Answered step by step

Verified Expert Solution

Question

1 Approved Answer

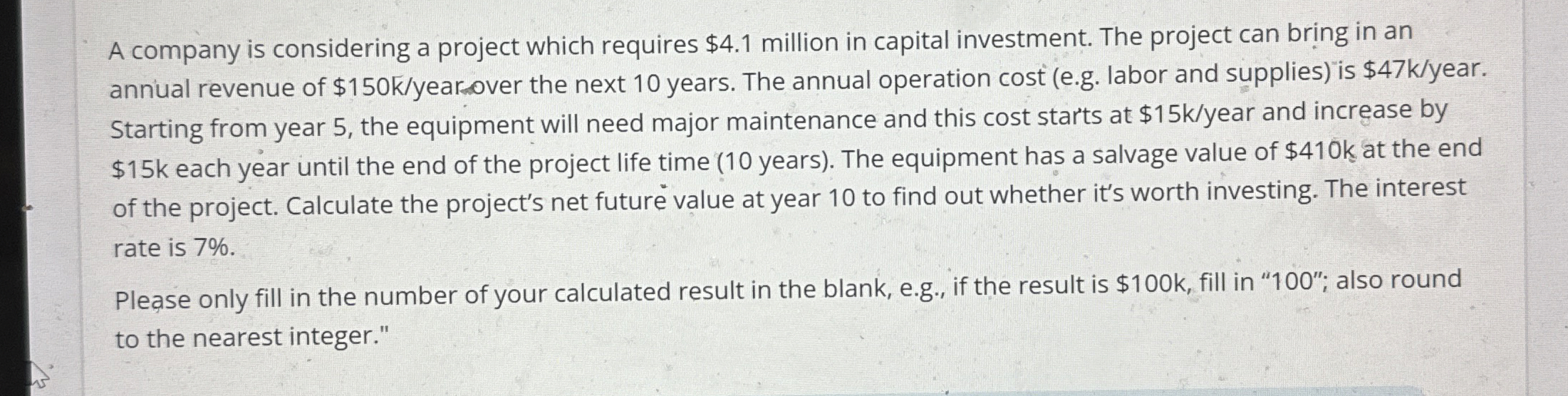

A company is considering a project which requires $ 4 . 1 million in capital investment. The project can bring in an annual revenue of

A company is considering a project which requires $ million in capital investment. The project can bring in an

annual revenue of $ yearsover the next years. The annual operation cost eg labor and supplies is $ year.

Starting from year the equipment will need major maintenance and this cost starts at $ear and increase by

$ each year until the end of the project life time years The equipment has a salvage value of $ at the end

of the project. Calculate the project's net future value at year to find out whether it's worth investing. The interest

rate is

Please only fill in the number of your calculated result in the blank, eg if the result is $ fill in ; also round

to the nearest integer."

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started