Question

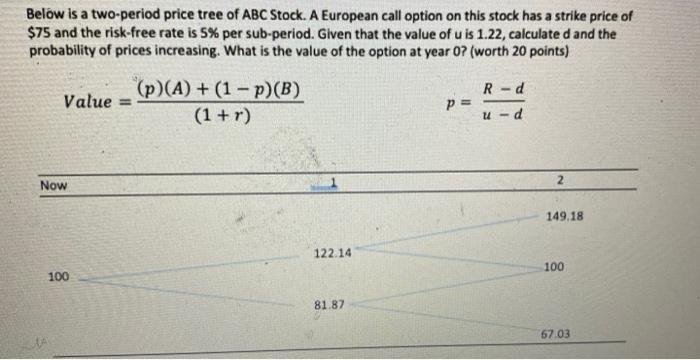

Below is a two-period price tree of ABC Stock. A European call option on this stock has a strike price of $75 and the

Below is a two-period price tree of ABC Stock. A European call option on this stock has a strike price of $75 and the risk-free rate is 5% per sub-period. Given that the value of u is 1.22, calculate d and the probability of prices increasing. What is the value of the option at year 0? (worth 20 points) Value= (p)(A)+(1-p)(B) (1+r) R-d p = u-d Now 2 149.18 122.14 100 100 81.87 67.03

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the value of d and the probability of prices increasing we can use the formulas provided in the question First we need to find the value of d using the formula ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management Science The Art Of Modeling With Spreadsheets

Authors: Stephen G. Powell, Kenneth R. Baker

4th Edition

978-1118517376, 9781118800348, 1118517377, 1118800346, 978-1118582695

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App