Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company owns a commercial property near a UBC and received an offer to buy it for $400,000 The manager of the company is

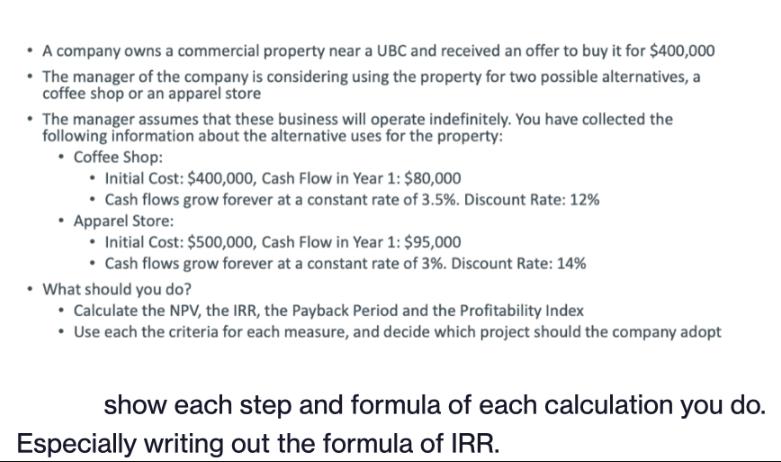

A company owns a commercial property near a UBC and received an offer to buy it for $400,000 The manager of the company is considering using the property for two possible alternatives, a coffee shop or an apparel store The manager assumes that these business will operate indefinitely. You have collected the following information about the alternative uses for the property: Coffee Shop: Initial Cost: $400,000, Cash Flow in Year 1: $80,000 Cash flows grow forever at a constant rate of 3.5%. Discount Rate: 12% Apparel Store: Initial Cost: $500,000, Cash Flow in Year 1: $95,000 Cash flows grow forever at a constant rate of 3%. Discount Rate: 14% What should you do? Calculate the NPV, the IRR, the Payback Period and the Profitability Index Use each the criteria for each measure, and decide which project should the company adopt show each step and formula of each calculation you do. Especially writing out the formula of IRR.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started