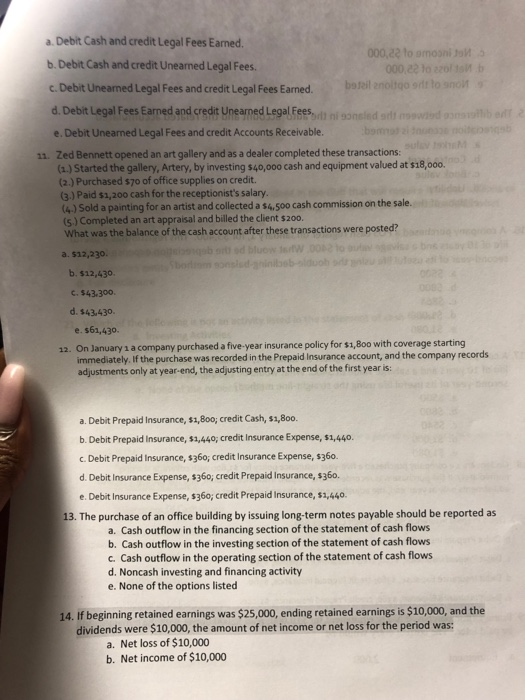

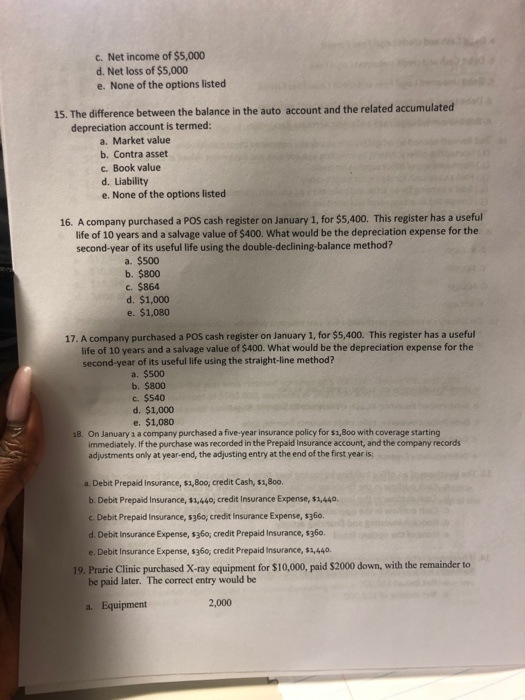

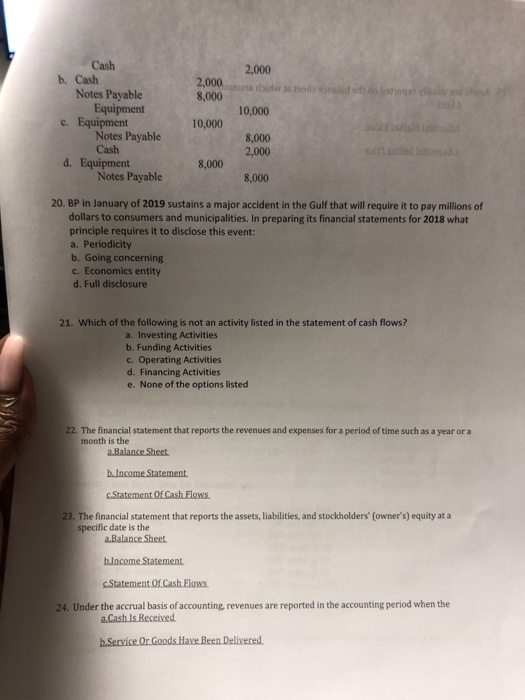

a. Debit Cash and credit Legal Fees Eaned. b. Debit Cash and credit Unearned Legal Fees c. Debit Unearned Legal Fees and credit Legal Fees Earned. d. Debit Legal Fees Earned and credit Unearned Legal Fees e. Debit Unearned Legal Fees and credit Accounts Receivable ni soneled s Zed Bennett opened an art gallery and as a dealer completed these transactions (1.) Started the gallery, Artery, by investing $40,000 cash and equipment valued at s18,000. (2.) Purchased s7o of office supplies on credit. (3-) Paid $1,200 cash for the receptionist's salary. 11. 4-) Sold a painting for an artist and collected a s4,5oo cash commission on the sale. (S.) Completed an art appraisal and billed the client s200. What was the balance of the cash account after these transactions were posted? a. $12,230. b. $12,430 . $43.300. d. s43.430 e. $61,430 12. On January 1 a company purchased a five-year insurance policy for $1,800 with coverage starting immediately. If the purchase was recorded in the Prepaid Insurance account, and the company records adjustments only at year-end, the adjusting entry at the end of the first year is: a. Debit Prepaid Insurance, $1,800, credit Cash, $1,800. b. Debit Prepaid Insurance, $1,440, credit Insurance Expense, $1,440. c. Debit Prepaid Insurance, $360, credit Insurance Expense, $360. d. Debit Insurance Expense, $360, credit Prepaid Insurance, s360. e. Debit Insurance Expense, $360, credit Prepaid Insurance, $1,440 13. The purchase of an office building by issuing long-term notes payable should be reported as a. Cash outflow in the financing section of the statement of cash flows b. Cash outflow in the investing section of the statement of cash flows c. Cash outflow in the operating section of the statement of cash flows d. Noncash investing and financing activity e. None of the options listed 14. if beginning retained earnings was $25,000, ending retained earnings is $10,000, and the dividends were $10,000, the amount of net income or net loss for the period was: a. Net loss of $10,000 b. Net income of $10,000 c. Net income of $5,000 d. Net loss of $5,000 e. None of the options listed 15. The difference between the balanc depreciation account is termed: e in the auto account and the related accumulated a. Market value b. Contra asset c. Book value d Liability e. None of the options listed 16. A company purchased a POs cash register on January 1, for $5,400. This register has a useful life of 10 years and a salvage value of $400. What would be the depreciation expense for the second-year of its useful life using the double-declining-balance method? a. $500 b. $800 c. $864 d. $1,000 e. $1,080 17. A company purchased a POS cash register on January 1, for $5,400. This register has a useful life of 10 years and a salvage value of $400. What would be the depreciation expense for the second-year of its useful life using the straight-line method? a. $500 b. $800 c. $540 d. $1,000 e. $1,080 On January 1 a company purchased a five-year insurance policy for s1,800 with coverage starting immediately. If the purchase was recorded in the Prepaid Insurance account, and the company records adjustments only at year-end, the adjusting entry at the end of the first year is: 18. a. Debit Prepaid Insurance, $1,800, credit Cash, $1,800 b. Debit Prepaid Insurance, $1,440, credit Insurance Expense, $1,440 . Debit Prepaid Insurance, s360, credit Insurance Expense, s360. d. Debit Insurnce Expense, s36o, credit Prepaid Insurance, s360. e. Debit Insurance Expense, $360, credit Prepaid Insurance, $3,440 19. Prarie Clinic purchased X-ray equipment for $10,000, paid $2000 down, with the remainder to be paid later. The correct entry would be a. Equipment 2,000 Cash 2,000 b. Cash 2,000 8,000 Notes Payable c. Equipment d. Equipment ble Equipment 10,000 10,000 Notes Payable Cash 8,000 2,000 8,000 8,000 20. BP in January of 2019 sustains a major accident in the Gulf that will require it to pay millions of dollars to consumers and municipalities. In preparing its financial statements for 2018 what principle requires it to disclose this event: a. Periodicity b. Going concerning c. Economics entity d. Full disclosure 21. Which of the following is not an activity listed in the statement of cash flows? a. Investing Activities b. Funding Activities c. Operating Activities d. Financing Activities e. None of the options listed 22. The financial statement that reports the revenues and expenses for a period of time such as a year or a month is the 23. The financial statement that reports the assets, liabilities, and stockholders' (owner's) equity at a specific date is the a.Balance Sheet 24. Under the accrual basis of accounting, revenues are reported in the accounting period when the 25. Assets are usually reported on the balance sheet at which amount