Answered step by step

Verified Expert Solution

Question

1 Approved Answer

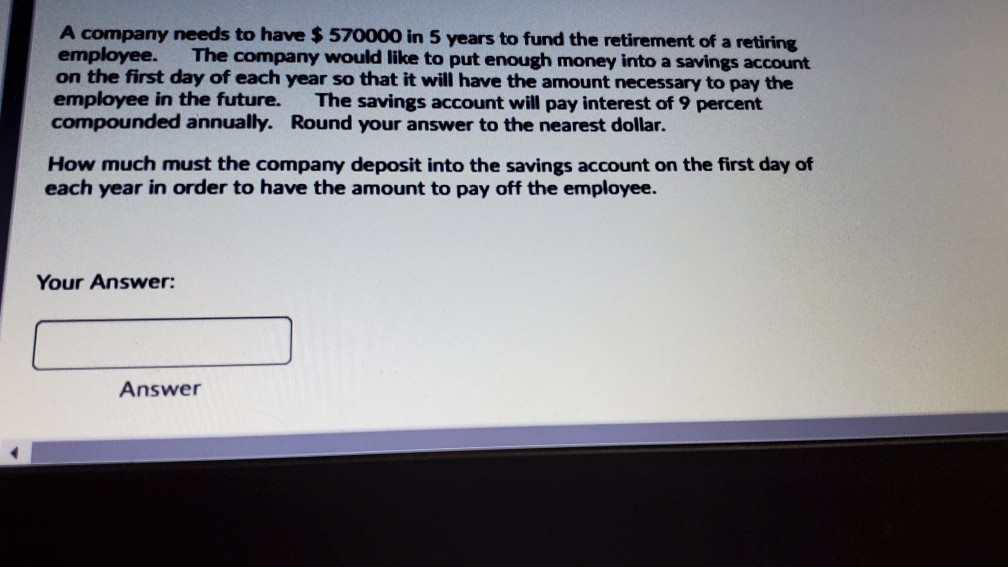

A company needs to have $ 570000 in 5 years to fund the retirement of a retiring employee. The company would like to put enough

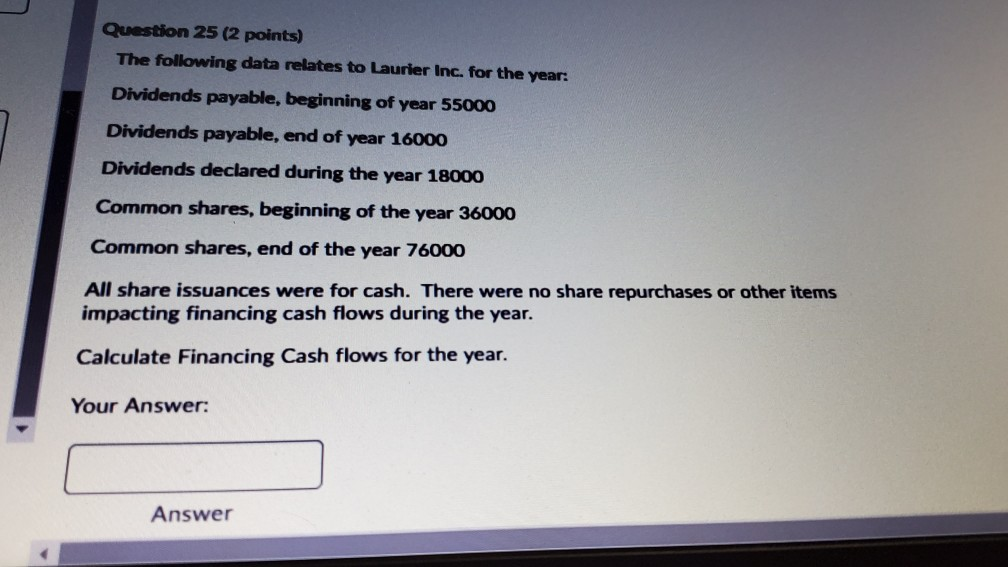

A company needs to have $ 570000 in 5 years to fund the retirement of a retiring employee. The company would like to put enough money into a savings account on the first day of each year so that it will have the amount necessary to pay the employee in the future. The savings account will pay interest of 9 percent compounded annually. Round your answer to the nearest dollar. How much must the company deposit into the savings account on the first day of each year in order to have the amount to pay off the employee. Your Answer: Answer Question 25 (2 points) The following data relates to Laurier Inc. for the year: Dividends payable, beginning of year 55000 Dividends payable, end of year 16000 Dividends declared during the year 18000 Common shares, beginning of the year 36000 Common shares, end of the year 76000 All share issuances were for cash. There were no share repurchases or other items impacting financing cash flows during the year. Calculate Financing Cash flows for the year. Your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started