Question

A company is considering the purchase of a capital asset for $100,000. Installation charges needed to make the asset for serviceable will total $30,000. The

A company is considering the purchase of a capital asset for $100,000. Installation charges needed to make the asset for serviceable will total $30,000. The asset will be depreciated over six years using the straight-line method and an estimated salvage value (SV6) of $10,000. The asset will be kept in service for six years, after which it will be sold for $20,000. During its useful life, it is estimated that the asset will produce annual revenues of $30,000. Operating and maintenance (O&M) costs are estimated to be $6,000 in the first year. These O&M costs are projected to increase by $1,000 per year each year thereafter. The after-tax MARR is 12% and the effective tax rate is 40%.

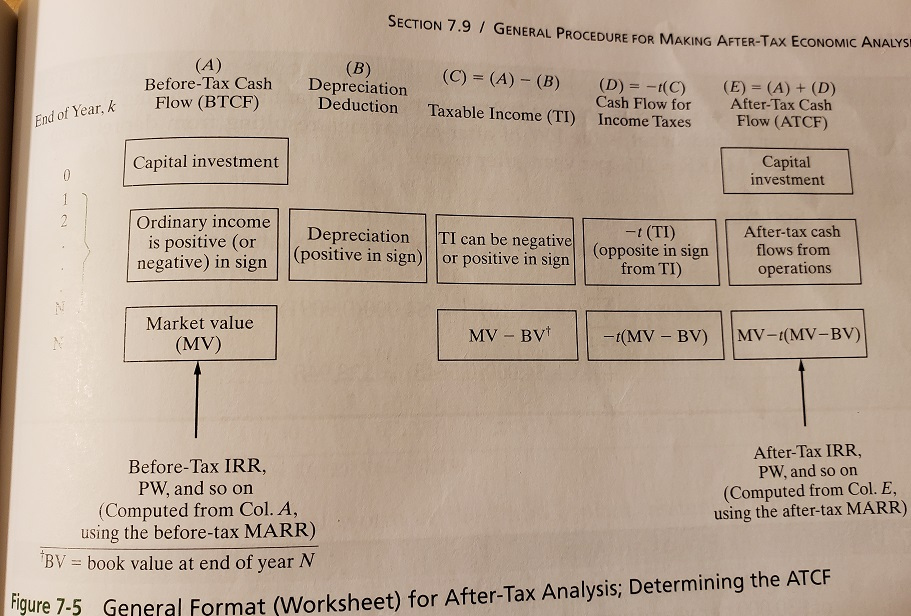

Use the tabular format given in Figure 7-5 to compute the after-tax cash flows.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started