Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company needs to raise $1,800,000 (this is the gross amount before any cost comes off) for a business expansion. The company decides to issue

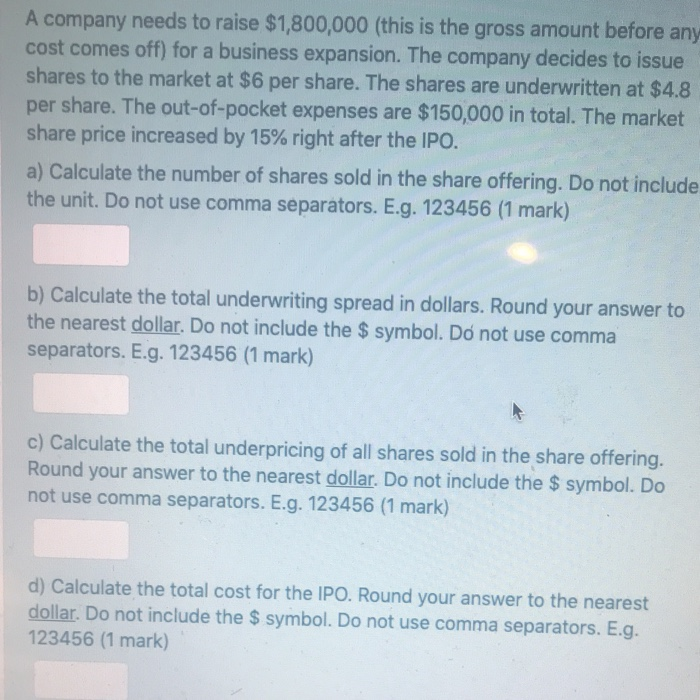

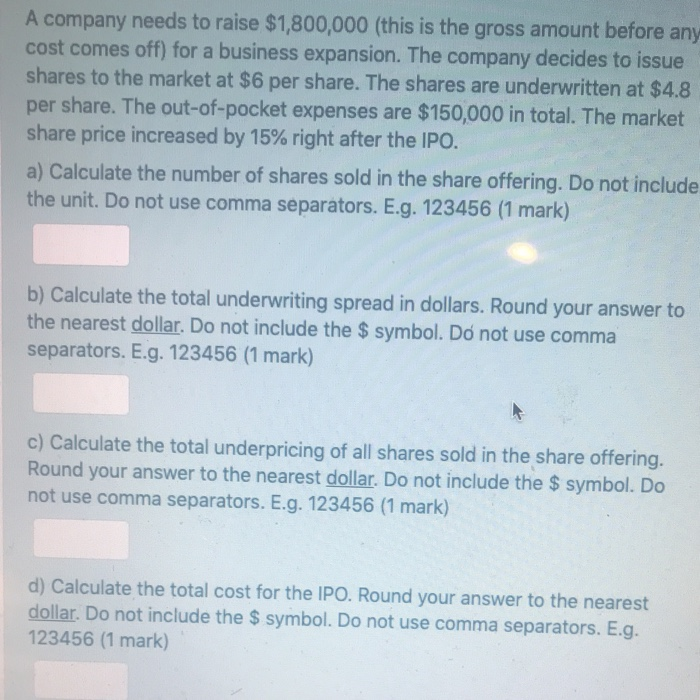

A company needs to raise $1,800,000 (this is the gross amount before any cost comes off) for a business expansion. The company decides to issue shares to the market at $6 per share. The shares are underwritten at $4.8 per share. The out-of-pocket expenses are $150,000 in total. The market share price increased by 15% right after the IPO. a) Calculate the number of shares sold in the share offering. Do not include the unit. Do not use comma separators. E.g. 123456 (1 mark) b) Calculate the total underwriting spread in dollars. Round your answer to the nearest dollar. Do not include the $ symbol. Do not use comma separators. E.g. 123456 (1 mark) c) Calculate the total underpricing of all shares sold in the share offering. Round your answer to the nearest dollar. Do not include the $ symbol. Do not use comma separators. E.g. 123456 (1 mark) d) Calculate the total cost for the IPO. Round your answer to the nearest dollar. Do not include the $ symbol. Do not use comma separators. E.g. 123456 (1 mark)

A company needs to raise $1,800,000 (this is the gross amount before any cost comes off) for a business expansion. The company decides to issue shares to the market at $6 per share. The shares are underwritten at $4.8 per share. The out-of-pocket expenses are $150,000 in total. The market share price increased by 15% right after the IPO. a) Calculate the number of shares sold in the share offering. Do not include the unit. Do not use comma separators. E.g. 123456 (1 mark) b) Calculate the total underwriting spread in dollars. Round your answer to the nearest dollar. Do not include the $ symbol. Do not use comma separators. E.g. 123456 (1 mark) c) Calculate the total underpricing of all shares sold in the share offering. Round your answer to the nearest dollar. Do not include the $ symbol. Do not use comma separators. E.g. 123456 (1 mark) d) Calculate the total cost for the IPO. Round your answer to the nearest dollar. Do not include the $ symbol. Do not use comma separators. E.g. 123456 (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started