Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is evaluating the purchase of a machine to improve product quality and output levels. The new machine would cost $ 8 1 1

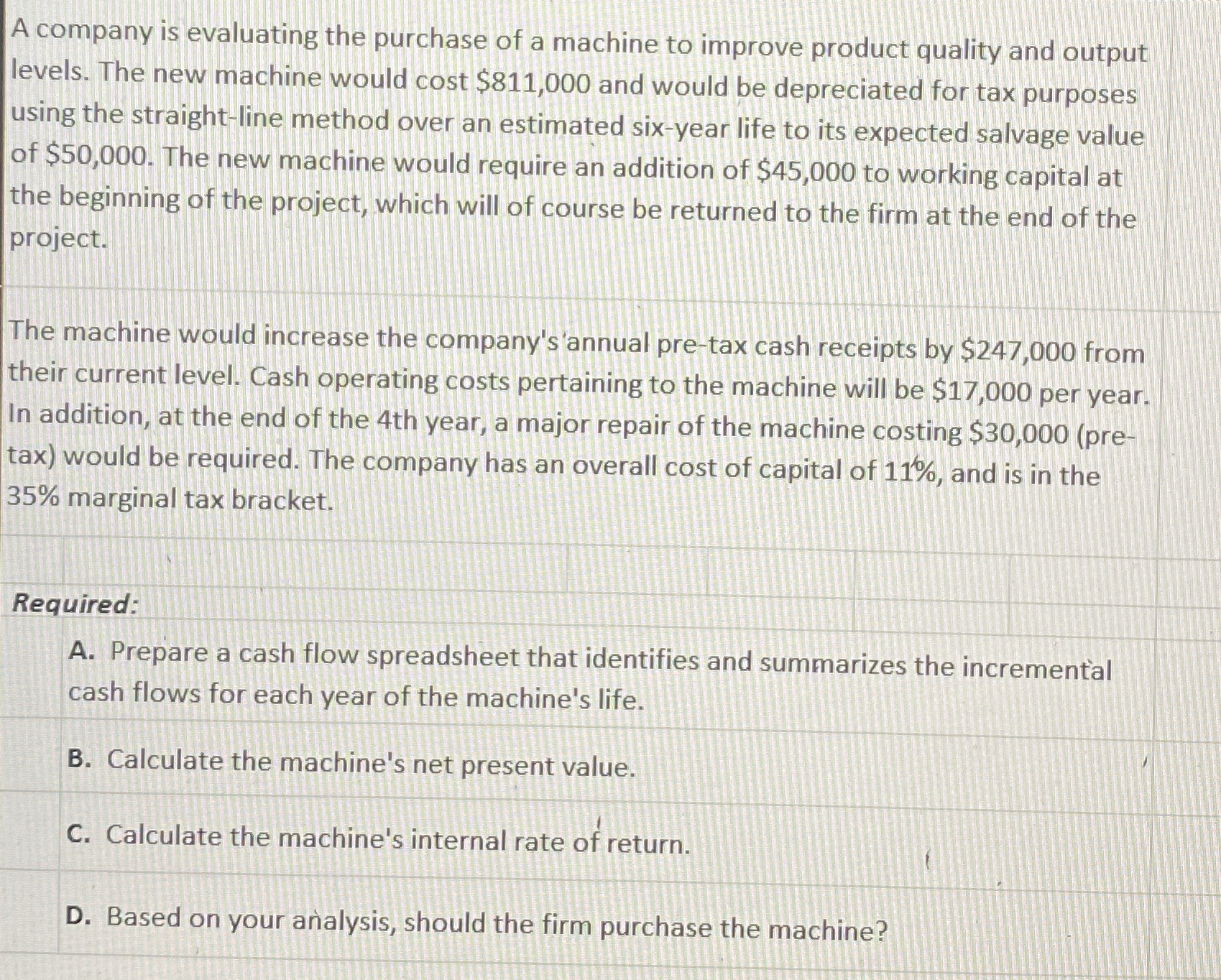

A company is evaluating the purchase of a machine to improve product quality and output levels. The new machine would cost $ and would be depreciated for tax purposes using the straightline method over an estimated sixyear life to its expected salvage value of $ The new machine would require an addition of $ to working capital at the beginning of the project, which will of course be returned to the firm at the end of the project.

The machine would increase the company's'annual pretax cash receipts by $ from their current level. Cash operating costs pertaining to the machine will be $ per year. In addition, at the end of the th year, a major repair of the machine costing $pretax would be required. The company has an overall cost of capital of and is in the marginal tax bracket.

Required:

A Prepare a cash flow spreadsheet that identifies and summarizes the incremental cash flows for each year of the machine's life.

B Calculate the machine's net present value.

C Calculate the machine's internal rate of return.

D Based on your analysis, should the firm purchase the machine?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started