Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A could have multiple answers. Retirement Savings. Miguel, a recent 22-year old college graduate, wants to retire a millionaire. He plans to retire at age

A could have multiple answers.

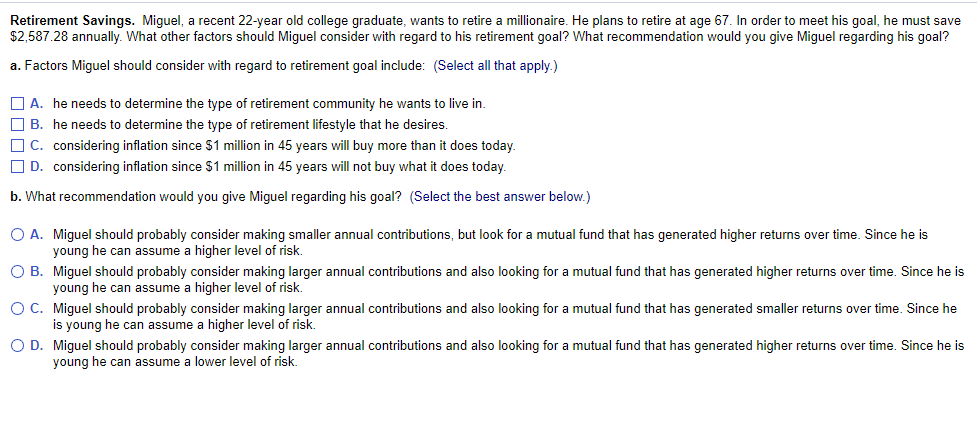

Retirement Savings. Miguel, a recent 22-year old college graduate, wants to retire a millionaire. He plans to retire at age 67. In order to meet his goal, he must save $2,587.28 annually. What other factors should Miguel consider with regard to his retirement goal? What recommendation would you give Miguel regarding his goal? a. Factors Miguel should consider with regard to retirement goal include: (Select all that apply.) A, he needs to determine the type of retirement community he wants to live in B. he needs to determine the type of retirement lifestyle that he desires c. considering inflation since $1 million in 45 years will buy more than it does today D. considering inflation since $1 million in 45 years will not buy what it does today b. What recommendation would you give Miguel regarding his goal? (Select the best answer below.) 0 A. Miguel should probably consider making smaller annual contributions, but look for a mutual fund that has generated higher returns over time. Since he is B. Miguel should probably consider making larger annual contributions and also looking for a mutual fund that has generated higher returns over time. Since he is ( C. Miguel should probably consider making larger annual contributions and also looking for a mutual fund that has generated smaller returns over time. Since he 0 D. Miguel should probably consider making larger annual contributions and also looking for a mutual fund that has generated higher returns over time. Since he is young he can assume a higher level of risk. young he can assume a higher level of risk. is young he can assume a higher level of ris young he can assume a lower level of risk. k

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started