Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company has beginning inventory of 300 units at $19 each; They purchased 400 units at $6.68 each on June 2; On June 15 ,

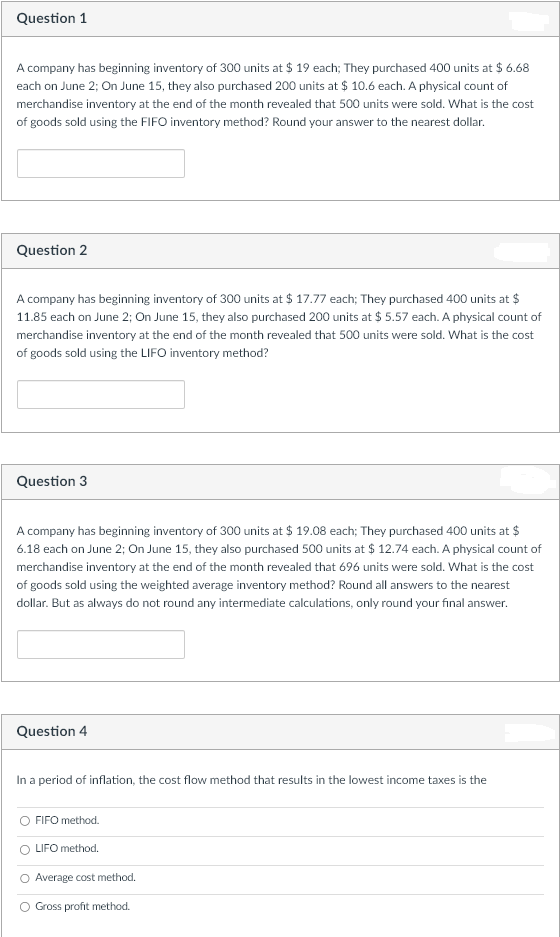

A company has beginning inventory of 300 units at $19 each; They purchased 400 units at $6.68 each on June 2; On June 15 , they also purchased 200 units at $10.6 each. A physical count of merchandise inventory at the end of the month revealed that 500 units were sold. What is the cost of goods sold using the FIFO inventory method? Round your answer to the nearest dollar. Question 2 A company has beginning inventory of 300 units at $17.77 each; They purchased 400 units at \$ 11.85 each on June 2; On June 15 , they also purchased 200 units at $5.57 each. A physical count of merchandise inventory at the end of the month revealed that 500 units were sold. What is the cost of goods sold using the LIFO inventory method? Question 3 A company has beginning inventory of 300 units at $19.08 each; They purchased 400 units at $ 6.18 each on June 2 ; On June 15 , they also purchased 500 units at $12.74 each. A physical count of merchandise inventory at the end of the month revealed that 696 units were sold. What is the cost of goods sold using the weighted average inventory method? Round all answers to the nearest dollar. But as always do not round any intermediate calculations, only round your final answer. Question 4 In a period of inflation, the cost flow method that results in the lowest income taxes is the FIFO method. LIFO method. Average cost method. Gross profit method

A company has beginning inventory of 300 units at $19 each; They purchased 400 units at $6.68 each on June 2; On June 15 , they also purchased 200 units at $10.6 each. A physical count of merchandise inventory at the end of the month revealed that 500 units were sold. What is the cost of goods sold using the FIFO inventory method? Round your answer to the nearest dollar. Question 2 A company has beginning inventory of 300 units at $17.77 each; They purchased 400 units at \$ 11.85 each on June 2; On June 15 , they also purchased 200 units at $5.57 each. A physical count of merchandise inventory at the end of the month revealed that 500 units were sold. What is the cost of goods sold using the LIFO inventory method? Question 3 A company has beginning inventory of 300 units at $19.08 each; They purchased 400 units at $ 6.18 each on June 2 ; On June 15 , they also purchased 500 units at $12.74 each. A physical count of merchandise inventory at the end of the month revealed that 696 units were sold. What is the cost of goods sold using the weighted average inventory method? Round all answers to the nearest dollar. But as always do not round any intermediate calculations, only round your final answer. Question 4 In a period of inflation, the cost flow method that results in the lowest income taxes is the FIFO method. LIFO method. Average cost method. Gross profit method Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started