Answered step by step

Verified Expert Solution

Question

1 Approved Answer

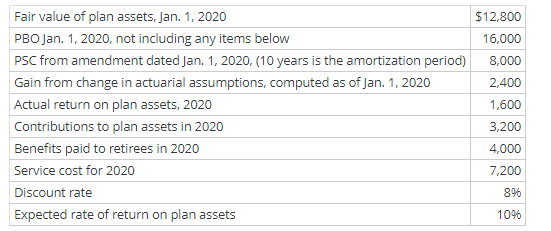

a. Compute pension expense for 2020. Amortize the full pension gain/loss over the average service life of 15 years using the straight-line method. b. Compute

a. Compute pension expense for 2020. Amortize the full pension gain/loss over the average service life of 15 years using the straight-line method.

b. Compute PBO at December 31st, 2020.

c. Compute the fair value of plan assets at December 31st, 2020.

Fair value of plan assets, Jan 1, 2020 PBO Jan 1, 2020, not including any items below PSC from amendment dated Jan 1, 2020. (10 years is the amortization period) Gain from change in actuarial assumptions, computed as of Jan. 1, 2020 Actual return on plan assets, 2020 Contributions to plan assets in 2020 Benefits paid to retirees in 2020 Service cost for 2020 Discount rate Expected rate of return on plan assets $12,800 16,000 8,000 2,400 1,600 3,200 4,000 7,200 896 1096Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started