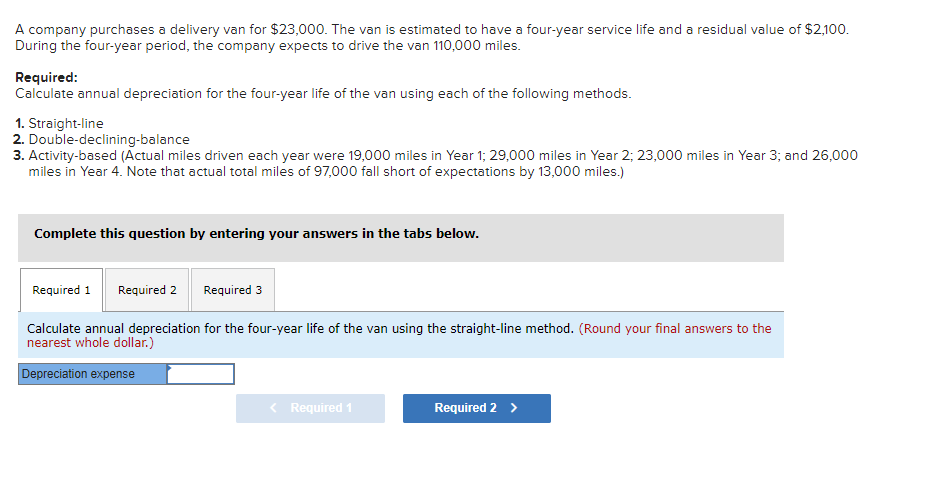

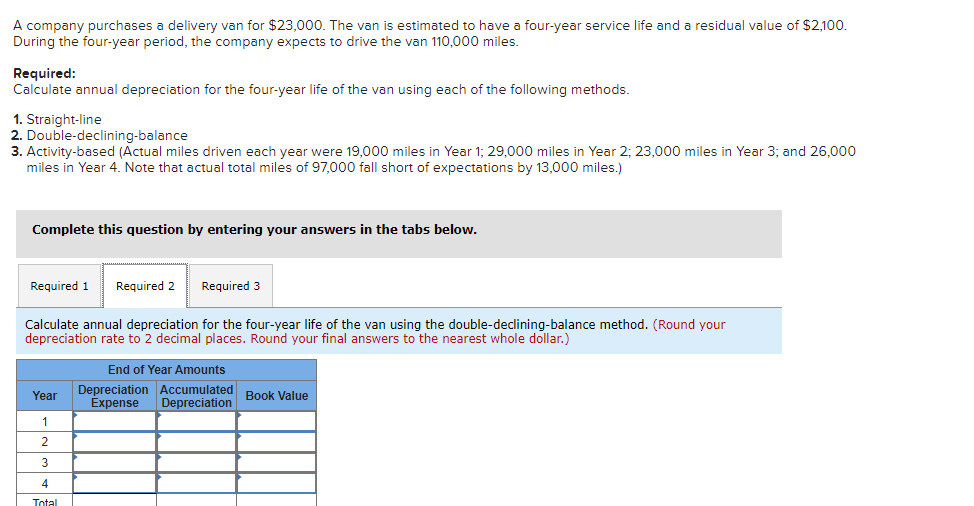

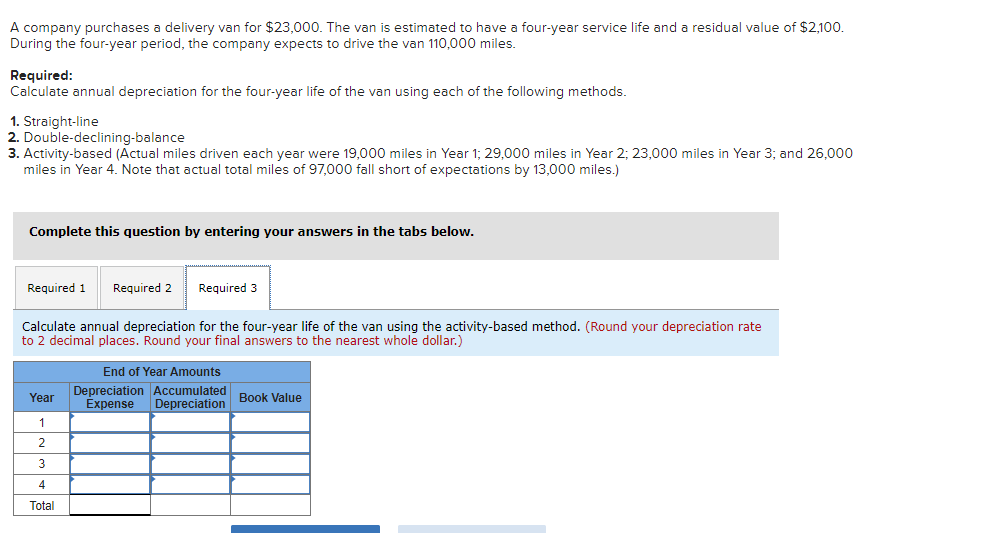

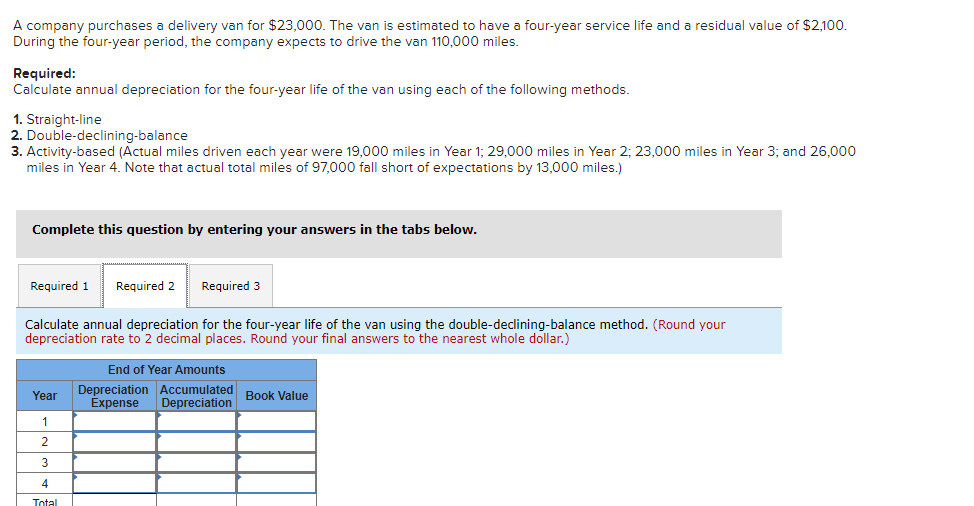

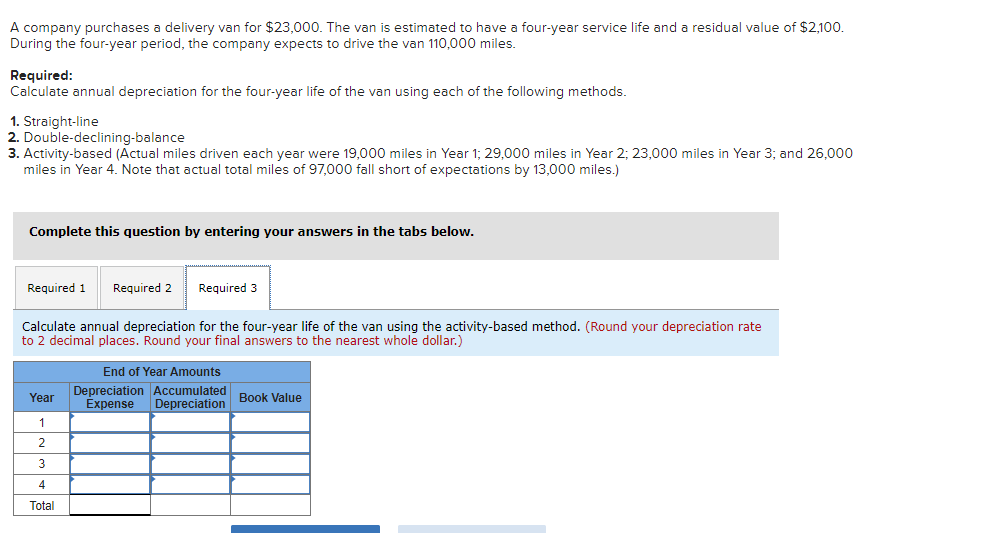

A company purchases a delivery van for $23,000. The van is estimated to have a four-year service life and a residual value of $2,100. During the four-year period, the company expects to drive the van 110,000 miles. Required: Calculate annual depreciation for the four-year life of the van using each of the following methods. 1. Straight-line 2. Double-declining-balance 3. Activity-based (Actual miles driven each year were 19,000 miles in Year 1; 29,000 miles in Year 2; 23,000 miles in Year 3; and 26,000 miles in Year 4. Note that actual total miles of 97,000 fall short of expectations by 13,000 miles.) Complete this question by entering your answers in the tabs below. Calculate annual depreciation for the four-year life of the van using the straight-line method. (Round your final answers to the nearest whole dollar.) A company purchases a delivery van for $23,000. The van is estimated to have a four-year service life and a residual value of $2,100. During the four-year period, the company expects to drive the van 110,000 miles. Required: Calculate annual depreciation for the four-year life of the van using each of the following methods. 1. Straight-line 2. Double-declining-balance 3. Activity-based (Actual miles driven each year were 19,000 miles in Year 1; 29,000 miles in Year 2; 23,000 miles in Year 3; and 26,000 miles in Year 4. Note that actual total miles of 97,000 fall short of expectations by 13,000 miles.) Complete this question by entering your answers in the tabs below. Calculate annual depreciation for the four-year life of the van using the double-declining-balance method. (Round your depreciation rate to 2 decimal places. Round your final answers to the nearest whole dollar.) A company purchases a delivery van for $23,000. The van is estimated to have a four-year service life and a residual value of $2,100. During the four-year period, the company expects to drive the van 110,000 miles. Required: Calculate annual depreciation for the four-year life of the van using each of the following methods. 1. Straight-line Double-declining-balance 3. Activity-based (Actual miles driven each year were 19,000 miles in Year 1; 29,000 miles in Year 2; 23,000 miles in Year 3; and 26,000 miles in Year 4. Note that actual total miles of 97,000 fall short of expectations by 13,000 miles.) Complete this question by entering your answers in the tabs below. Calculate annual depreciation for the four-year life of the van using the activity-based method. (Round your depreciation rate to 2 decimal places. Round your final answers to the nearest whole dollar.)