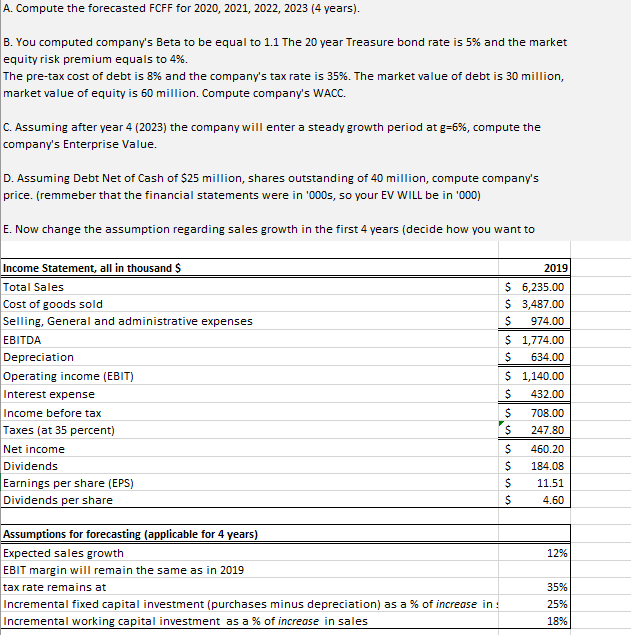

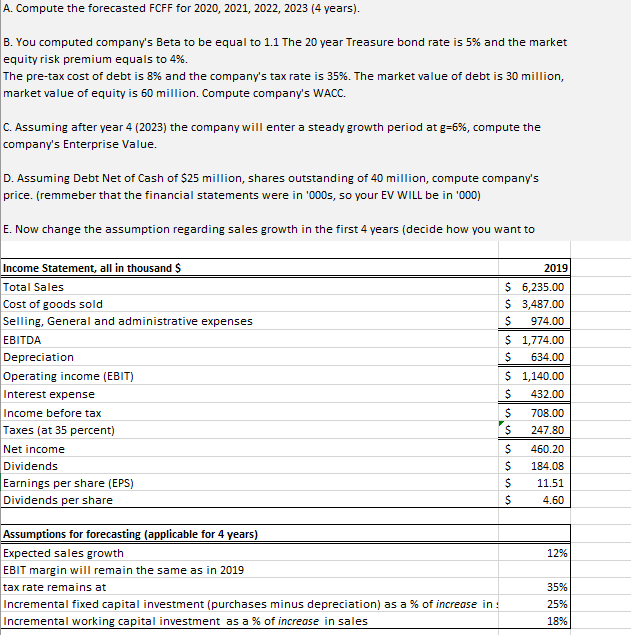

A. Compute the forecasted FCFF for 2020, 2021, 2022, 2023 (4 years). B. You computed company's Beta to be equal to 1.1 The 20 year Treasure bond rate is 5% and the market equity risk premium equals to 4%. The pre-tax cost of debt is 8% and the company's tax rate is 35%. The market value of debt is 30 million, market value of equity is 60 million. Compute company's WACC. C. Assuming after year 4 (2023) the company will enter a steady growth period at g=6%, compute the company's Enterprise Value. D. Assuming Debt Net of Cash of $25 million, shares outstanding of 40 million, compute company's price. (remmeber that the financial statements were in '000s, so your EV WILL be in '000) E. Now change the assumption regarding sales growth in the first 4 years (decide how you want to Income Statement, all in thousand $ Total Sales Cost of goods sold Selling, General and administrative expenses EBITDA Depreciation Operating income (EBIT) Interest expense Income before tax Taxes (at 35 percent) Net income Dividends Earnings per share (EPS) Dividends per share 2019 $ 6,235.00 $ 3,487.00 $ 974.00 $ 1,774.00 $ 634.00 $ 1,140.00 $ 432.00 $ 708.00 $ 247.80 $ 460.20 $ 184.08 $ 11.51 $ 4.60 12% Assumptions for forecasting (applicable for 4 years) Expected sales growth EBIT margin will remain the same as in 2019 tax rate remains at Incremental fixed capital investment (purchases minus depreciation) as a % of increase in : Incremental working capital investment as a % of increase in sales 35% 25% 18% A. Compute the forecasted FCFF for 2020, 2021, 2022, 2023 (4 years). B. You computed company's Beta to be equal to 1.1 The 20 year Treasure bond rate is 5% and the market equity risk premium equals to 4%. The pre-tax cost of debt is 8% and the company's tax rate is 35%. The market value of debt is 30 million, market value of equity is 60 million. Compute company's WACC. C. Assuming after year 4 (2023) the company will enter a steady growth period at g=6%, compute the company's Enterprise Value. D. Assuming Debt Net of Cash of $25 million, shares outstanding of 40 million, compute company's price. (remmeber that the financial statements were in '000s, so your EV WILL be in '000) E. Now change the assumption regarding sales growth in the first 4 years (decide how you want to Income Statement, all in thousand $ Total Sales Cost of goods sold Selling, General and administrative expenses EBITDA Depreciation Operating income (EBIT) Interest expense Income before tax Taxes (at 35 percent) Net income Dividends Earnings per share (EPS) Dividends per share 2019 $ 6,235.00 $ 3,487.00 $ 974.00 $ 1,774.00 $ 634.00 $ 1,140.00 $ 432.00 $ 708.00 $ 247.80 $ 460.20 $ 184.08 $ 11.51 $ 4.60 12% Assumptions for forecasting (applicable for 4 years) Expected sales growth EBIT margin will remain the same as in 2019 tax rate remains at Incremental fixed capital investment (purchases minus depreciation) as a % of increase in : Incremental working capital investment as a % of increase in sales 35% 25% 18%