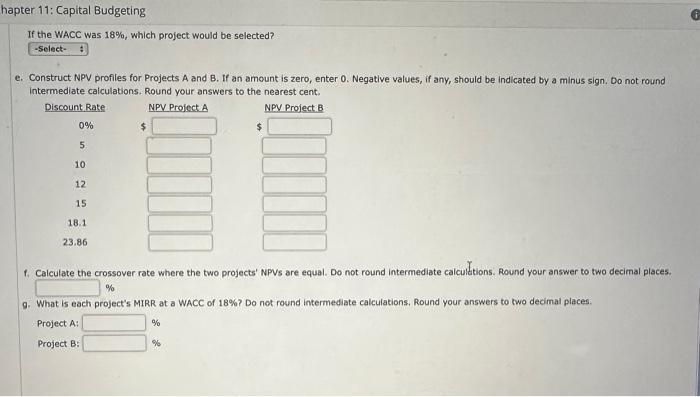

A company has an 1.1% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows: Project Project a. What is each profect's NPV? Negative values, If any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest cent. Project A: \$ Project B: \$ b. What is each project's IRR? Do not round intermediate calculations. Round your answers to two decimal places. Project A: % Project B: % c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) Do not round Intermediate calculations. Round your answers to two decimal places. Project A: % Project B: % d. From your answers to parts a-c, which project would be selected? If the WACC was 18%, which project would be selected? e. Construct NPV profiles for Projects A and B. If an amount is zero, enter 0 . Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest cent. If the WACC was 18%, which project would be selected? e. Construct NPV profiles for Projects A and B. If an amount is zero, enter 0 . Negative values, if any, should be indicated by a minus sign. Do not round intermediate caiculations. Round your answers to the nearest cent, f. Calculate the crossover rate where the two projects' NPVs are equal. Do not round intermediate calcultitions. Round your answer to two decimal places. % 9. What is each project's MIRR at a WACC of 18% ? Do not round intermediate calculations. Round your answers to two decimal places: Project A: % Project B: \% A company has an 1.1% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows: Project Project a. What is each profect's NPV? Negative values, If any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest cent. Project A: \$ Project B: \$ b. What is each project's IRR? Do not round intermediate calculations. Round your answers to two decimal places. Project A: % Project B: % c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) Do not round Intermediate calculations. Round your answers to two decimal places. Project A: % Project B: % d. From your answers to parts a-c, which project would be selected? If the WACC was 18%, which project would be selected? e. Construct NPV profiles for Projects A and B. If an amount is zero, enter 0 . Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest cent. If the WACC was 18%, which project would be selected? e. Construct NPV profiles for Projects A and B. If an amount is zero, enter 0 . Negative values, if any, should be indicated by a minus sign. Do not round intermediate caiculations. Round your answers to the nearest cent, f. Calculate the crossover rate where the two projects' NPVs are equal. Do not round intermediate calcultitions. Round your answer to two decimal places. % 9. What is each project's MIRR at a WACC of 18% ? Do not round intermediate calculations. Round your answers to two decimal places: Project A: % Project B: \%