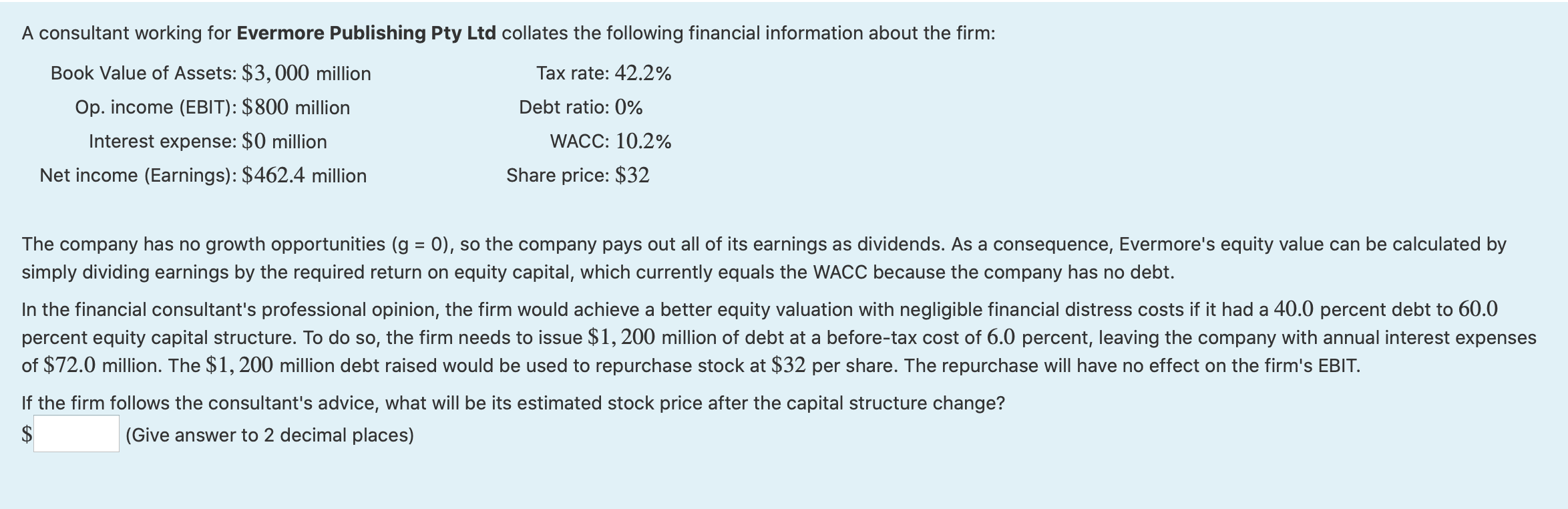

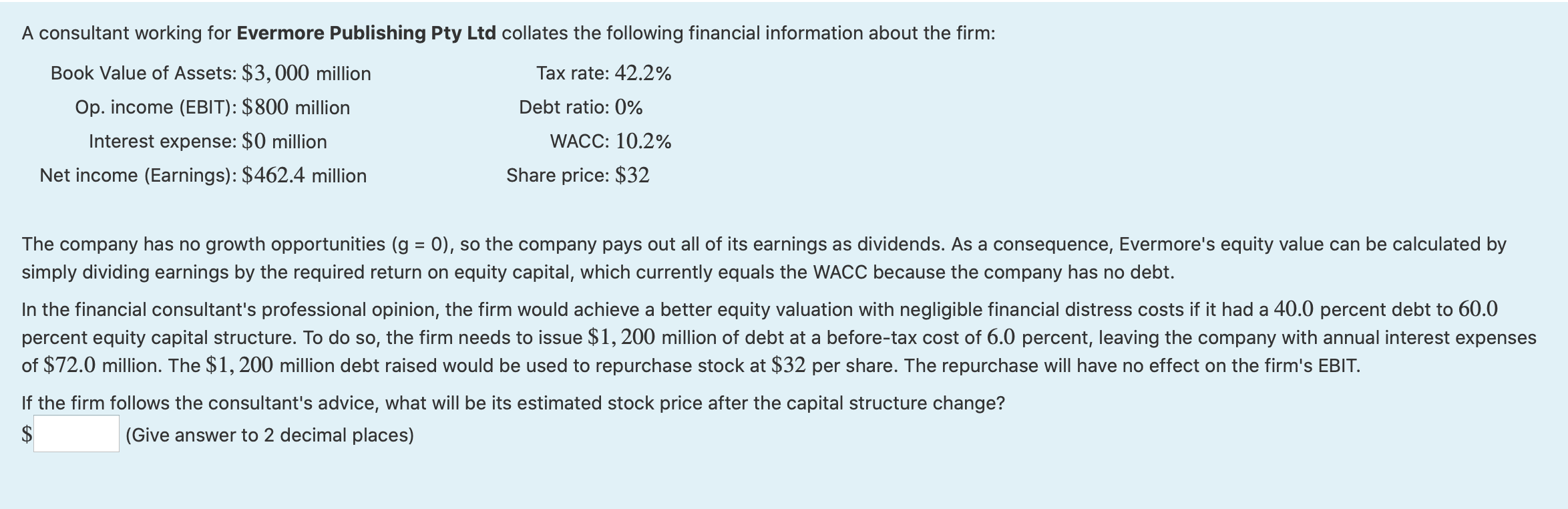

A consultant working for Evermore Publishing Pty Ltd collates the following financial information about the firm: Book Value of Assets: $3,000 million Op. income (EBIT): $800 million Interest expense: $0 million Net income (Earnings): $462.4 million Tax rate: 42.2% Debt ratio: 0% WACC: 10.2% Share price: $32 The company has no growth opportunities (g = 0), so the company pays out all of its earnings as dividends. As a consequence, Evermore's equity value can be calculated by simply dividing earnings by the required return on equity capital, which currently equals the WACC because the company has no debt. In the financial consultant's professional opinion, the firm would achie a better equity valuation with negligible fina cial stress costs if had a 40.0 percent debt to 60.0 percent equity capital structure. To do so, the firm needs to issue $1,200 million of debt at a before-tax cost of 6.0 percent, leaving the company with annual interest expenses of $72.0 million. The $1, 200 million debt raised would be used to repurchase stock at $32 per share. The repurchase will have no effect on the firm's EBIT. If the firm follows the consultant's advice, what will be its estimated stock price after the capital structure change? $ (Give answer to 2 decimal places) A consultant working for Evermore Publishing Pty Ltd collates the following financial information about the firm: Book Value of Assets: $3,000 million Op. income (EBIT): $800 million Interest expense: $0 million Net income (Earnings): $462.4 million Tax rate: 42.2% Debt ratio: 0% WACC: 10.2% Share price: $32 The company has no growth opportunities (g = 0), so the company pays out all of its earnings as dividends. As a consequence, Evermore's equity value can be calculated by simply dividing earnings by the required return on equity capital, which currently equals the WACC because the company has no debt. In the financial consultant's professional opinion, the firm would achie a better equity valuation with negligible fina cial stress costs if had a 40.0 percent debt to 60.0 percent equity capital structure. To do so, the firm needs to issue $1,200 million of debt at a before-tax cost of 6.0 percent, leaving the company with annual interest expenses of $72.0 million. The $1, 200 million debt raised would be used to repurchase stock at $32 per share. The repurchase will have no effect on the firm's EBIT. If the firm follows the consultant's advice, what will be its estimated stock price after the capital structure change? $ (Give answer to 2 decimal places)