Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company pays $50,000 in cash and stock to acquire 65% of the voting stock of another company. The fair value of the 35% noncontrolling

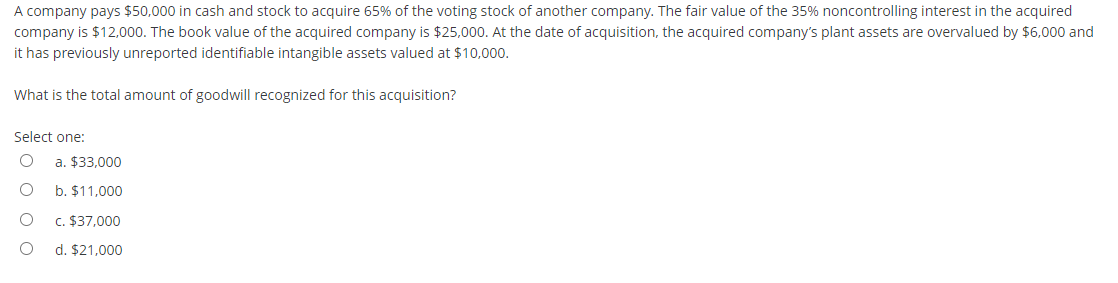

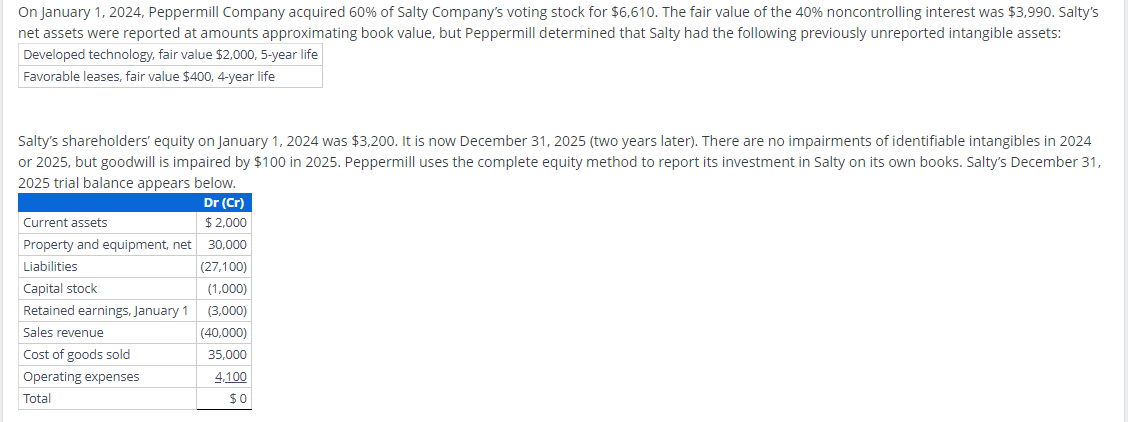

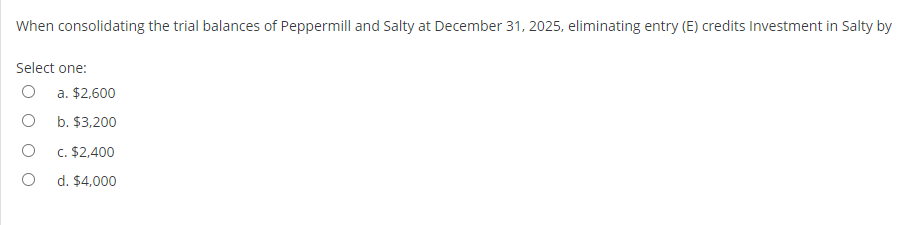

A company pays $50,000 in cash and stock to acquire 65% of the voting stock of another company. The fair value of the 35% noncontrolling interest in the acquired company is $12,000. The book value of the acquired company is $25,000. At the date of acquisition, the acquired company's plant assets are overvalued by $6,000 and it has previously unreported identifiable intangible assets valued at $10,000. What is the total amount of goodwill recognized for this acquisition? Select one: a. $33,000 b. $11,000 c. $37,000 d. $21,000 On January 1, 2024, Peppermill Company acquired 60% of Salty Company's voting stock for $6,610. The fair value of the 40% noncontrolling interest was $3,990. Salty's net assets were reported at amounts approximating book value, but Peppermill determined that Salty had the following previously unreported intangible assets: Salty's shareholders' equity on January 1, 2024 was $3,200. It is now December 31, 2025 (two years later). There are no impairments of identifiable intangibles in 2024 or 2025 , but goodwill is impaired by $100 in 2025 . Peppermill uses the complete equity method to report its investment in Salty on its own books. Salty's December 31 , When consolidating the trial balances of Peppermill and Salty at December 31,2025, eliminating entry (E) credits Investment in Salty by Select one: a. $2,600 b. $3,200 c. $2,400 d. $4,000 A company pays $50,000 in cash and stock to acquire 65% of the voting stock of another company. The fair value of the 35% noncontrolling interest in the acquired company is $12,000. The book value of the acquired company is $25,000. At the date of acquisition, the acquired company's plant assets are overvalued by $6,000 and it has previously unreported identifiable intangible assets valued at $10,000. What is the total amount of goodwill recognized for this acquisition? Select one: a. $33,000 b. $11,000 c. $37,000 d. $21,000 On January 1, 2024, Peppermill Company acquired 60% of Salty Company's voting stock for $6,610. The fair value of the 40% noncontrolling interest was $3,990. Salty's net assets were reported at amounts approximating book value, but Peppermill determined that Salty had the following previously unreported intangible assets: Salty's shareholders' equity on January 1, 2024 was $3,200. It is now December 31, 2025 (two years later). There are no impairments of identifiable intangibles in 2024 or 2025 , but goodwill is impaired by $100 in 2025 . Peppermill uses the complete equity method to report its investment in Salty on its own books. Salty's December 31 , When consolidating the trial balances of Peppermill and Salty at December 31,2025, eliminating entry (E) credits Investment in Salty by Select one: a. $2,600 b. $3,200 c. $2,400 d. $4,000

A company pays $50,000 in cash and stock to acquire 65% of the voting stock of another company. The fair value of the 35% noncontrolling interest in the acquired company is $12,000. The book value of the acquired company is $25,000. At the date of acquisition, the acquired company's plant assets are overvalued by $6,000 and it has previously unreported identifiable intangible assets valued at $10,000. What is the total amount of goodwill recognized for this acquisition? Select one: a. $33,000 b. $11,000 c. $37,000 d. $21,000 On January 1, 2024, Peppermill Company acquired 60% of Salty Company's voting stock for $6,610. The fair value of the 40% noncontrolling interest was $3,990. Salty's net assets were reported at amounts approximating book value, but Peppermill determined that Salty had the following previously unreported intangible assets: Salty's shareholders' equity on January 1, 2024 was $3,200. It is now December 31, 2025 (two years later). There are no impairments of identifiable intangibles in 2024 or 2025 , but goodwill is impaired by $100 in 2025 . Peppermill uses the complete equity method to report its investment in Salty on its own books. Salty's December 31 , When consolidating the trial balances of Peppermill and Salty at December 31,2025, eliminating entry (E) credits Investment in Salty by Select one: a. $2,600 b. $3,200 c. $2,400 d. $4,000 A company pays $50,000 in cash and stock to acquire 65% of the voting stock of another company. The fair value of the 35% noncontrolling interest in the acquired company is $12,000. The book value of the acquired company is $25,000. At the date of acquisition, the acquired company's plant assets are overvalued by $6,000 and it has previously unreported identifiable intangible assets valued at $10,000. What is the total amount of goodwill recognized for this acquisition? Select one: a. $33,000 b. $11,000 c. $37,000 d. $21,000 On January 1, 2024, Peppermill Company acquired 60% of Salty Company's voting stock for $6,610. The fair value of the 40% noncontrolling interest was $3,990. Salty's net assets were reported at amounts approximating book value, but Peppermill determined that Salty had the following previously unreported intangible assets: Salty's shareholders' equity on January 1, 2024 was $3,200. It is now December 31, 2025 (two years later). There are no impairments of identifiable intangibles in 2024 or 2025 , but goodwill is impaired by $100 in 2025 . Peppermill uses the complete equity method to report its investment in Salty on its own books. Salty's December 31 , When consolidating the trial balances of Peppermill and Salty at December 31,2025, eliminating entry (E) credits Investment in Salty by Select one: a. $2,600 b. $3,200 c. $2,400 d. $4,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started