Question

a) Consider two workers who started working at the same company on the same day. These workers are identical in every respect, except one has

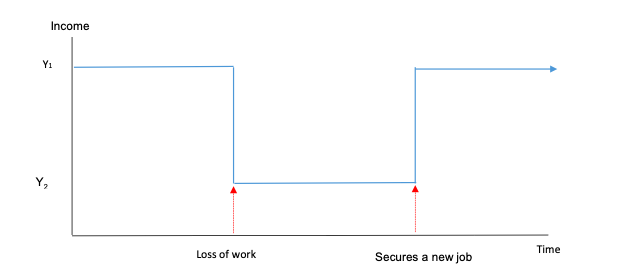

a) Consider two workers who started working at the same company on the same day. These workers are identical in every respect, except one has the ability to borrow funds if needed, while the other does not. Both workers have the same projected path of income as presented in the diagram below:

(i) For each worker, redraw their path of income (separate diagrams) in your answer, and add their respective consumption paths. In each case, show how their consumption paths might change over time as their income suffers an unexpected negative shock from a job loss, followed by a recovery in income as they each gain a new job paying the same salary they had before. Be sure to indicate how each workers path of consumption might differ depending on their ability to borrow. Make sure you state all underlying assumptions.

(ii) Discuss two factors that could constrain a households ability to smooth consumption.

(iii) Based on the analysis in (i) above, explain the predicted relationship between changes in income and consumption for an economy that has a very high percentage of credit-constrained households. How would this relationship change if most households in the economy had easy access to credit?

B1 Robert Shiller, a Professor of Economics at Yale University and the Economic Sciences Nobel Prize winner in 2013, argued that the presence of irrational exuberance and animal spirits have contributed to the volatility of investment over the past few decades.

(i): Explain what is meant by these terms and how this behaviour has led to the development of self-reinforcing investment cycles, for example, asset price bubbles. Do you think investors have learnt from their past mistakes? Why/why not?

(ii) :Use an example of a coordination game (one that was not covered in class or the adopted textbook) to highlight the importance of coordinated decision-making when considering different investment projects. Identify any Nash equilibrium/equilibria and explore how government can help ensure a Pareto-optimal investment outcome for your chosen example.

Income Y1 Y, Loss of work Time Secures a new jobStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started