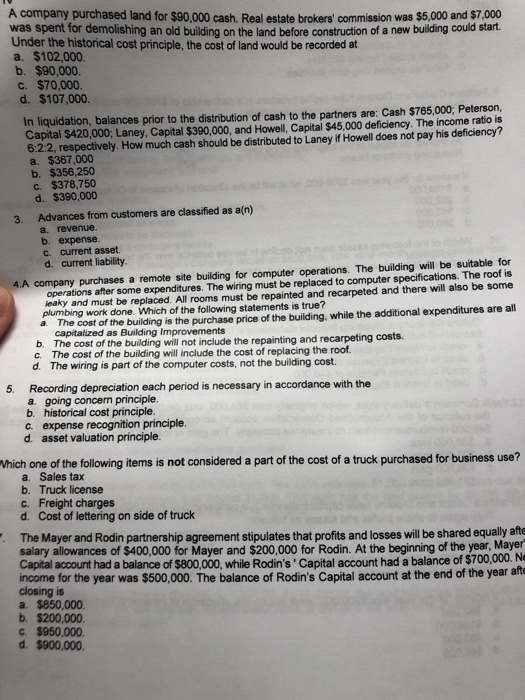

A company purchased land for $90,000 cash, Real estate brokers' commission was $5,000 and 57,000 was spent for demolishing an old building on the land before construction of a new building could start Under the historical cost principle, the cost of land would be recorded at a. $102,000. b. $90,000 c. $70,000 d. $107.000. In liquidation, balances prior to the distribution of cash to the partners are: Cash $765,000; Peterson, Capital S420,000: Laney, Capital $390.000, and Howell, Capital $45,000 deficiency. The income ratio is 622. respectively. How much cash should be distributed to Laney If Howell does not pay his deficiency? a $367,000 b. $356,250 c. $378,750 d. $390,000 3. Advances from customers are classified as a(n) a. revenue. b. expense. c. current asset. d. current liability. 4A company purchases a remote site building for computer operations. The building will be suitable for operations after some expenditures. The wiring must be replaced to computer specifications. The roof is waky and must be replaced. All rooms must be repainted and recarpeted and there will also be some plumbing work done. Which of the following statements is true? a The cost of the building is the purchase price of the building, while the additional expenditures are all capitalized as Building Improvements b. The cost of the building will not include the repainting and recarpeting costs c. The cost of the building will include the cost of replacing the roof. d. The wiring is part of the computer costs, not the building cost. 5. Recording depreciation each period is necessary in accordance with the a going concern principle. b. historical cost principle. c. expense recognition principle. d. asset valuation principle. Vhich one of the following items is not considered a part of the cost of a truck purchased for business use? a. Sales tax b. Truck license C. Freight charges d. Cost of lettering on side of truck The Mayer and Rodin partnership agreement stipulates that profits and losses will be shared equally aft salary allowances of $400,000 for Mayer and $200,000 for Rodin. At the beginning of the year, Mayer Capital account had a balance of $800.000, while Rodin's Capital account had a balance of $700,000. N Income for the year was $500,000. The balance of Rodin's Capital account at the end of the year and closing is a. $850,000 b. $200,000 c. $950,000 d. $900,000