Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A couple will retire in 45 years. They plan to spend $50,000 of their savings each year with the withdrawal coming at the end of

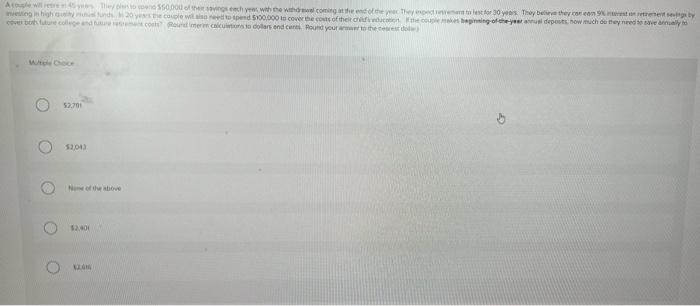

A couple will retire in 45 years. They plan to spend $50,000 of their savings each year with the withdrawal coming at the end of the year. They expect retirement to last for 30 years. They believe they can earn 9% interest on retirement savings by investing in high-quality mutual funds. In 20 years a couple will also need to spend $100,000 to cover the costs of their child's education. If the couple makes beginning of the year annual deposits how much do they need to save annually to cover both future college and future retirement costs (round in term calculations to dollars and cents. Round your answer to the nearest dollar.)

A couple will retre 45 yrs They plan to spend investing in high quality muual funds cover both future college and future Witple Choce O O $2,701 $2,043 Name of the above $2,40( KLON $50,000 of their savings each year with the withdrewel coming at the end of the year They expect rremant to lest for 30 years. They believe they can ean 9% retement ses by 20 years the couple will also need to spend $100,000 to cover the costs of their chieducation the couple makes beginning of the year annusi deposts, how much do they need to save annually to em costs Roured intern calculations to dollars end cents Round your armwer to t ceres dol answer choices: $2781, $2043, none of the above, $2401, $2616

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started