Answered step by step

Verified Expert Solution

Question

1 Approved Answer

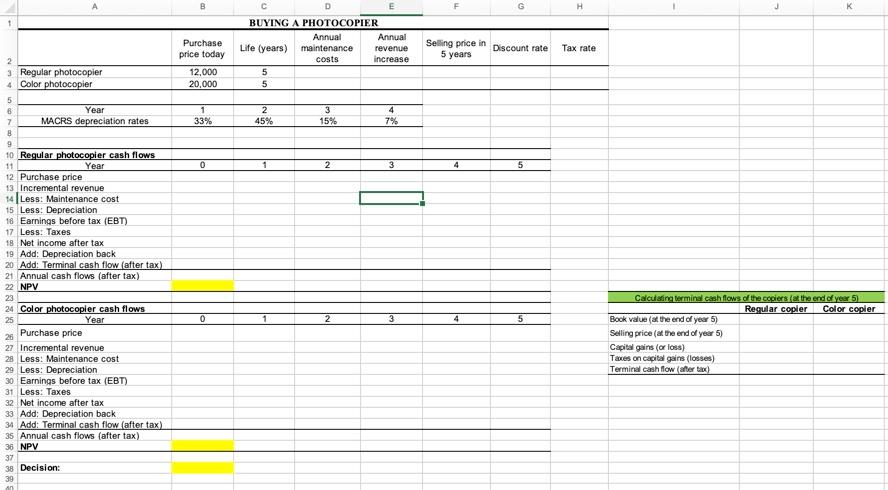

A company is considering whether to buy a regular or color photocopier for their office. The cost of the regular photocopy machine is $12,000, its

- A company is considering whether to buy a regular or color photocopier for their office. The cost of the regular photocopy machine is $12,000, its life span is 5 years, and the company has to pay another $1,500 annually in maintenance costs. The color photocopiers price is $20,000, its life span is also 5 years, and the annual maintenance costs are $4,500. Compared to the regular photocopier, the color photocopier is expected to increase the revenue of the office by $10,000 annually before taxes. Both photocopiers fall into the MACRS 3-year property class and the applicable depreciation rates are 33%, 45%, 15%, and 7% respectively for years 1, 2, 3, and 4. However, the market values of the photocopiers at the end of their 5-year life are expected to be $2,000 (regular) and $10,000 (color). Assume that the company is profitable and pays a 21% tax rate. The appropriate discount rate for the projects is 12%. Which photocopy machine should the firm buy?

Please use this guide and show the formulas! Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started