Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A corporation has $60 million available for the coming year to allocate to its three subsidiaries. Because of commitments to stability of personnel employment and

A corporation has $60 million available for the coming year to allocate to its three subsidiaries. Because of commitments to stability of personnel employment and for other reasons, the corporation has established a range of funding for each subsidiary to be between a minimum of $10 million and a maximum of $30 million.

To maintain some degree of equity among Subsidiary 2 and 3, the corporation wants Subsidiary 3 to receive no more than twice the funding for Subsidiary 2. Owing to the nature of its operation, Subsidiary 1 cannot utilize more than $20 million without major new capital expansion. The corporation is unwilling to undertake such expansion currently.

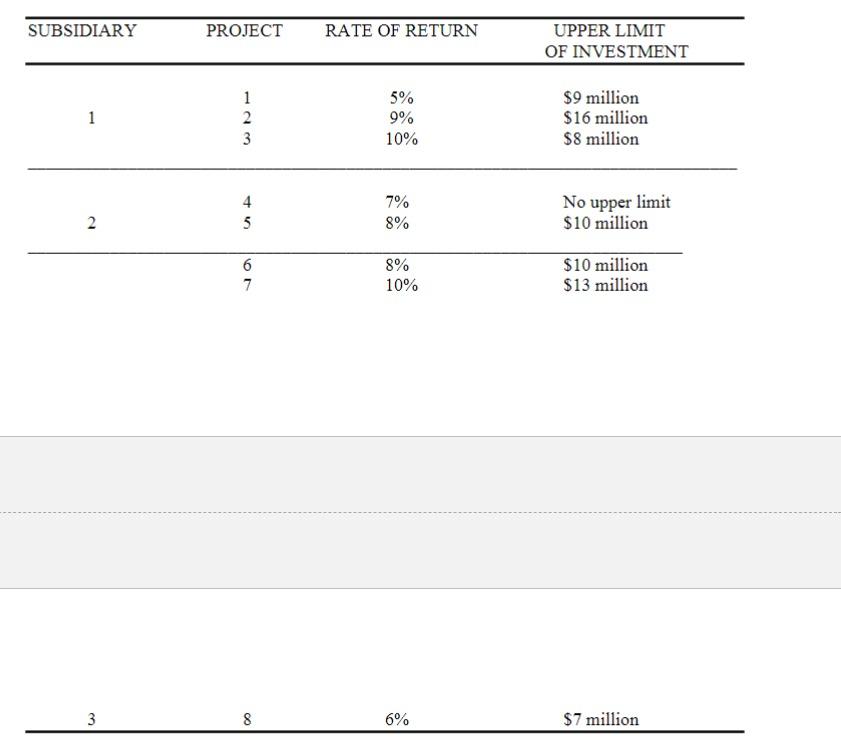

The funding for each subsidiary will be used to fund several projects it undertakes (see table below). A rate of return (as a percent of investment) has been established for each project. In addition, certain of the projects permit only limited investment. The data of each project is given below. For example, the maximum subsidiary 1 can invest in project 2 is $16 million and for every $100 invested in project 2 the company earns $9 profit (return on investment).

Formulate a linear programming problem that maximizes the total return (in $million) on all investments for the corporation. Of course, the corporation wants to know how to allocate its investment budget to the three subsidiaries and their projects.

To maintain some degree of equity among Subsidiary 2 and 3, the corporation wants Subsidiary 3 to receive no more than twice the funding for Subsidiary 2. Owing to the nature of its operation, Subsidiary 1 cannot utilize more than $20 million without major new capital expansion. The corporation is unwilling to undertake such expansion currently.

The funding for each subsidiary will be used to fund several projects it undertakes (see table below). A rate of return (as a percent of investment) has been established for each project. In addition, certain of the projects permit only limited investment. The data of each project is given below. For example, the maximum subsidiary 1 can invest in project 2 is $16 million and for every $100 invested in project 2 the company earns $9 profit (return on investment).

Formulate a linear programming problem that maximizes the total return (in $million) on all investments for the corporation. Of course, the corporation wants to know how to allocate its investment budget to the three subsidiaries and their projects.

SUBSIDIARY 1 2 3 PROJECT 123 2 3 45 6 7 8 RATE OF RETURN 5% 9% 10% 7% 8% 8% 10% 6% UPPER LIMIT OF INVESTMENT $9 million $16 million $8 million No upper limit $10 million $10 million $13 million $7 million

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To formulate a linear programming problem for this scenario lets define the decision variables objec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started