Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Compute the initial goodwill as at 1 January 2015 arising on acquisition of East and West. [6 marks] (b) Calculate the gain or loss

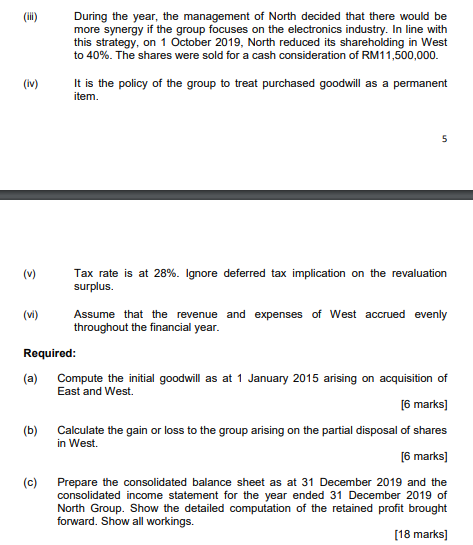

(a) Compute the initial goodwill as at 1 January 2015 arising on acquisition of East and West. [6 marks]

(b) Calculate the gain or loss to the group arising on the partial disposal of shares in West. [6 marks]

(c) Prepare the consolidated balance sheet as at 31 December 2019 and the consolidated income statement for the year ended 31 December 2019 of North Group. Show the detailed computation of the retained profit brought forward. Show all workings.

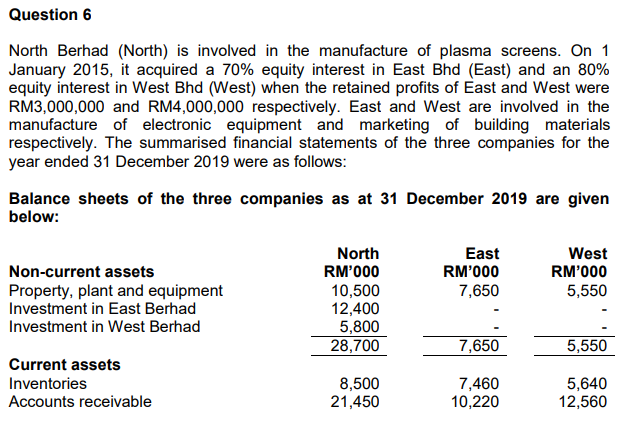

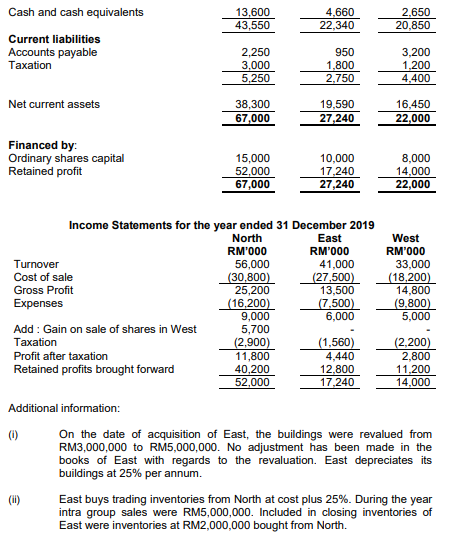

Question 6 North Berhad (North) is involved in the manufacture of plasma screens. On 1 January 2015, it acquired a 70% equity interest in East Bhd (East) and an 80% equity interest in West Bhd (West) when the retained profits of East and West were RM3,000,000 and RM4,000,000 respectively. East and West are involved in the manufacture of electronic equipment and marketing of building materials respectively. The summarised financial statements of the three companies for the year ended 31 December 2019 were as follows: Balance sheets of the three companies as at 31 December 2019 are given below: East RM'000 7,650 West RM'000 5,550 Non-current assets Property, plant and equipment Investment in East Berhad Investment in West Berhad North RM'000 10,500 12,400 5,800 28,700 7,650 5,550 Current assets Inventories Accounts receivable 8,500 21,450 7,460 10,220 5,640 12,560 13,600 43,550 4,660 22,340 2,650 20,850 Cash and cash equivalents Current liabilities Accounts payable Taxation 2.250 3,000 5,250 950 1,800 2.750 3,200 1,200 4.400 Net current assets 38,300 67,000 19,590 27,240 16,450 22,000 Financed by: Ordinary shares capital Retained profit 15,000 52,000 67,000 10.000 17,240 27,240 8,000 14,000 22,000 Income Statements for the year ended 31 December 2019 North East RM'000 RM'000 Turnover 56,000 41,000 Cost of sale (30,800) (27,500) Gross Profit 25,200 13,500 Expenses (16,200) (7,500) 9,000 6,000 Add: Gain on sale of shares in West 5,700 Taxation (2.900) (1,560) Profit after taxation 11,800 4,440 Retained profits brought forward 40,200 12,800 52,000 17,240 West RM'000 33,000 (18,200) 14,800 (9.800) 5,000 (2.200) 2,800 11,200 14,000 Additional information: (0) On the date of acquisition of East, the buildings were revalued from RM3,000,000 to RM5,000,000. No adjustment has been made in the books of East with regards to the revaluation. East depreciates its buildings at 25% per annum. (ii) East buys trading inventories from North at cost plus 25%. During the year intra group sales were RM5,000,000. Included in closing inventories of East were inventories at RM2,000,000 bought from North. During the year, the management of North decided that there would be more synergy if the group focuses on the electronics industry. In line with this strategy, on 1 October 2019, North reduced its shareholding in West to 40%. The shares were sold for a cash consideration of RM11,500,000. It is the policy of the group to treat purchased goodwill as a permanent item. (iv) 5 (v) Tax rate is at 28%. Ignore deferred tax implication on the revaluation surplus. (vi) Assume that the revenue and expenses of West accrued evenly throughout the financial year. Required: (a) Compute the initial goodwill as at 1 January 2015 arising on acquisition of East and West. [6 marks] (b) Calculate the gain or loss to the group arising on the partial disposal of shares in West. [6 marks) (c) Prepare the consolidated balance sheet as at 31 December 2019 and the consolidated income statement for the year ended 31 December 2019 of North Group. Show the detailed computation of the retained profit brought forward. Show all workings. [18 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started