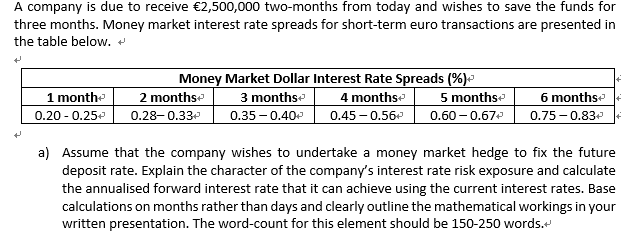

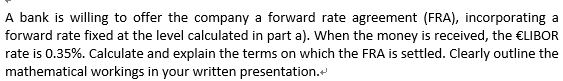

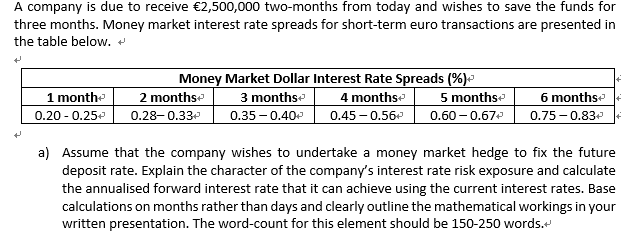

A company is due to receive 2,500,000 two-months from today and wishes to save the funds for three months. Money market interest rate spreads for short-term euro transactions are presented in the table below. Money Market Dollar Interest Rate Spreads (%)- 1 month 0.20 0.25 0.28 0.33 2 months 3 months 0.35-0.40 6 months 0.45-0.560.60-0.670.75- 0.83 4 months 5 months a) Assume that the company wishes to undertake a money market hedge to fix the future deposit rate. Explain the character of the company's interest rate risk exposure and calculate the annualised forward interest rate that it can achieve using the current interest rates. Base calculations on months rather than days and clearly outline the mathematical workings in your written presentation. The word-count for this element should be 150-250 words.*" A bank is willing to offer the company a forward rate agreement (FRA), incorporating a forward rate fixed at the level calculated in part a). When the money is received, the ELIBOR rate is 0.35%. Calculate and explain the terms on which the FRA is settled. Clearly outline the mathematical workings in your written presentation. Given the forward rate available to the company, discuss the factors that it should consider at the outset when deciding whether to fix the future interest rate. The word count for this A company is due to receive 2,500,000 two-months from today and wishes to save the funds for three months. Money market interest rate spreads for short-term euro transactions are presented in the table below. Money Market Dollar Interest Rate Spreads (%)- 1 month 0.20 0.25 0.28 0.33 2 months 3 months 0.35-0.40 6 months 0.45-0.560.60-0.670.75- 0.83 4 months 5 months a) Assume that the company wishes to undertake a money market hedge to fix the future deposit rate. Explain the character of the company's interest rate risk exposure and calculate the annualised forward interest rate that it can achieve using the current interest rates. Base calculations on months rather than days and clearly outline the mathematical workings in your written presentation. The word-count for this element should be 150-250 words.*" A bank is willing to offer the company a forward rate agreement (FRA), incorporating a forward rate fixed at the level calculated in part a). When the money is received, the ELIBOR rate is 0.35%. Calculate and explain the terms on which the FRA is settled. Clearly outline the mathematical workings in your written presentation. Given the forward rate available to the company, discuss the factors that it should consider at the outset when deciding whether to fix the future interest rate. The word count for this