Answered step by step

Verified Expert Solution

Question

1 Approved Answer

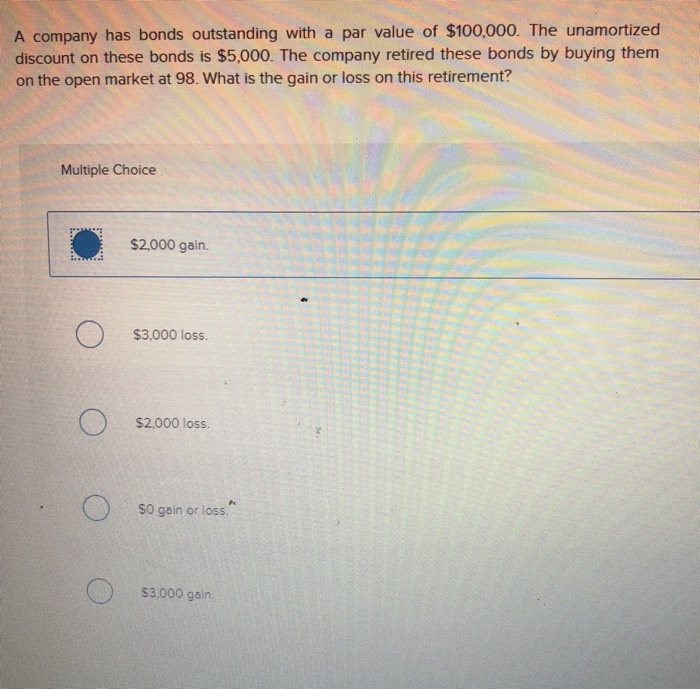

A company has bonds outstanding with a par value of $100,000. The unamortized discount on these bonds is $5,000. The company retired these bonds by

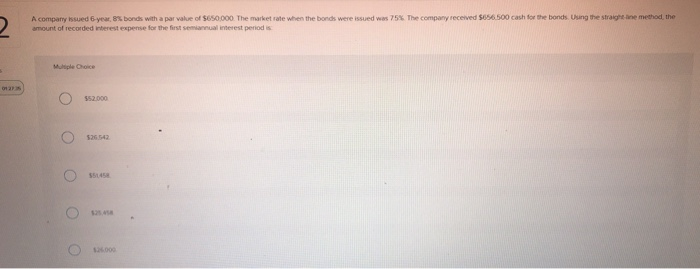

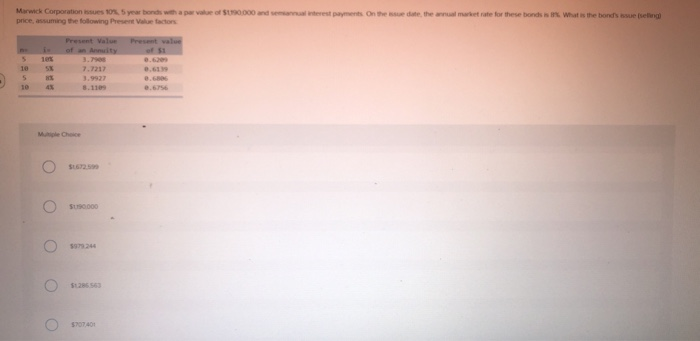

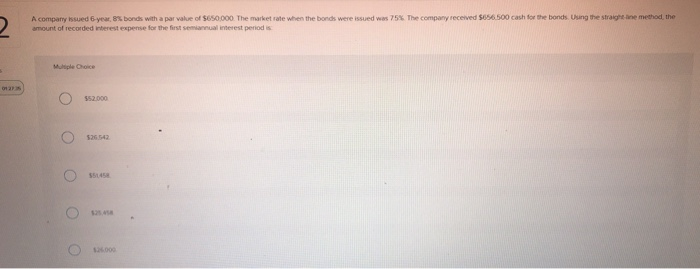

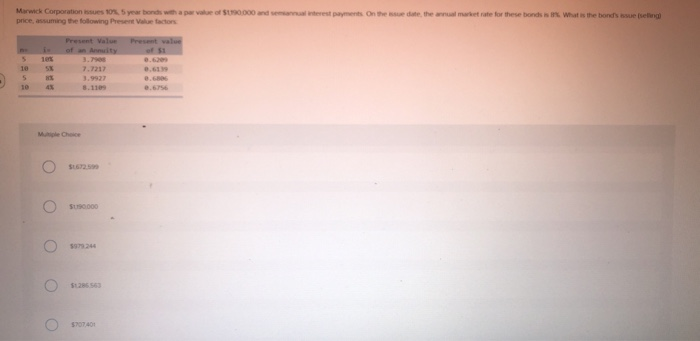

A company has bonds outstanding with a par value of $100,000. The unamortized discount on these bonds is $5,000. The company retired these bonds by buying them on the open market at 98. What is the gain or loss on this retirement? Multiple Choice $2,000 gain. $3,000 l. $2,000 l. so gn r loss s3,000 gain A company issued 6 years bonds with a parole of 650.000 The market rate when the bonds were issued was 75% The company received $656500 cash for the bonds. Using the stran e method the amount of recorded interest expense for the first se a rest periods Ossa o o o o of Os Marwick Corporation s on 5 year bonds with a par value of 10000 de price, assuming the following Present Value factors a rest payments on the date the market rate for these bonds What is the bonds we selling Present value Present Value of Annuity 10 . SU000 S1286

A company has bonds outstanding with a par value of $100,000. The unamortized discount on these bonds is $5,000. The company retired these bonds by buying them on the open market at 98. What is the gain or loss on this retirement? Multiple Choice $2,000 gain. $3,000 l. $2,000 l. so gn r loss s3,000 gain A company issued 6 years bonds with a parole of 650.000 The market rate when the bonds were issued was 75% The company received $656500 cash for the bonds. Using the stran e method the amount of recorded interest expense for the first se a rest periods Ossa o o o o of Os Marwick Corporation s on 5 year bonds with a par value of 10000 de price, assuming the following Present Value factors a rest payments on the date the market rate for these bonds What is the bonds we selling Present value Present Value of Annuity 10 . SU000 S1286

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started