Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is considering investing in a new information management system that will cost $2.0 million to buy and $30,000 to install. The system

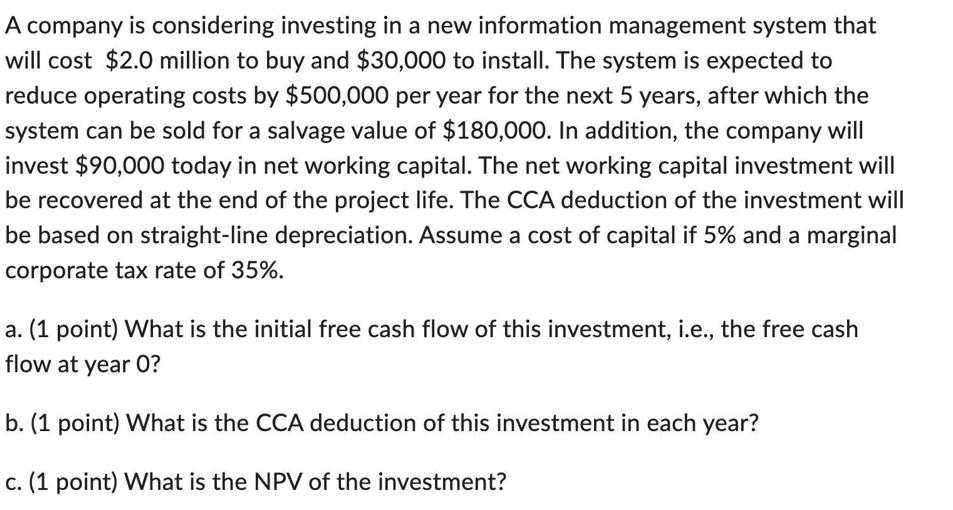

A company is considering investing in a new information management system that will cost $2.0 million to buy and $30,000 to install. The system is expected to reduce operating costs by $500,000 per year for the next 5 years, after which the system can be sold for a salvage value of $180,000. In addition, the company will invest $90,000 today in net working capital. The net working capital investment will be recovered at the end of the project life. The CCA deduction of the investment will be based on straight-line depreciation. Assume a cost of capital if 5% and a marginal corporate tax rate of 35%. a. (1 point) What is the initial free cash flow of this investment, i.e., the free cash flow at year O? b. (1 point) What is the CCA deduction of this investment in each year? c. (1 point) What is the NPV of the investment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the initial free cash flow of the investment year 0 we need to consider the initial i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started