Question

A company is considering investing in four bonds; $1 million is available for investment. The expected annual return, the worst-case annual return on each bond,

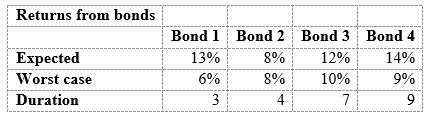

A company is considering investing in four bonds; $1 million is available for investment. The expected annual return, the worst-case annual return on each bond, and the duration of each bond are given below:

Bond returns (The duration of a bond is a measure of the bond's sensitivity to interest rates.) The company wants to maximize the expected return from its bond investments, subject to three constraints:

* The worst-case return of the bond portfolio must be at least 8%.

* The average duration of the portfolio must be at most 6.

* Because of diversification requirements, at most 40% of the total amount invested can be invested in a single bond.

Determine how the company can maximize the expected return on its investment.

a) What the the expected return of the optimized portfolio? (answer in percent to two decimals) %

b) What is the total expected return? (no commas or $-sign)

c) How much is invested in the highest (expected) yielding bond? (no commas or $-sign)

d) Which, if any, bond(s) received no investment? (answer with number)

Returns from bonds \begin{tabular}{|l|r|r|r|r|r|} \hline & Bond 1 & Bond 2 & Bond 3 & Bond 4 \\ \hline Expected & 13% & 8% & 12% & 14% \\ \hline Worst case & 6% & 8% & 10% & 9% \\ \hline Duration & 3 & 4 & 7 & 9 \\ \hline \end{tabular} Returns from bonds \begin{tabular}{|l|r|r|r|r|r|} \hline & Bond 1 & Bond 2 & Bond 3 & Bond 4 \\ \hline Expected & 13% & 8% & 12% & 14% \\ \hline Worst case & 6% & 8% & 10% & 9% \\ \hline Duration & 3 & 4 & 7 & 9 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started