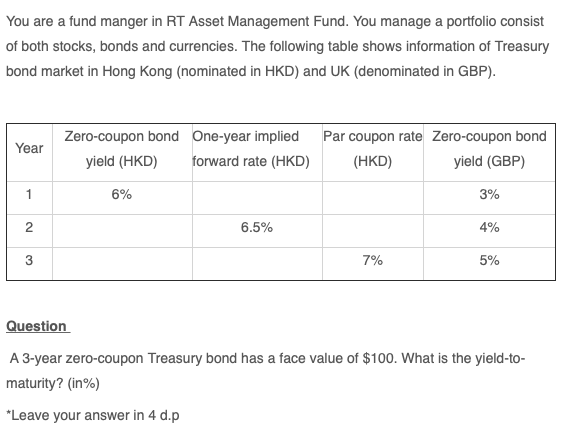

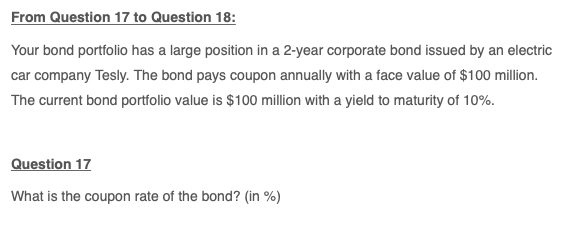

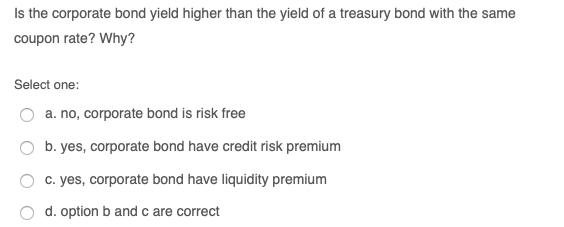

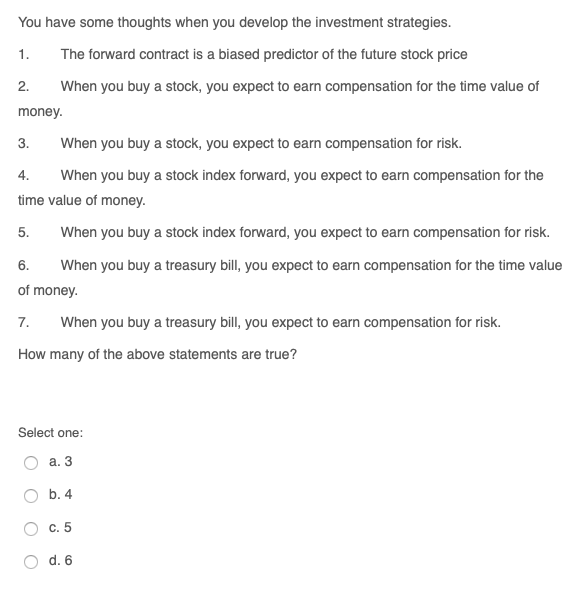

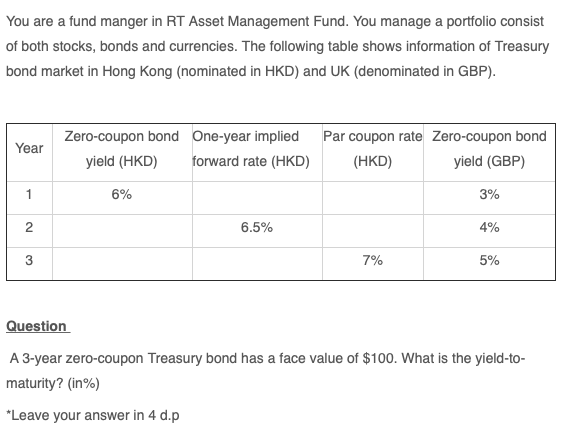

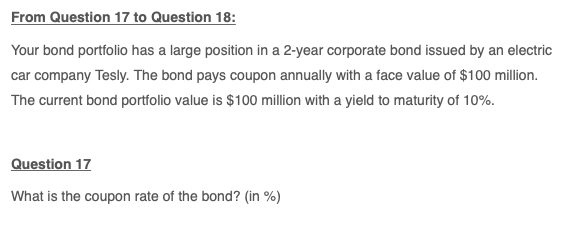

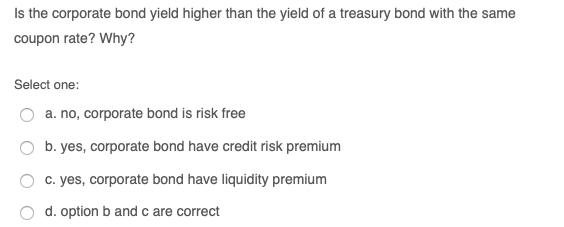

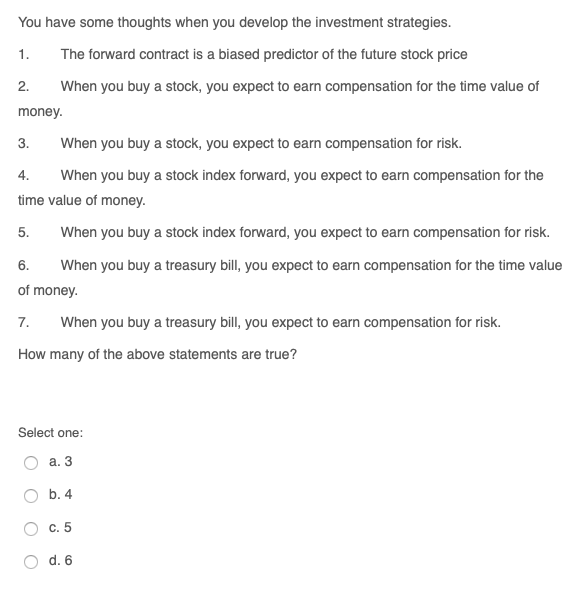

From Question 17 to Question 18: Your bond portfolio has a large position in a 2-year corporate bond issued by an electric car company Tesly. The bond pays coupon annually with a face value of $100 million. The current bond portfolio value is $100 million with a yield to maturity of 10%. Question 17 What is the coupon rate of the bond? (in %) Is the corporate bond yield higher than the yield of a treasury bond with the same coupon rate? Why? Select one: a. no, corporate bond is risk free b. yes, corporate bond have credit risk premium C. yes, corporate bond have liquidity premium d. option b and c are correct 2. You have some thoughts when you develop the investment strategies. 1. The forward contract is a biased predictor of the future stock price When you buy a stock, you expect to earn compensation for the time value of money. 3. When you buy a stock, you expect to earn compensation for risk. 4. When you buy a stock index forward, you expect to earn compensation for the time value of money. 5. When you buy a stock index forward, you expect to earn compensation for risk. 6. When you buy a treasury bill, you expect to earn compensation for the time value of money. 7. When you buy a treasury bill, you expect to earn compensation for risk. How many of the above statements are true? Select one: a. 3 b. 4 c. 5 c c d. 6 From Question 17 to Question 18: Your bond portfolio has a large position in a 2-year corporate bond issued by an electric car company Tesly. The bond pays coupon annually with a face value of $100 million. The current bond portfolio value is $100 million with a yield to maturity of 10%. Question 17 What is the coupon rate of the bond? (in %) Is the corporate bond yield higher than the yield of a treasury bond with the same coupon rate? Why? Select one: a. no, corporate bond is risk free b. yes, corporate bond have credit risk premium C. yes, corporate bond have liquidity premium d. option b and c are correct 2. You have some thoughts when you develop the investment strategies. 1. The forward contract is a biased predictor of the future stock price When you buy a stock, you expect to earn compensation for the time value of money. 3. When you buy a stock, you expect to earn compensation for risk. 4. When you buy a stock index forward, you expect to earn compensation for the time value of money. 5. When you buy a stock index forward, you expect to earn compensation for risk. 6. When you buy a treasury bill, you expect to earn compensation for the time value of money. 7. When you buy a treasury bill, you expect to earn compensation for risk. How many of the above statements are true? Select one: a. 3 b. 4 c. 5 c c d. 6