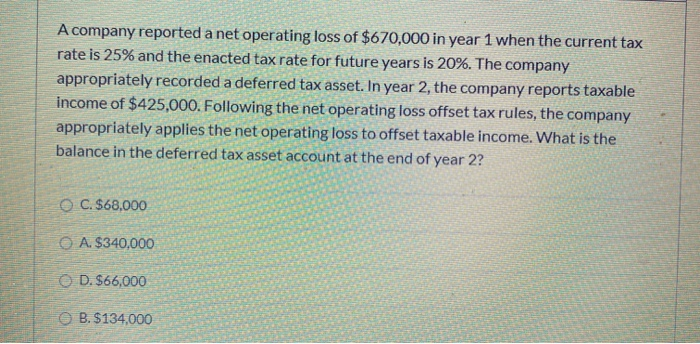

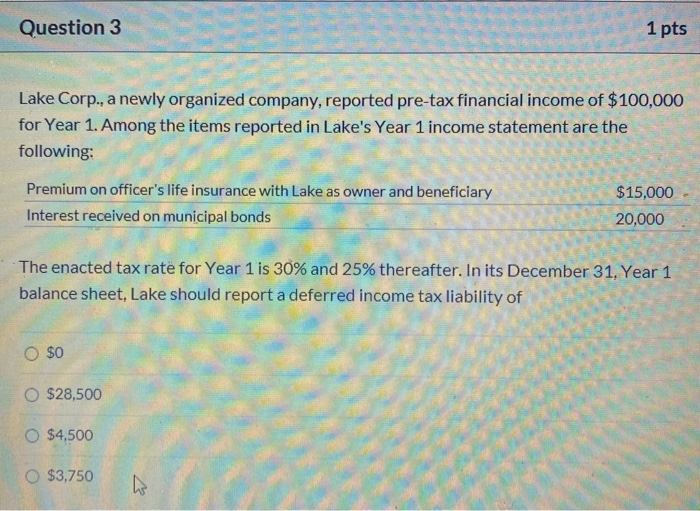

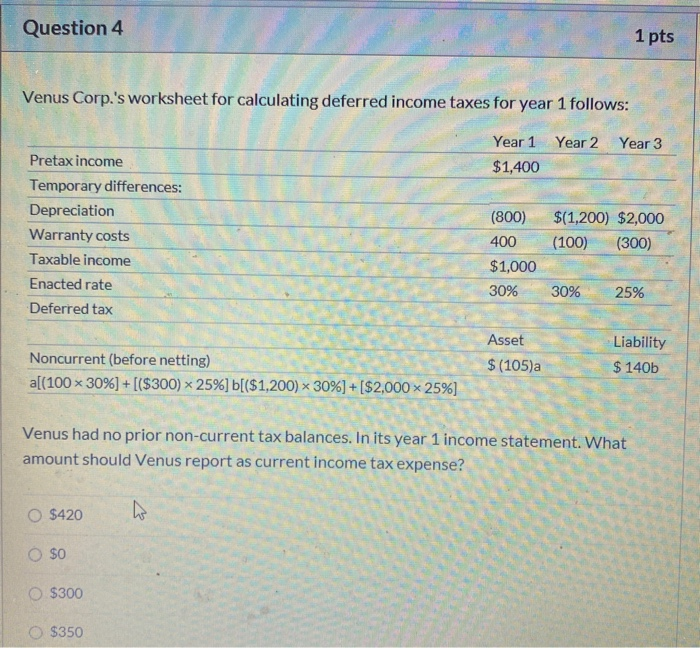

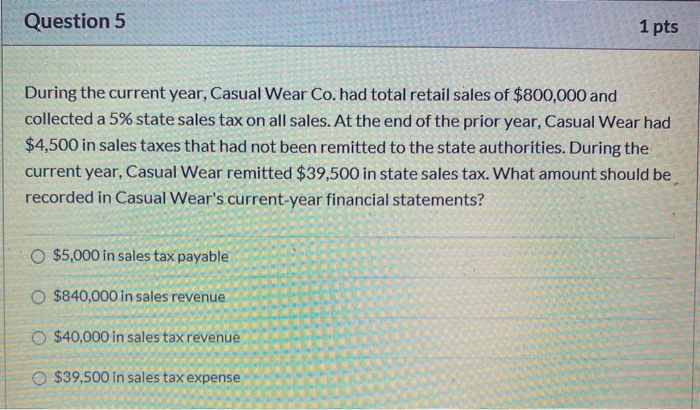

A company reported a net operating loss of $670,000 in year 1 when the current tax rate is 25% and the enacted tax rate for future years is 20%. The company appropriately recorded a deferred tax asset. In year 2, the company reports taxable income of $425,000. Following the net operating loss offset tax rules, the company appropriately applies the net operating loss to offset taxable income. What is the balance in the deferred tax asset account at the end of year 2? C. $68,000 A. $340,000 D. $66,000 B. $134,000 Question 3 1 pts Lake Corp., a newly organized company, reported pre-tax financial income of $100,000 for Year 1. Among the items reported in Lake's Year 1 income statement are the following: Premium on officer's life insurance with Lake as owner and beneficiary Interest received on municipal bonds $15,000 20,000 The enacted tax rate for Year 1 is 30% and 25% thereafter. In its December 31, Year 1 balance sheet, Lake should report a deferred income tax liability of $0 O $28,500 O $4,500 O $3,750 Question 4 1 pts Venus Corp.'s worksheet for calculating deferred income taxes for year 1 follows: Year 2 Year 3 Year 1 $1,400 Pretax income Temporary differences: Depreciation Warranty costs Taxable income Enacted rate Deferred tax $(1,200) $2,000 (100) (300) (800) 400 $1,000 30% 30% 25% Noncurrent (before netting) a[(100 x 30%] + [($300) x 25%] b[($1,200) 30%] + [$2,000 x 25%] Asset $(105) Liability $ 140b Venus had no prior non-current tax balances. In its year 1 income statement. What amount should Venus report as current income tax expense? 0 $420 ho $0 $300 $350 Question 5 1 pts During the current year, Casual Wear Co. had total retail sales of $800,000 and collected a 5% state sales tax on all sales. At the end of the prior year, Casual Wear had $4,500 in sales taxes that had not been remitted to the state authorities. During the current year, Casual Wear remitted $39,500 in state sales tax. What amount should be recorded in Casual Wear's current-year financial statements? $5,000 in sales tax payable $840,000 in sales revenue $40,000 in sales tax revenue $39.500 in sales tax expense