Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a: D.C. does not currently track actual cost information, but Kay has estimated some additional production data provided in Table 5. Using the approach(es)

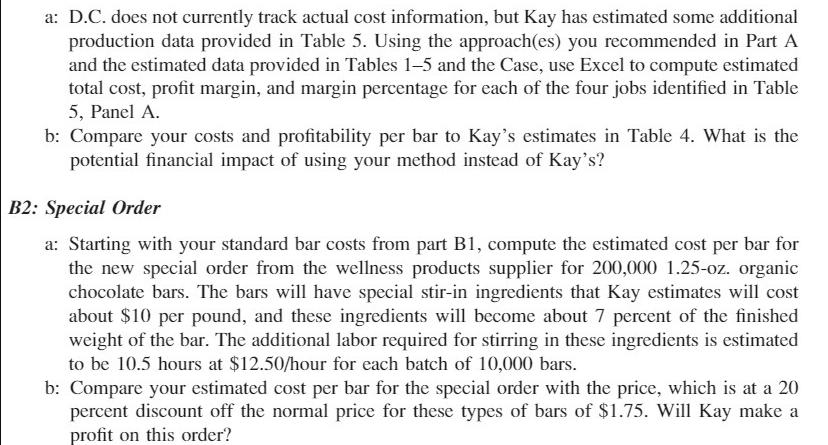

a: D.C. does not currently track actual cost information, but Kay has estimated some additional production data provided in Table 5. Using the approach(es) you recommended in Part A and the estimated data provided in Tables 1-5 and the Case, use Excel to compute estimated total cost, profit margin, and margin percentage for each of the four jobs identified in Table 5, Panel A. b: Compare your costs and profitability per bar to Kay's estimates in Table 4. What is the potential financial impact of using your method instead of Kay's? B2: Special Order a: Starting with your standard bar costs from part B1, compute the estimated cost per bar for the new special order from the wellness products supplier for 200,000 1.25-oz. organic chocolate bars. The bars will have special stir-in ingredients that Kay estimates will cost about $10 per pound, and these ingredients will become about 7 percent of the finished weight of the bar. The additional labor required for stirring in these ingredients is estimated to be 10.5 hours at $12.50/hour for each batch of 10,000 bars. b: Compare your estimated cost per bar for the special order with the price, which is at a 20 percent discount off the normal price for these types of bars of $1.75. Will Kay make a profit on this order?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started