Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Compute the price of a share of stock that pays a $1 per year dividend and that you expect to be able to

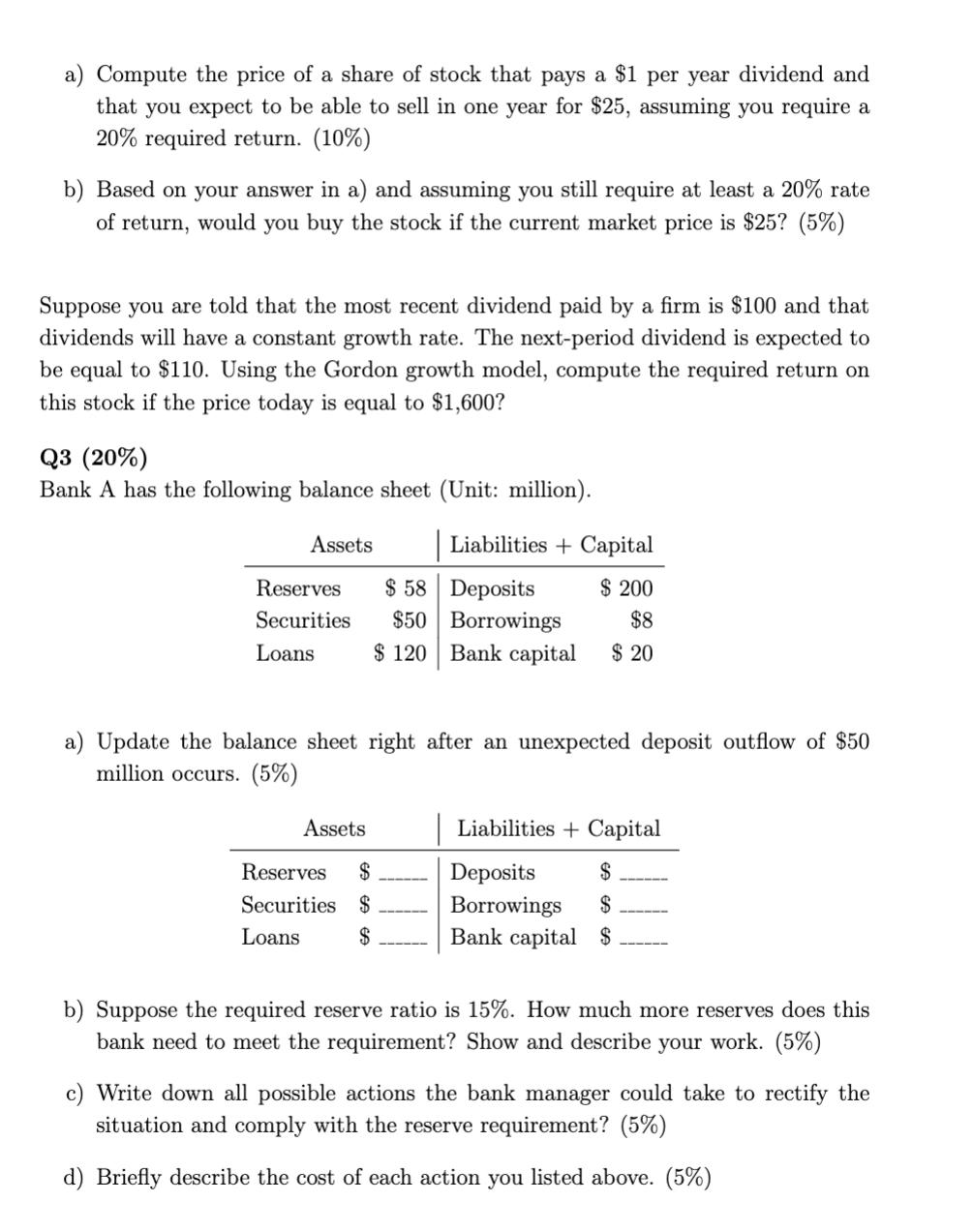

a) Compute the price of a share of stock that pays a $1 per year dividend and that you expect to be able to sell in one year for $25, assuming you require a 20% required return. (10%) b) Based on your answer in a) and assuming you still require at least a 20% rate of return, would you buy the stock if the current market price is $25? (5%) Suppose you are told that the most recent dividend paid by a firm is $100 and that dividends will have a constant growth rate. The next-period dividend is expected to be equal to $110. Using the Gordon growth model, compute the required return on this stock if the price today is equal to $1,600? Q3 (20%) Bank A has the following balance sheet (Unit: million). Assets Liabilities +Capital Reserves Securities Loans $ 58 $50 Deposits Borrowings $ 200 $8 $ 120 Bank capital $ 20 a) Update the balance sheet right after an unexpected deposit outflow of $50 million occurs. (5%) Liabilities Capital Assets Reserves $ Securities $ Loans $ Deposits Borrowings Bank capital $ $ $ b) Suppose the required reserve ratio is 15%. How much more reserves does this bank need to meet the requirement? Show and describe your work. (5%) c) Write down all possible actions the bank manager could take to rectify the situation and comply with the reserve requirement? (5%) d) Briefly describe the cost of each action you listed above. (5%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started