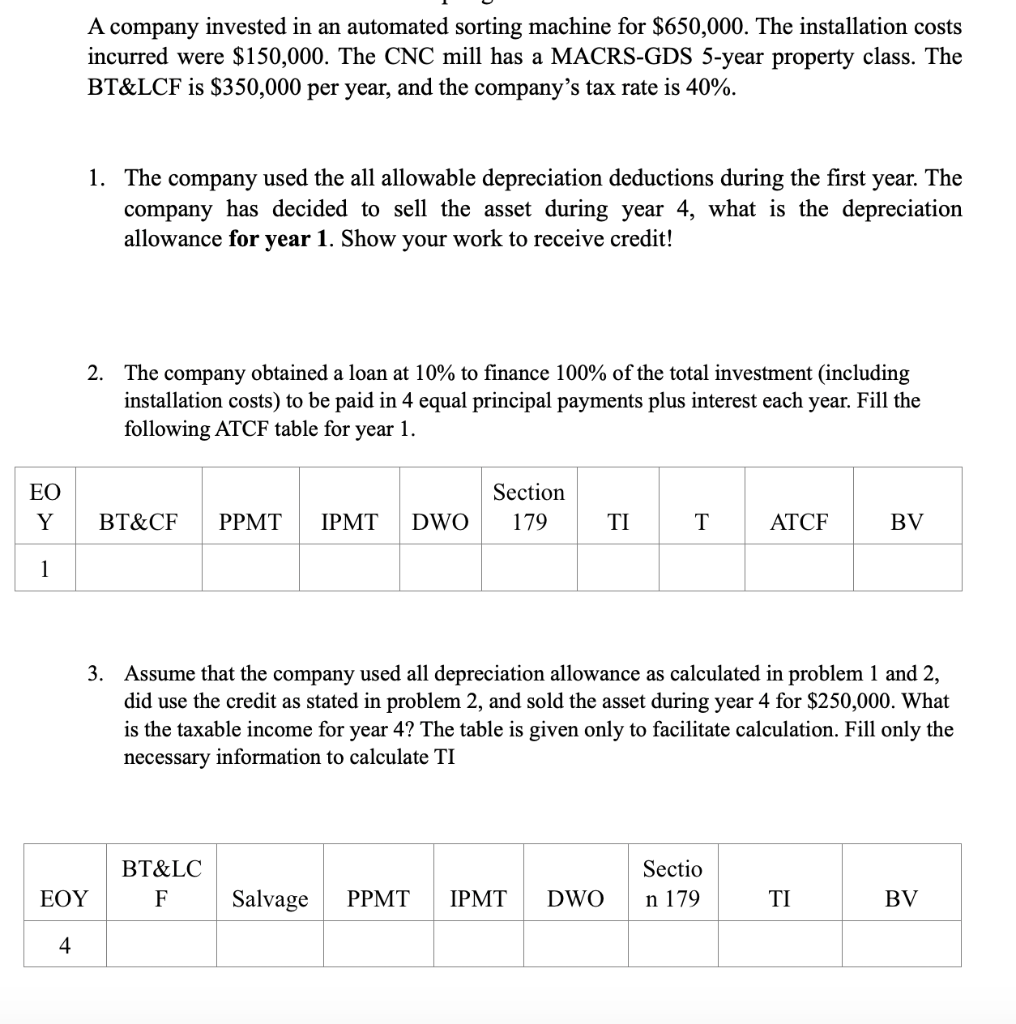

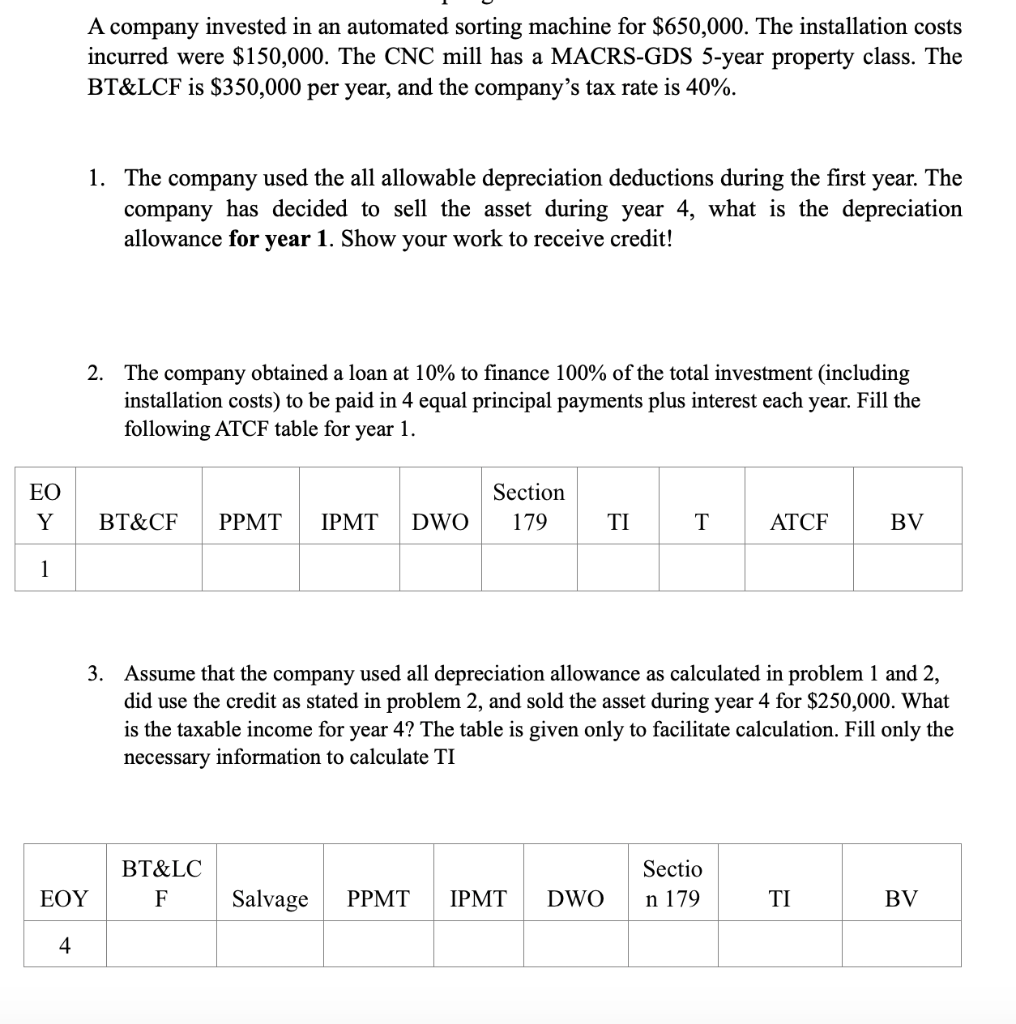

A company invested in an automated sorting machine for $650,000. The installation costs incurred were $150,000. The CNC mill has a MACRS-GDS 5-year property class. The BT&LCF is $350,000 per year, and the company's tax rate is 40%. 1. The company used the all allowable depreciation deductions during the first year. The company has decided to sell the asset during year 4, what is the depreciation allowance for year 1. Show your work to receive credit! 2. The company obtained a loan at 10% to finance 100% of the total investment (including installation costs) to be paid in 4 equal principal payments plus interest each year. Fill the following ATCF table for year 1. FO Y BT&CF PPMT IPMT DWO Section 179 TIT ATCF BV 3. Assume that the company used all depreciation allowance as calculated in problem 1 and 2, did use the credit as stated in problem 2, and sold the asset during year 4 for $250,000. What is the taxable income for year 4? The table is given only to facilitate calculation. Fill only the necessary information to calculate TI EOY BT&LC F Salvage PPM IPMT DWO Sectio n 179 TI BV 4 A company invested in an automated sorting machine for $650,000. The installation costs incurred were $150,000. The CNC mill has a MACRS-GDS 5-year property class. The BT&LCF is $350,000 per year, and the company's tax rate is 40%. 1. The company used the all allowable depreciation deductions during the first year. The company has decided to sell the asset during year 4, what is the depreciation allowance for year 1. Show your work to receive credit! 2. The company obtained a loan at 10% to finance 100% of the total investment (including installation costs) to be paid in 4 equal principal payments plus interest each year. Fill the following ATCF table for year 1. FO Y BT&CF PPMT IPMT DWO Section 179 TIT ATCF BV 3. Assume that the company used all depreciation allowance as calculated in problem 1 and 2, did use the credit as stated in problem 2, and sold the asset during year 4 for $250,000. What is the taxable income for year 4? The table is given only to facilitate calculation. Fill only the necessary information to calculate TI EOY BT&LC F Salvage PPM IPMT DWO Sectio n 179 TI BV 4