Question

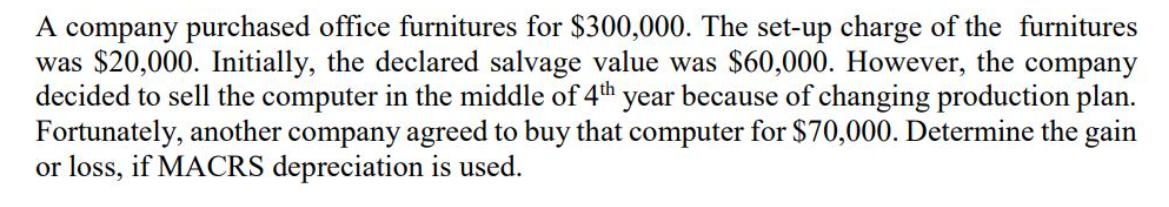

A company purchased office furnitures for $300,000. The set-up charge of the furnitures was $20,000. Initially, the declared salvage value was $60,000. However, the

A company purchased office furnitures for $300,000. The set-up charge of the furnitures was $20,000. Initially, the declared salvage value was $60,000. However, the company decided to sell the computer in the middle of 4th year because of changing production plan. Fortunately, another company agreed to buy that computer for $70,000. Determine the gain or loss, if MACRS depreciation is used.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the gain or loss using MACRS depreciation we first need to calculate the accumulated de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Finance

Authors: Scott Besley, Eugene F. Brigham

6th edition

9781305178045, 1285429648, 1305178041, 978-1285429649

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App