Question

A Company is in the process of evaluating its Allowance for Doubtful Accounts at December 31, 2018. The following information is available: Year Ended December

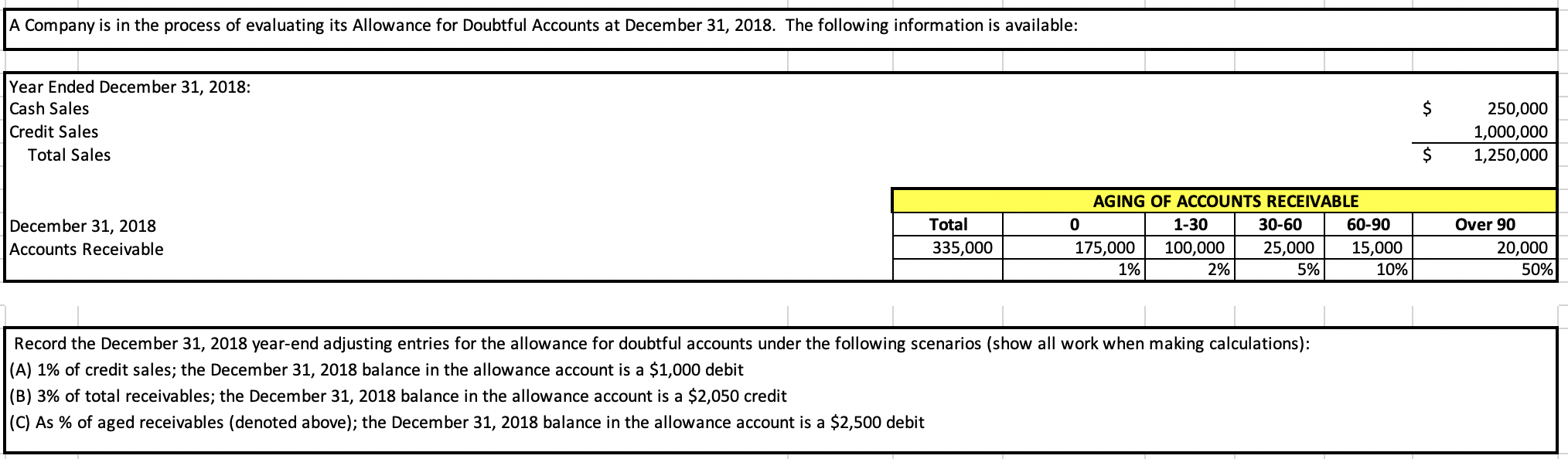

A Company is in the process of evaluating its Allowance for Doubtful Accounts at December 31, 2018. The following information is available: Year Ended December 31, 2018: Cash Sales $ 250,000 Credit Sales 1,000,000 Total Sales 1,250,000 AGING OF ACCOUNTS RECEIVABLE December 31, 2018 Total 0 1-30 30-60 60-90 Over 90 Accounts Receivable 335,000 175,000 100,000 25,000 15,000 20,000 1% 2% 5% 10% 50% Record the December 31, 2018 year-end adjusting entries for the allowance for doubtful accounts under the following scenarios (show all work when making calculations): (A) 1% of credit sales; the December 31, 2018 balance in the allowance account is a $1,000 debit (B) 3% of total receivables; the December 31, 2018 balance in the allowance account is a $2,050 credit (C) As % of aged receivables (denoted above); the December 31, 2018 balance in the allowance account is a $2,500 debit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started