Answered step by step

Verified Expert Solution

Question

1 Approved Answer

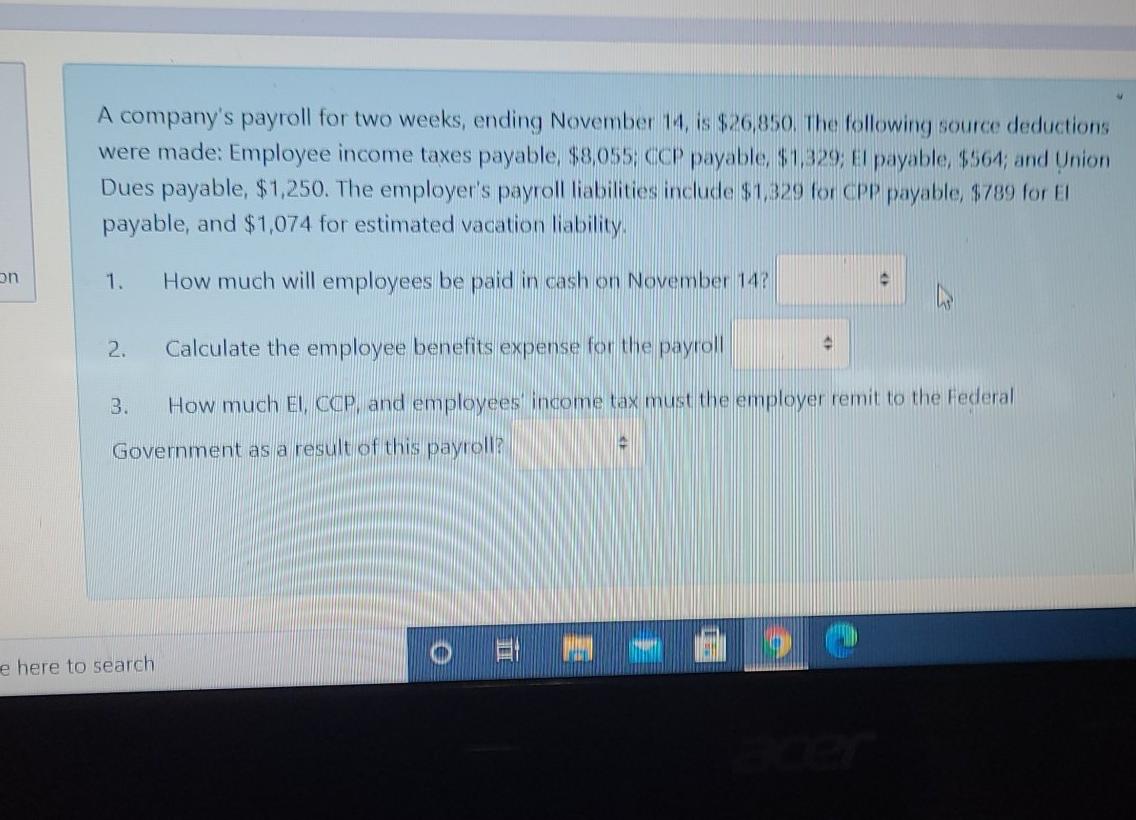

A company's payroll for two weeks, ending November 14, is $26850. The following source deductions were made: Employee income taxes payable, $8085: CCP payable $1329;

A company's payroll for two weeks, ending November 14, is $26850. The following source deductions were made: Employee income taxes payable, $8085: CCP payable $1329; e payable $564; and Union Dues payable, $1,250. The employer's payroll liabilities include $1329 for CPP payable $789 for El payable, and $1,074 for estimated vacation liability, on 1. How much will employees be paid in cash on November 147 2. Calculate the employee benefits expense for the payroll 3. How much El, CCP, and employees income tax must the employer remit to the Federal Government as a result of this payroll G e here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started