Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Consider a six-month forward contract on a unit of stock ( S ) that is currently priced at ( 80 ). The continuously compounded

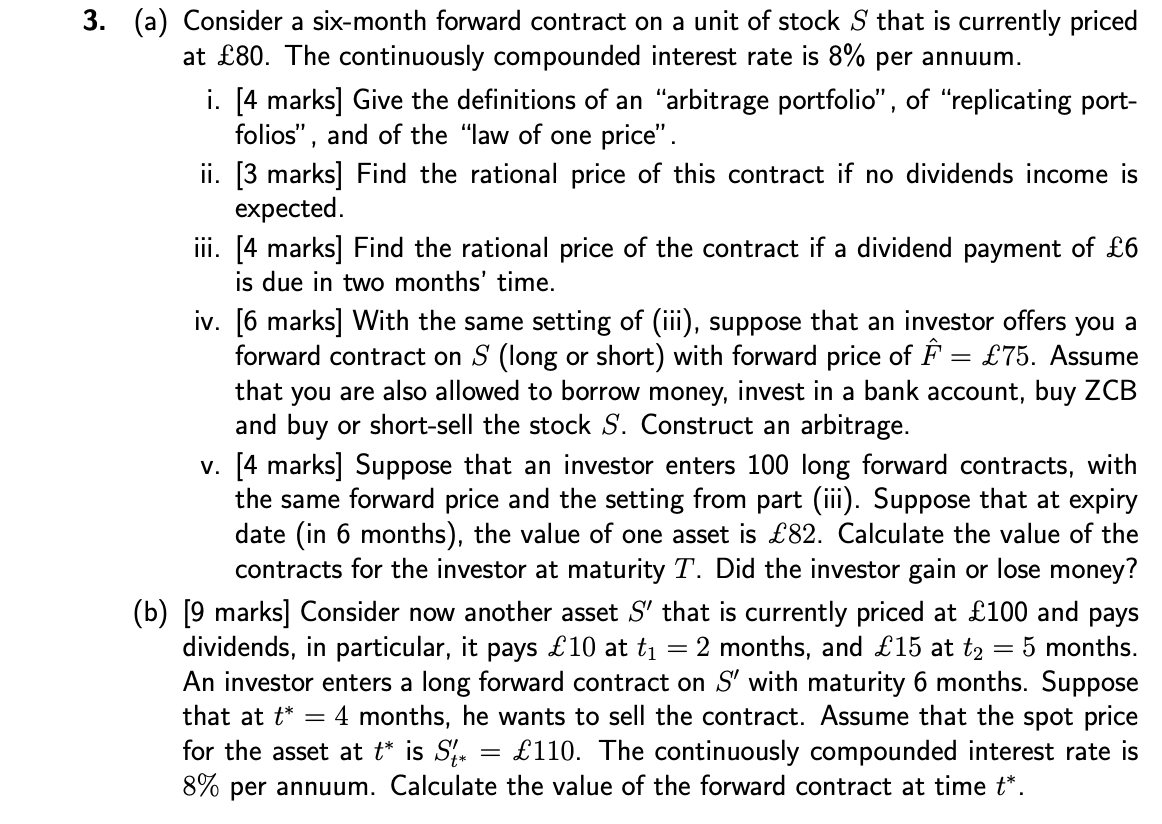

(a) Consider a six-month forward contract on a unit of stock \\( S \\) that is currently priced at \\( 80 \\). The continuously compounded interest rate is \8 per annuum. i. [4 marks] Give the definitions of an \"arbitrage portfolio\", of \"replicating portfolios\", and of the \"law of one price\". ii. [3 marks] Find the rational price of this contract if no dividends income is expected. iii. [4 marks] Find the rational price of the contract if a dividend payment of \\( 6 \\) is due in two months' time. iv. [6 marks] With the same setting of (iii), suppose that an investor offers you a forward contract on \\( S \\) (long or short) with forward price of \\( \\hat{F}= 75 \\). Assume that you are also allowed to borrow money, invest in a bank account, buy ZCB and buy or short-sell the stock \\( S \\). Construct an arbitrage. v. [4 marks] Suppose that an investor enters 100 long forward contracts, with the same forward price and the setting from part (iii). Suppose that at expiry date (in 6 months), the value of one asset is \\( 82 \\). Calculate the value of the contracts for the investor at maturity \\( T \\). Did the investor gain or lose money? (b) [9 marks] Consider now another asset \\( S^{\\prime} \\) that is currently priced at \\( 100 \\) and pays dividends, in particular, it pays \\( 10 \\) at \\( t_{1}=2 \\) months, and \\( 15 \\) at \\( t_{2}=5 \\) months. An investor enters a long forward contract on \\( S^{\\prime} \\) with maturity 6 months. Suppose that at \\( t^{*}=4 \\) months, he wants to sell the contract. Assume that the spot price for the asset at \\( t^{*} \\) is \\( S_{t^{*}}^{\\prime}= 110 \\). The continuously compounded interest rate is \8 per annuum. Calculate the value of the forward contract at time \\( t^{*} \\)

(a) Consider a six-month forward contract on a unit of stock \\( S \\) that is currently priced at \\( 80 \\). The continuously compounded interest rate is \8 per annuum. i. [4 marks] Give the definitions of an \"arbitrage portfolio\", of \"replicating portfolios\", and of the \"law of one price\". ii. [3 marks] Find the rational price of this contract if no dividends income is expected. iii. [4 marks] Find the rational price of the contract if a dividend payment of \\( 6 \\) is due in two months' time. iv. [6 marks] With the same setting of (iii), suppose that an investor offers you a forward contract on \\( S \\) (long or short) with forward price of \\( \\hat{F}= 75 \\). Assume that you are also allowed to borrow money, invest in a bank account, buy ZCB and buy or short-sell the stock \\( S \\). Construct an arbitrage. v. [4 marks] Suppose that an investor enters 100 long forward contracts, with the same forward price and the setting from part (iii). Suppose that at expiry date (in 6 months), the value of one asset is \\( 82 \\). Calculate the value of the contracts for the investor at maturity \\( T \\). Did the investor gain or lose money? (b) [9 marks] Consider now another asset \\( S^{\\prime} \\) that is currently priced at \\( 100 \\) and pays dividends, in particular, it pays \\( 10 \\) at \\( t_{1}=2 \\) months, and \\( 15 \\) at \\( t_{2}=5 \\) months. An investor enters a long forward contract on \\( S^{\\prime} \\) with maturity 6 months. Suppose that at \\( t^{*}=4 \\) months, he wants to sell the contract. Assume that the spot price for the asset at \\( t^{*} \\) is \\( S_{t^{*}}^{\\prime}= 110 \\). The continuously compounded interest rate is \8 per annuum. Calculate the value of the forward contract at time \\( t^{*} \\) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started