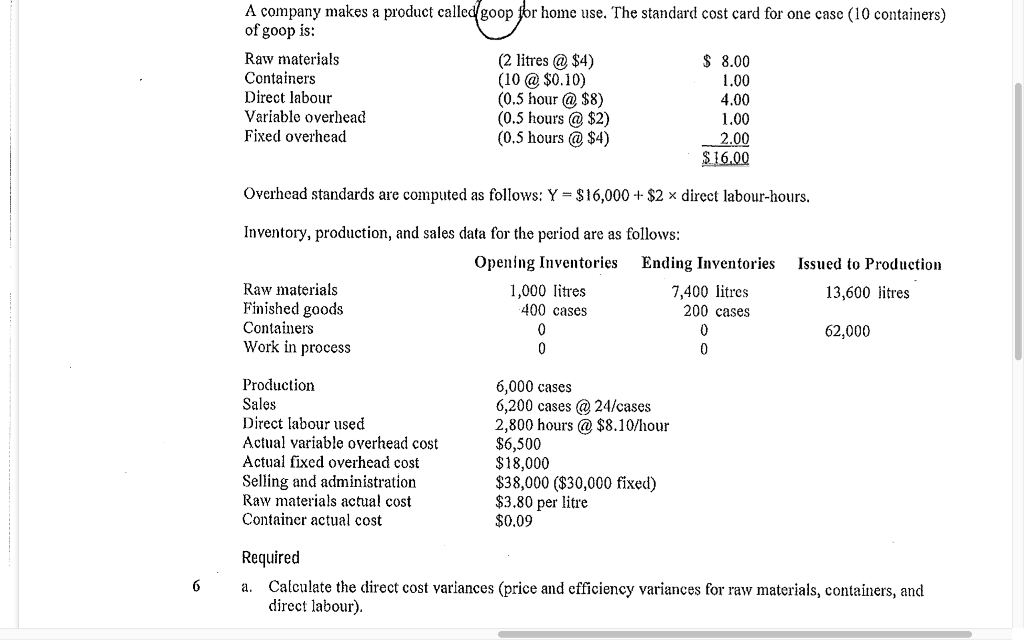

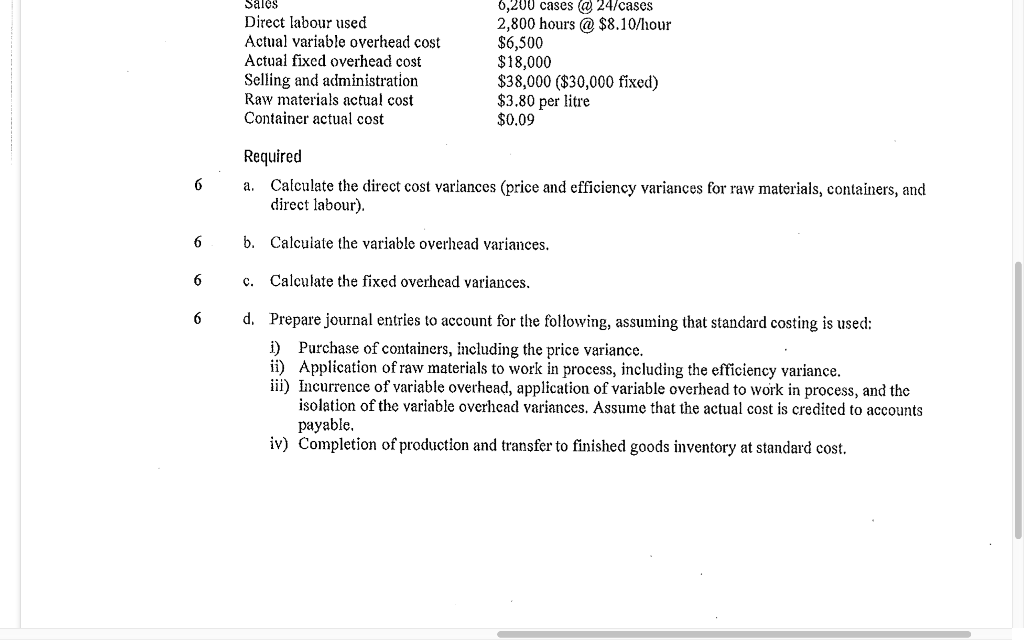

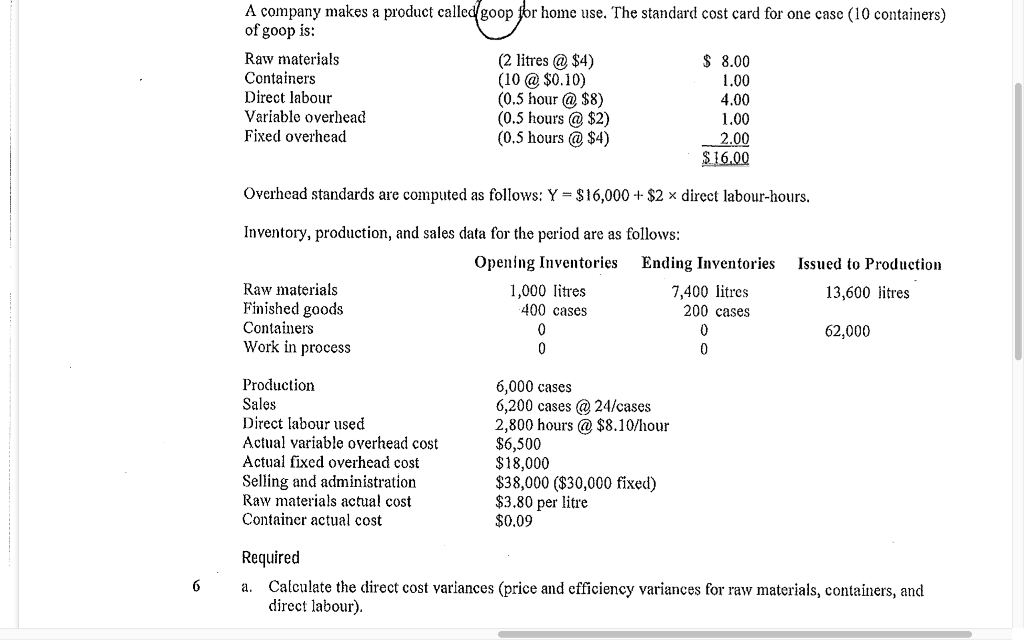

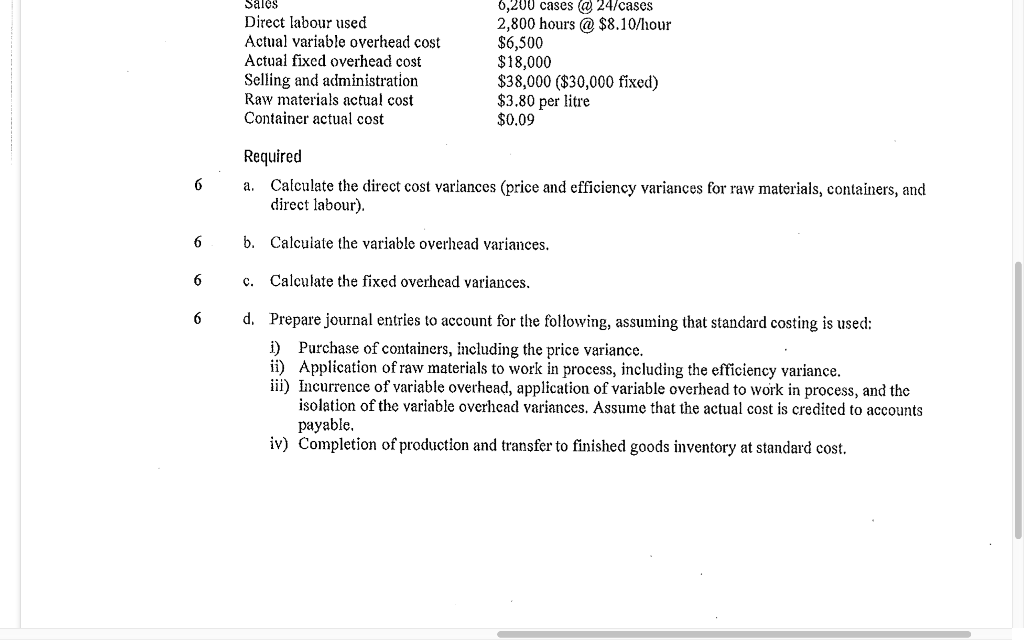

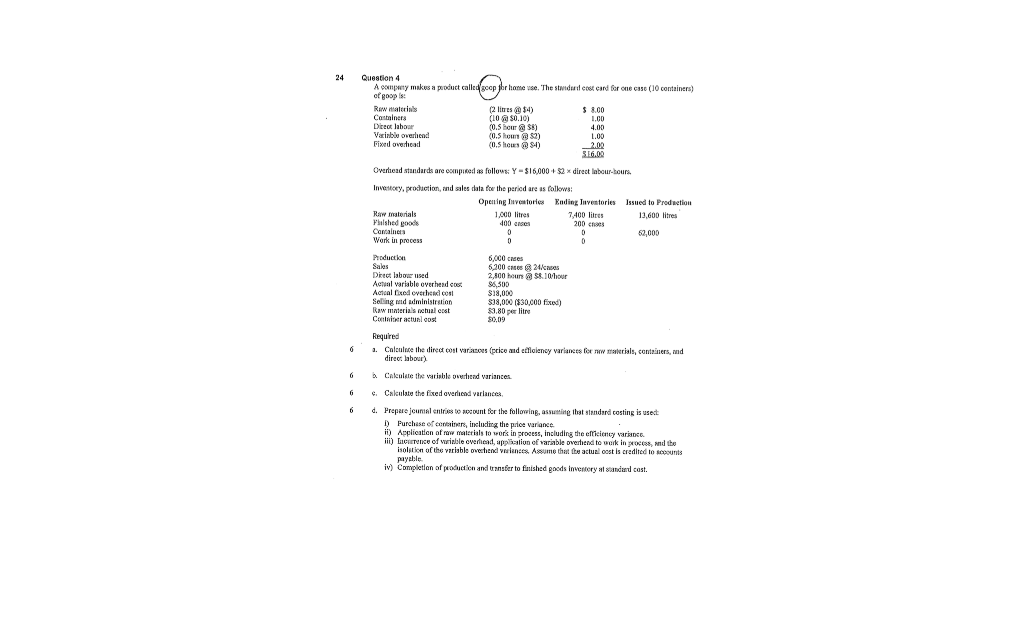

A company makes a product called goop for home use. The standard cost card for one case (10 containers) of goop is: Raw materials (2 litres @ $4) $ 8.00 Containers (10 @ $0.10) 1.00 Direct labour (0.5 hour @ $8) 4.00 Variable overhead (0.5 hours @ $2) 1.00 Fixed overhead (0.5 hours @ $4) 2.00 $16.00 Overhead standards are computed as follows: Y = $16,000+ $2 x direct labour-hours. Inventory, production, and sales data for the period are as follows: Opening Inventories Ending Inventories Raw materials 1,000 litres 7,400 litres Finished goods 400 cases 200 cases Containers 0 Work in process 0 Issued to Production 13,600 litres 62,000 Production Sales Direct labour used Actual variable overhead cost Actual fixed overhead cost Selling and administration Raw materials actual cost Container actual cost 6,000 cases 6,200 cases @ 24/cases 2,800 hours @ $8.10/hour $6,500 $18,000 $38,000 ($30,000 fixed) $3.80 per litre $0.09 6 Required Calculate the direct cost variances (price and efficiency variances for raw materials, containers, and direct labour) a. Sales Direct labour used Actual variable overhead cost Actual fixed overhead cost Selling and administration Raw materials actual cost Container actual cost 0,200 cases @ 24/cases 2,800 hours @ $8.10/hour $6,500 $18,000 $38,000 $30,000 fixed) $3.80 per litre $0.09 6 Required a. Calculate the direct cost variances (price and efficiency variances for raw materials, containers, and direct labour). 6 b. Calculate the variable overhead variances. 6 c. Calculate the fixed overhead variances. 6 d. Prepare journal entries to account for the following, assuming that standard costing is used: i) Purchase of containers, including the price variance. ii) Application of raw materials to work in process, including the efficiency variance. iii) Incurrence of variable overhead, application of variable overhead to work in process, and the isolation of the variable overhead variances. Assume that the actual cost is credited to accounts payable. iv) Completion of production and transfer to finished goods inventory at standard cost. (USA) 24 Question 4 A company makes a product called geop por home use. The studio card for one on (10 containers) of goopis: (2 litres $4) $ 8.00 Containers (1080.10) 1.00 Direct labor 0.5 hour $8) 4.00 Vaible overhead 0.5 houn) 1.00 Fixed overhead 2.02 556.02 Overliezd standards are compared as follows: Y-516,000+ $2 x direct labour-tours. Investy, prachuction, and sales data for the period are as follows: Opening inventories Ending Investories Issued to Production Raw materials 1.000 litres 7.400 litres 13,600 litres Phished good 400 SC 200 C Containers 0 52,000 Work in process 0 0 Production 6,000 cases Sales 6200 cm 24. Direct labore used 2,800 hours 5810/hour Actual variable overhede S6,500 Actual Cedevahel.com $18,000 Selling med administration $18,000 $30,000 fixed) Raw materials nchial cost 83.80 per litre Contractual cost 30,09 Required 6 a. Calonce the direct cost versos (price and efficiency variances for waterials, containers, and direct labor) Calculate the variable rend variances 6 4. Calculate the fixed averad verlances, 6 d. Prepare jaunial entre to count for the following, assutting standard costing is usect 1) Purchase of commer, including the price variance ii) Application of raw materials to work in process, including the efficiency varico. iii) Ce of winsle overhead, upprun of variable overhed to work in proces, and the isolation of the variable overend venees. Assume that the actual cost is credited to see payable iv) Completion of production and transfer to finished goods inventory and cost A company makes a product called goop for home use. The standard cost card for one case (10 containers) of goop is: Raw materials (2 litres @ $4) $ 8.00 Containers (10 @ $0.10) 1.00 Direct labour (0.5 hour @ $8) 4.00 Variable overhead (0.5 hours @ $2) 1.00 Fixed overhead (0.5 hours @ $4) 2.00 $16.00 Overhead standards are computed as follows: Y = $16,000+ $2 x direct labour-hours. Inventory, production, and sales data for the period are as follows: Opening Inventories Ending Inventories Raw materials 1,000 litres 7,400 litres Finished goods 400 cases 200 cases Containers 0 Work in process 0 Issued to Production 13,600 litres 62,000 Production Sales Direct labour used Actual variable overhead cost Actual fixed overhead cost Selling and administration Raw materials actual cost Container actual cost 6,000 cases 6,200 cases @ 24/cases 2,800 hours @ $8.10/hour $6,500 $18,000 $38,000 ($30,000 fixed) $3.80 per litre $0.09 6 Required Calculate the direct cost variances (price and efficiency variances for raw materials, containers, and direct labour) a. Sales Direct labour used Actual variable overhead cost Actual fixed overhead cost Selling and administration Raw materials actual cost Container actual cost 0,200 cases @ 24/cases 2,800 hours @ $8.10/hour $6,500 $18,000 $38,000 $30,000 fixed) $3.80 per litre $0.09 6 Required a. Calculate the direct cost variances (price and efficiency variances for raw materials, containers, and direct labour). 6 b. Calculate the variable overhead variances. 6 c. Calculate the fixed overhead variances. 6 d. Prepare journal entries to account for the following, assuming that standard costing is used: i) Purchase of containers, including the price variance. ii) Application of raw materials to work in process, including the efficiency variance. iii) Incurrence of variable overhead, application of variable overhead to work in process, and the isolation of the variable overhead variances. Assume that the actual cost is credited to accounts payable. iv) Completion of production and transfer to finished goods inventory at standard cost. (USA) 24 Question 4 A company makes a product called geop por home use. The studio card for one on (10 containers) of goopis: (2 litres $4) $ 8.00 Containers (1080.10) 1.00 Direct labor 0.5 hour $8) 4.00 Vaible overhead 0.5 houn) 1.00 Fixed overhead 2.02 556.02 Overliezd standards are compared as follows: Y-516,000+ $2 x direct labour-tours. Investy, prachuction, and sales data for the period are as follows: Opening inventories Ending Investories Issued to Production Raw materials 1.000 litres 7.400 litres 13,600 litres Phished good 400 SC 200 C Containers 0 52,000 Work in process 0 0 Production 6,000 cases Sales 6200 cm 24. Direct labore used 2,800 hours 5810/hour Actual variable overhede S6,500 Actual Cedevahel.com $18,000 Selling med administration $18,000 $30,000 fixed) Raw materials nchial cost 83.80 per litre Contractual cost 30,09 Required 6 a. Calonce the direct cost versos (price and efficiency variances for waterials, containers, and direct labor) Calculate the variable rend variances 6 4. Calculate the fixed averad verlances, 6 d. Prepare jaunial entre to count for the following, assutting standard costing is usect 1) Purchase of commer, including the price variance ii) Application of raw materials to work in process, including the efficiency varico. iii) Ce of winsle overhead, upprun of variable overhed to work in proces, and the isolation of the variable overend venees. Assume that the actual cost is credited to see payable iv) Completion of production and transfer to finished goods inventory and cost