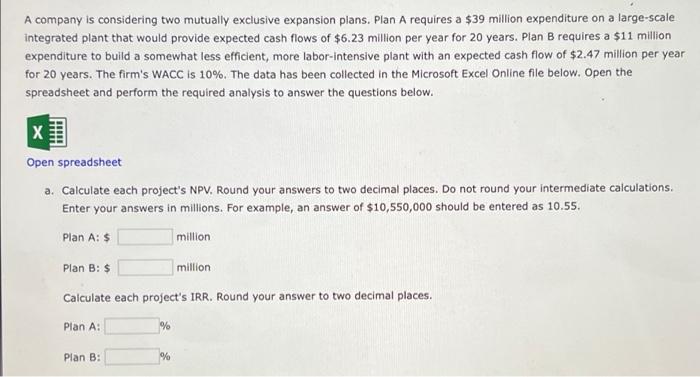

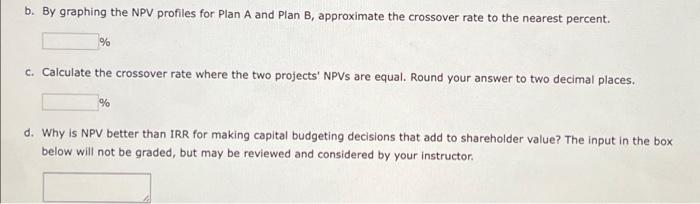

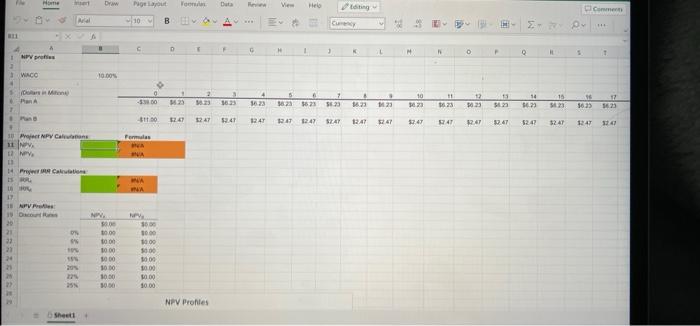

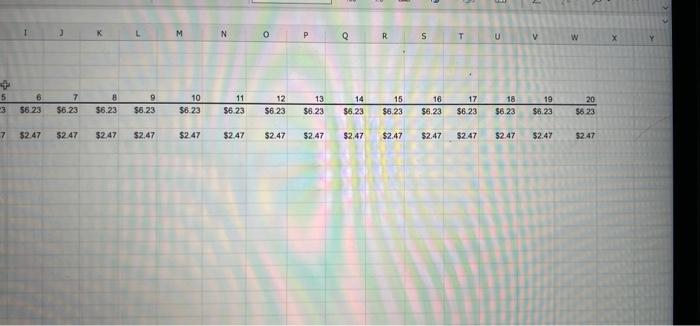

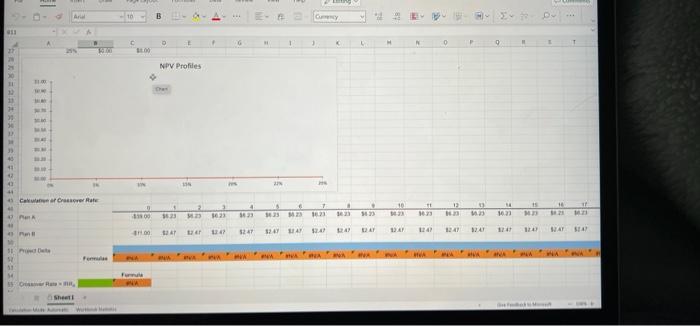

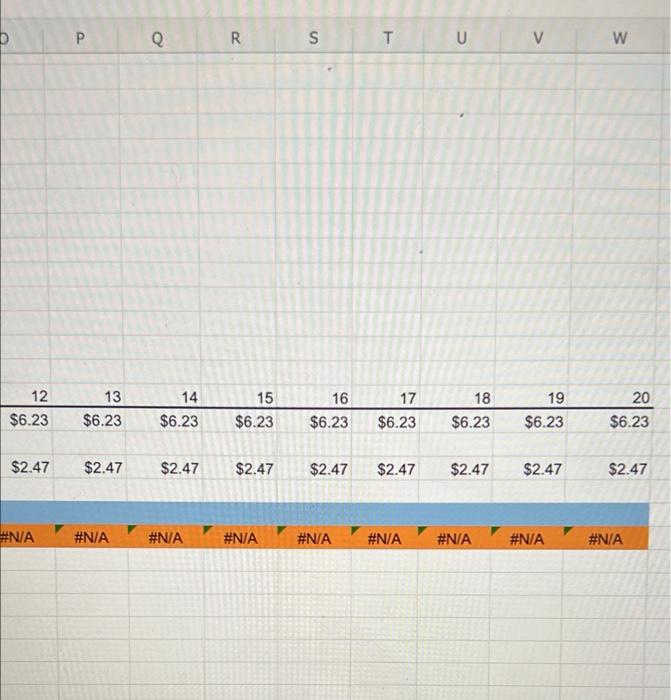

A company is considering two mutually exclusive expansion plans. Plan A requires a $39 million expenditure on a large-scale integrated plant that would provide expected cash flows of $6.23 million per year for 20 years. Plan B requires a $11 million expenditure to build a somewhat less efficient, more labor-intensive plant with an expected cash flow of $2.47 million per year for 20 years. The firm's WACC is 10%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. X Open spreadsheet a. Calculate each project's NPV. Round your answers to two decimal places. Do not round your intermediate calculations. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Plan A: $ million Plan B: $ million Calculate each project's IRR. Round your answer to two decimal places. Plan A: % Plan B % b. By graphing the NPV profiles for Plan A and Plan B, approximate the crossover rate to the nearest percent. % c. Calculate the crossover rate where the two projects' NPVs are equal. Round your answer to two decimal places. % d. Why is NPV better than IRR for making capital budgeting decisions that add to shareholder value? The input in the box below will not be graded, but may be reviewed and considered by your instructor Dr Von Duta Ve Hello Editing Pigelut 10 B Commen IN w V D 9 1 1 1 2 O 5 IT 1 NP profes WACO 10.00 Dotar Min 10 11 -3.900 CEM 23 CERE VV 3823 3523 $123 23 123 1623 $123 11 $123 14 SE? 15 $123 16 5635 1623 0011 24 17 23 12.41 1241 1211 12:47 24 1247 27 25 24 1747 247 1247 52.47 1247 14 Formas je NPV Calons 11. NY 14 Pre Calaton no NA WA 18 AVP 19 Decor 05 0001 3000 1000 to 10 5000 1000 0001 1000 10.00 30.00 0008 0001 SET 10.00 NPV Profiles Sheets L M 0 P Q R S V W 5 6 56.23 7 56.23 9 $6.23 10 $6 23 11 $6.23 12 $6.23 13 $6.23 14 $6.23 15 $6.23 16 $6.23 17 $6.23 IR 18 $6.23 19 $6.23 $6.23 20 $623 7 $2.47 $2.47 $2.47 $2.47 $247 $2.47 $2.47 $2.47 $2.47 $2.47 $2.47 $2.47 52.47 52.47 52.47 10 ITS 6 0 0 1 T ST 001 NPV Profiles Thes 11 WE 2 4 Carrera 10 11 13 15 16 13 3 4 3023 14 1023 383 3623 16 56332 W CH M 41 1241 HO SIAP 1241 5247 WAT 1241 5247 NA 11 1 OR Sheet P Q R S T T U V w 12 $6.23 13 $6.23 14 $6.23 15 $6.23 16 $6.23 17 $6.23 18 $6.23 19 $6.23 20 $6.23 $2.47 $2.47 $2.47 $2.47 $2.47 $2.47 $2.47 $2.47 $2.47 #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A