Answered step by step

Verified Expert Solution

Question

1 Approved Answer

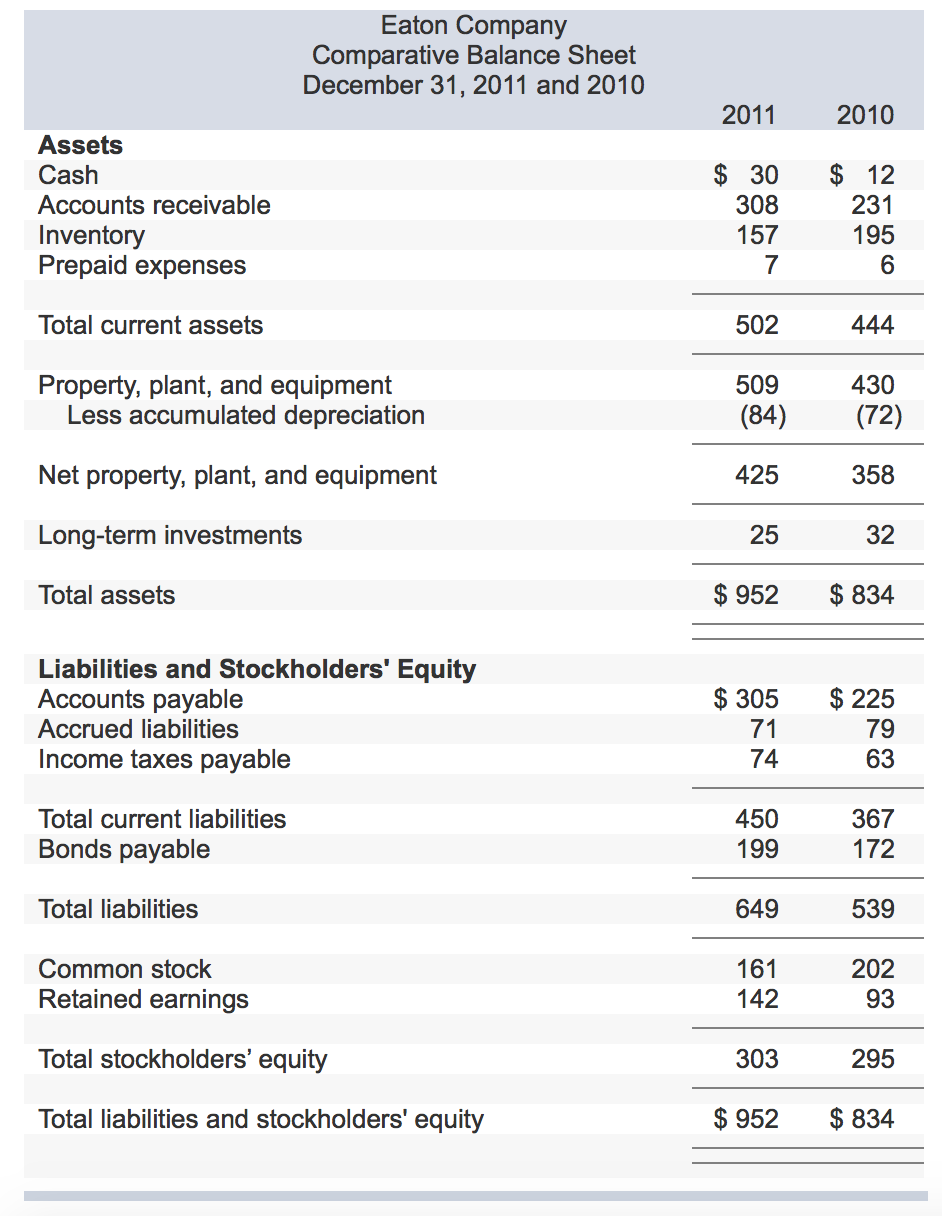

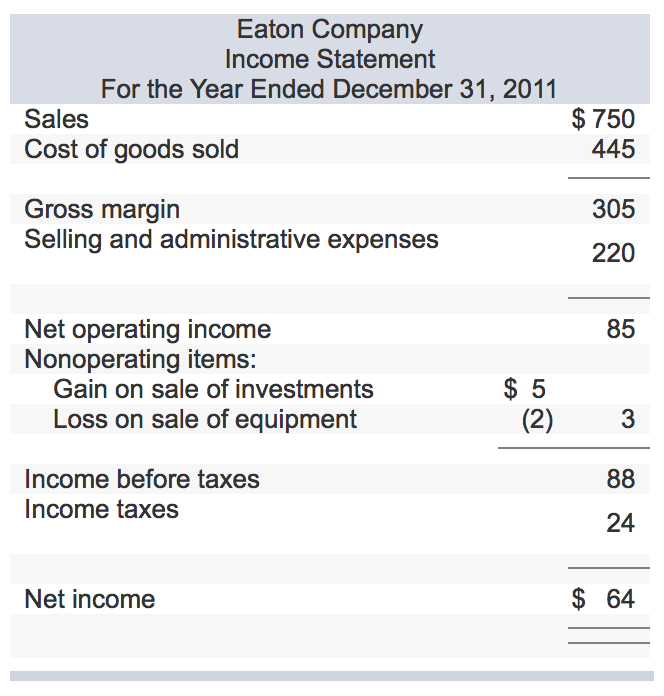

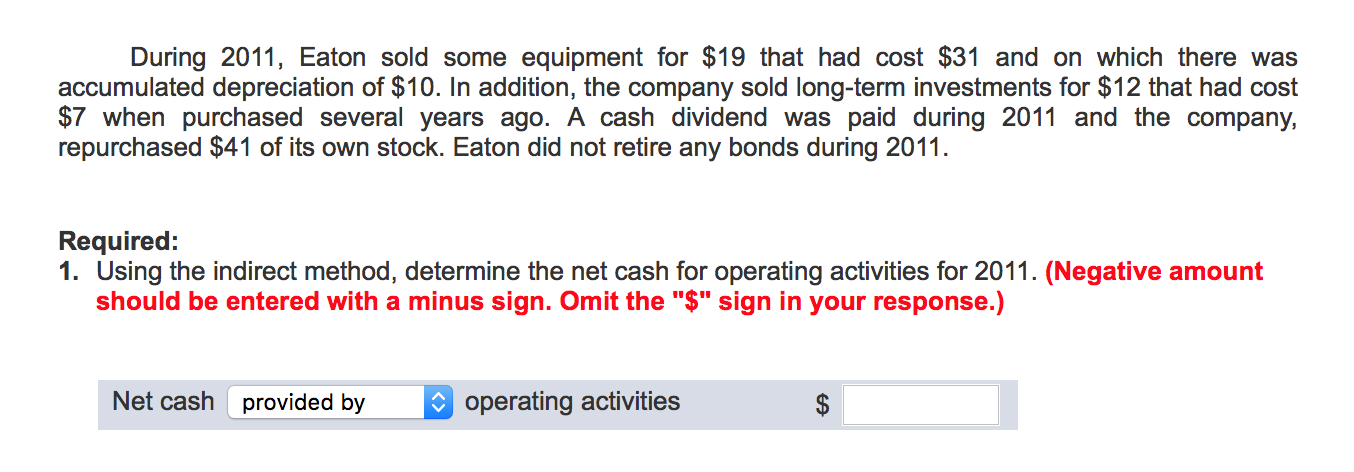

A comparative balance sheet and income statement for Eaton Company follow: 2. Using the information in (1) above, along with an analysis of the remaining

A comparative balance sheet and income statement for Eaton Company follow:

| 2. | Using the information in (1) above, along with an analysis of the remaining balance sheet accounts, prepare a statement of cash flows for 2011. (Amounts to be deducted should be indicated with a minus sign. Omit the "$" sign in your response.) |

Eaton Company Comparative Balance Sheet December 31, 2011 and 2010 2011 2010 Assets Cash Accounts receivable Inventory Prepaid expenses $ 30 $ 12 231 195 6 308 157 7 502 509 Total current assets Property, plant, and equipment 430 Less accumulated depreciation Net property, plant, and equipment Long-term investments Total assets (84)(72) 358 32 $952 $ 834 425 25 Liabilities and Stockholders' Equity Accounts payable Accrued liabilities Income taxes payable $305 $ 225 79 63 71 74 367 172 450 Total current liabilities Bonds payable 199 649 161 Total liabilities 539 202 93 Common stock Retained earnings 142 Total stockholders' equity 303 295 Total liabilities and stockholders' equity $952$ 834

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started