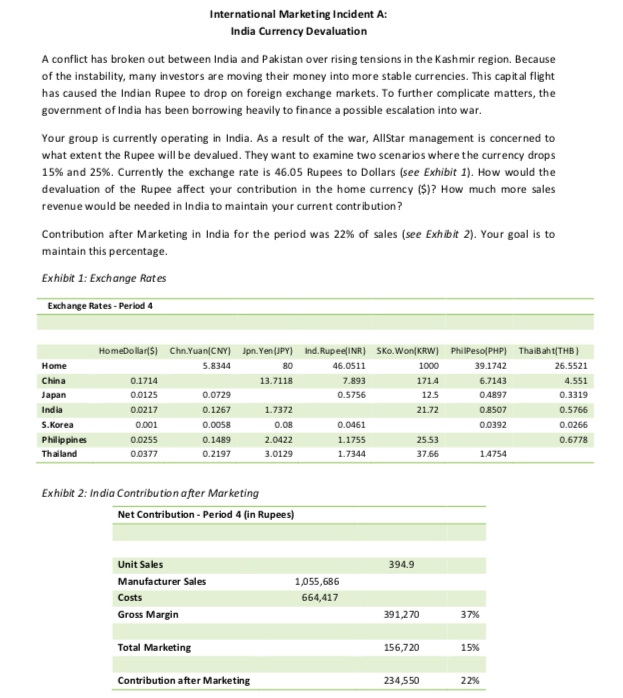

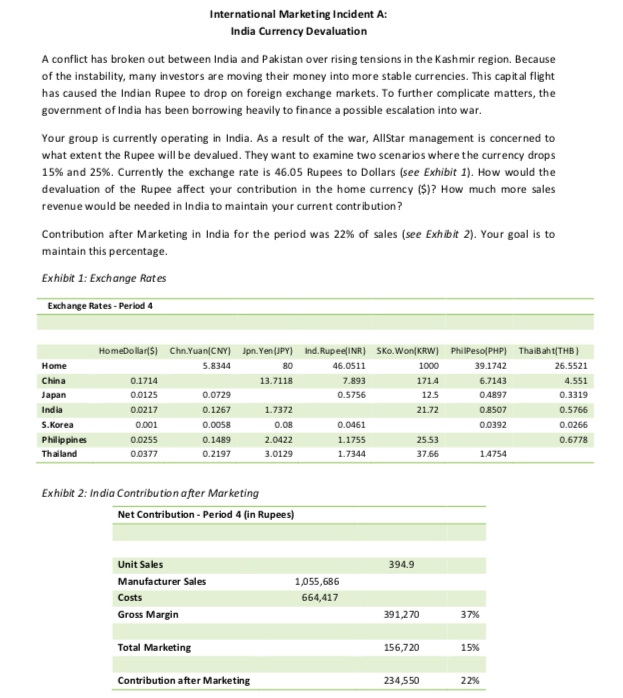

A conflict has broken out between India and Pakistan over rising tensions in the Kashmir region. Because of the instability, many investors are moving their money into more stable currencies. This capital flight has caused the Indian Rupee to drop on foreign exchange markets. To complicate matters, the government of India has been borrowing heavily to finance a possible escalation into war. Your group is currently operating in India. As a result of the war, AllStar management is concerned to what extent the Rupee will be devalued. They want to examine two scenarios where the currency drops 15% and 25%. Currently the exchange rate is 46.05 Rupees to Dollars (see Exhibit 1). How would the devaluation of the Rupee affect your contribution in the home currency ($)? How much more sales revenue would be needed in India to maintain your current contribution? Contribution after Marketing in India for the period was 22% of sales (Exhibit 2). Your goal is to maintain this percentage.

International Marketing Incident A: India Currency Devaluation A conflict has broken out between India and Pakistan over rising tensions in the Kashmir region. Because of the instability, many investors are moving their money into more stable currencies. This capital flight has caused the Indian Rupee to drop on foreign exchange markets. To further complicate matters, the government of India has been borrowing heavily to finance a possible escalation into war. Your group is currently operating in India. As a result of the war, AllStar management is concerned to what extent the Rupee will be devalued. They want to examine two scenarios where the currency drops 15% and 25%. Currently the exchange rate is 46.05 Rupees to Dollars (see Exhibit 1). How would the devaluation of the Rupee affect your contribution in the home currency ($)? How much more sales revenue would be needed in India to maintain your current contribution? Contribution after Marketing in India for the period was 22% of sales (see Exhibit 2). Your goal is to maintain this percentage. Exhibit 1: Exchange Rates Exchange Rates - Period 4 Home China Japan India S.Korea Philippines Thailand HomeDollar(s) Chn.Yuan(CNY) Jpn. Yen (JPY) Ind. Rupee(INR) SKO.Won(KRW) PhilPeso(PHP) ThaiBaht(THB) 5.8344 80 46.0511 1000 39.1742 26.5521 0.1714 13.7118 7.893 1714 6.7143 4.551 0.0125 0.0729 0.5756 125 0.4897 0.3319 0.0217 0.1267 1.7372 21.72 0.8507 0.5766 0.001 0.0058 0.08 0.0461 0.0392 0.0266 0.0255 0.1489 2.0422 1.1755 25.53 0.6778 0.0377 0.2197 3.0129 1.7344 37.66 14754 Exhibit 2: India Contribution after Marketing Net Contribution - Period 4 (in Rupees) 394.9 Unit Sales Manufacturer Sales Costs Gross Margin 1,055,686 664,417 391,270 37% Total Marketing 156,720 15% Contribution after Marketing 234,550 22% International Marketing Incident A: India Currency Devaluation A conflict has broken out between India and Pakistan over rising tensions in the Kashmir region. Because of the instability, many investors are moving their money into more stable currencies. This capital flight has caused the Indian Rupee to drop on foreign exchange markets. To further complicate matters, the government of India has been borrowing heavily to finance a possible escalation into war. Your group is currently operating in India. As a result of the war, AllStar management is concerned to what extent the Rupee will be devalued. They want to examine two scenarios where the currency drops 15% and 25%. Currently the exchange rate is 46.05 Rupees to Dollars (see Exhibit 1). How would the devaluation of the Rupee affect your contribution in the home currency ($)? How much more sales revenue would be needed in India to maintain your current contribution? Contribution after Marketing in India for the period was 22% of sales (see Exhibit 2). Your goal is to maintain this percentage. Exhibit 1: Exchange Rates Exchange Rates - Period 4 Home China Japan India S.Korea Philippines Thailand HomeDollar(s) Chn.Yuan(CNY) Jpn. Yen (JPY) Ind. Rupee(INR) SKO.Won(KRW) PhilPeso(PHP) ThaiBaht(THB) 5.8344 80 46.0511 1000 39.1742 26.5521 0.1714 13.7118 7.893 1714 6.7143 4.551 0.0125 0.0729 0.5756 125 0.4897 0.3319 0.0217 0.1267 1.7372 21.72 0.8507 0.5766 0.001 0.0058 0.08 0.0461 0.0392 0.0266 0.0255 0.1489 2.0422 1.1755 25.53 0.6778 0.0377 0.2197 3.0129 1.7344 37.66 14754 Exhibit 2: India Contribution after Marketing Net Contribution - Period 4 (in Rupees) 394.9 Unit Sales Manufacturer Sales Costs Gross Margin 1,055,686 664,417 391,270 37% Total Marketing 156,720 15% Contribution after Marketing 234,550 22%