Question

Plymouth Corporation (a U.S. company) began operations on September 1, 2014, when the owner borrowed S250,000 to establish the business. Plymouth then had the following

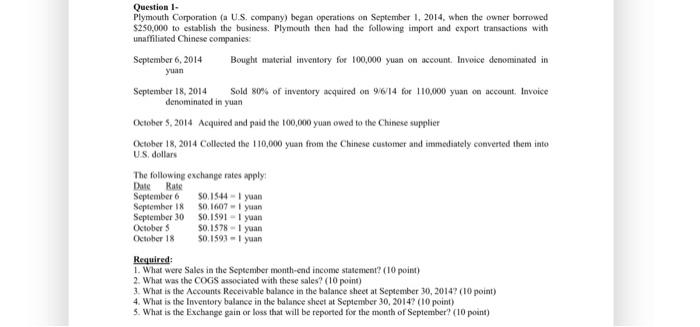

Plymouth Corporation (a U.S. company) began operations on September 1, 2014, when the owner borrowed S250,000 to establish the business. Plymouth then had the following import and export transactions with unaffiliated Chinese companies:

September 6, 2014

yuan

Bought material inventory for 100,000 yuan on account. Invoice denominated in

September 18, 2014

Sold 80% of inventory acquired on 9/6/14 for 110,000 yuan on account. Invoice

denominated in yuan

October 5, 2014 Acquired and paid the 100,000 yuan owed to the Chinese supplier

October 18, 2014 Collected the 110,000 yuan from the Chinese customer and immediately converted them into

U.S. dollars

The following exchange rates apply:

Date Rate

September 6

September 18

September 30

October 5

October 18

S0.1544 - 1 yuan

SO.1607 - 1 yuan

S0.1591 m 1 yuan

SO.1578 - 1 yuan

SO.1593 = 1 yuan

Required:

- What were Sales in the September month-end income statement? (10 point)

- What was the COGS associated with these sales? (10 point)

- What is the Accounts Receivable balance in the balance sheet at September 30, 2014? (10 point)

- What is the Inventory balance in the balance sheet at September 30, 2014? (10 point)

- What is the Exchange gain or loss that will be reported for the month of September? (10 point)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started