Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Consider the cash flows provided by the following two assets: Asset I: Fixed half-yearly cash flows that last forever. The first payment of $80,000

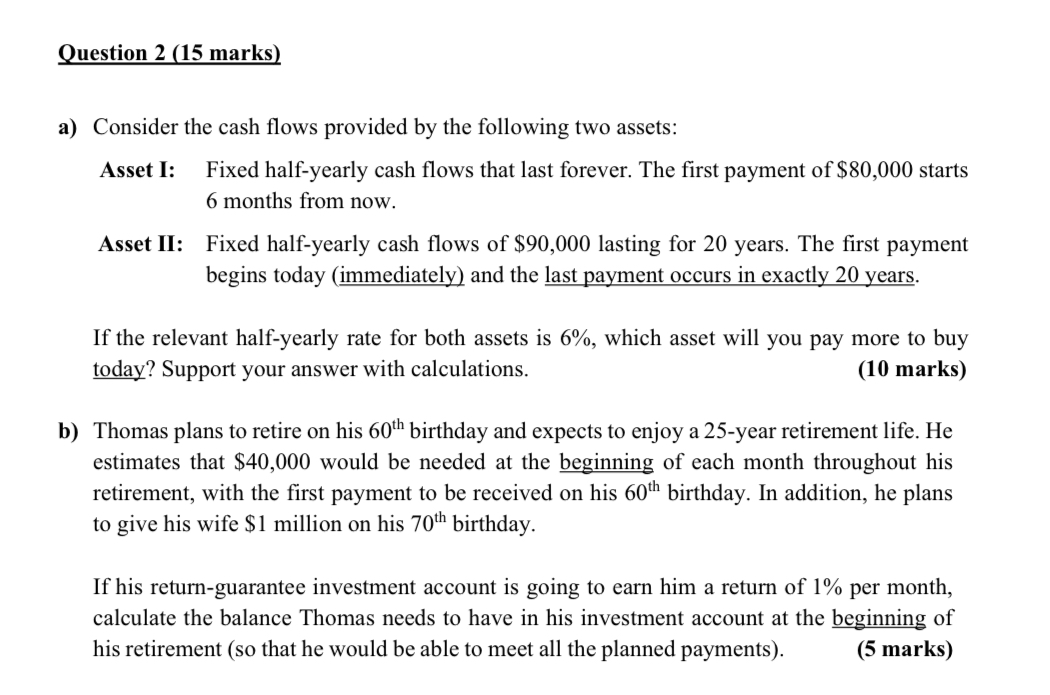

a) Consider the cash flows provided by the following two assets: Asset I: Fixed half-yearly cash flows that last forever. The first payment of $80,000 starts 6 months from now. Asset II: Fixed half-yearly cash flows of $90,000 lasting for 20 years. The first payment begins today (immediately) and the last payment occurs in exactly 20 years. If the relevant half-yearly rate for both assets is 6%, which asset will you pay more to buy today? Support your answer with calculations. (10 marks) b) Thomas plans to retire on his 60th birthday and expects to enjoy a 25 -year retirement life. He estimates that $40,000 would be needed at the beginning of each month throughout his retirement, with the first payment to be received on his 60th birthday. In addition, he plans to give his wife $1 million on his 70th birthday. If his return-guarantee investment account is going to earn him a return of 1% per month, calculate the balance Thomas needs to have in his investment account at the beginning of his retirement (so that he would be able to meet all the planned payments)

a) Consider the cash flows provided by the following two assets: Asset I: Fixed half-yearly cash flows that last forever. The first payment of $80,000 starts 6 months from now. Asset II: Fixed half-yearly cash flows of $90,000 lasting for 20 years. The first payment begins today (immediately) and the last payment occurs in exactly 20 years. If the relevant half-yearly rate for both assets is 6%, which asset will you pay more to buy today? Support your answer with calculations. (10 marks) b) Thomas plans to retire on his 60th birthday and expects to enjoy a 25 -year retirement life. He estimates that $40,000 would be needed at the beginning of each month throughout his retirement, with the first payment to be received on his 60th birthday. In addition, he plans to give his wife $1 million on his 70th birthday. If his return-guarantee investment account is going to earn him a return of 1% per month, calculate the balance Thomas needs to have in his investment account at the beginning of his retirement (so that he would be able to meet all the planned payments) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started