Question

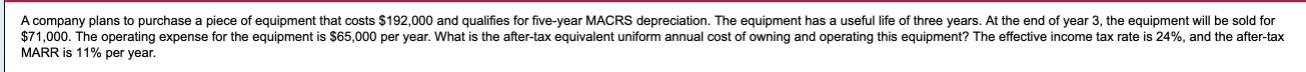

A company plans to purchase a piece of equipment that costs $192,000 and qualifies for five-year MACRS depreciation. The equipment has a useful life

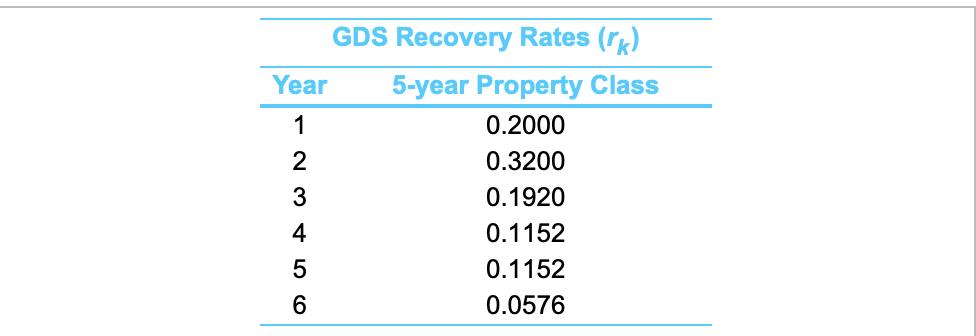

A company plans to purchase a piece of equipment that costs $192,000 and qualifies for five-year MACRS depreciation. The equipment has a useful life of three years. At the end of year 3, the equipment will be sold for $71,000. The operating expense for the equipment is $65,000 per year. What is the after-tax equivalent uniform annual cost of owning and operating this equipment? The effective income tax rate is 24%, and the after-tax MARR is 11% per year. The after-tax equivalent uniform annual cost is $ (Round to the nearest dollar.) GDS Recovery Rates (rk) Year 5-year Property Class 1 0.2000 0.3200 0.1920 0.1152 0.1152 0.0576 23456

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Hey champ Welcome to this platform Here you will get answers wit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

7th Canadian Edition Volume 1

1119048508, 978-1119048503

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App