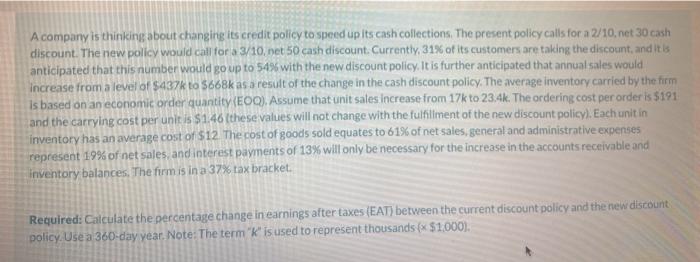

A company is thinking about changing its credit policy to speed up its cash collections. The present policy calls for a 2/10, net 30 cash discount. The new policy would call for a 3/10, net 50 cash discount. Currently, 31% of its customers are taking the discount, and it is anticipated that this number would go up to 54% with the new discount policy. It is further anticipated that annual sales would increase from a level of $437% to 566Bk as a result of the change in the cash discount policy. The average inventory carried by the firm is based on an economic order quantity (EOQ). Assume that unit sales increase from 17k to 23.4k. The ordering cost per order is $191 and the carrying cost per unit is $1.46 (these values will not change with the fulfillment of the new discount policy). Each unit in inventory has an average cost of $12. The cost of goods sold equates to 61% of net sales, general and administrative expenses represent 19% of net sales and interest payments of 13% will only be necessary for the increase in the accounts receivable and inventory balances. The firm is in a 37% tax bracket. Required: Calculate the percentage change in earnings after taxes (EAT) between the current discount policy and the new discount policy. Use a 360-day year. Note: The term "K" is used to represent thousands (* $1.000). A company is thinking about changing its credit policy to speed up its cash collections. The present policy calls for a 2/10, net 30 cash discount. The new policy would call for a 3/10, net 50 cash discount. Currently, 31% of its customers are taking the discount, and it is anticipated that this number would go up to 54% with the new discount policy. It is further anticipated that annual sales would increase from a level of $437% to 566Bk as a result of the change in the cash discount policy. The average inventory carried by the firm is based on an economic order quantity (EOQ). Assume that unit sales increase from 17k to 23.4k. The ordering cost per order is $191 and the carrying cost per unit is $1.46 (these values will not change with the fulfillment of the new discount policy). Each unit in inventory has an average cost of $12. The cost of goods sold equates to 61% of net sales, general and administrative expenses represent 19% of net sales and interest payments of 13% will only be necessary for the increase in the accounts receivable and inventory balances. The firm is in a 37% tax bracket. Required: Calculate the percentage change in earnings after taxes (EAT) between the current discount policy and the new discount policy. Use a 360-day year. Note: The term "K" is used to represent thousands (* $1.000)