A detailed case study on Fitbit: The Business About Wrist. From below image

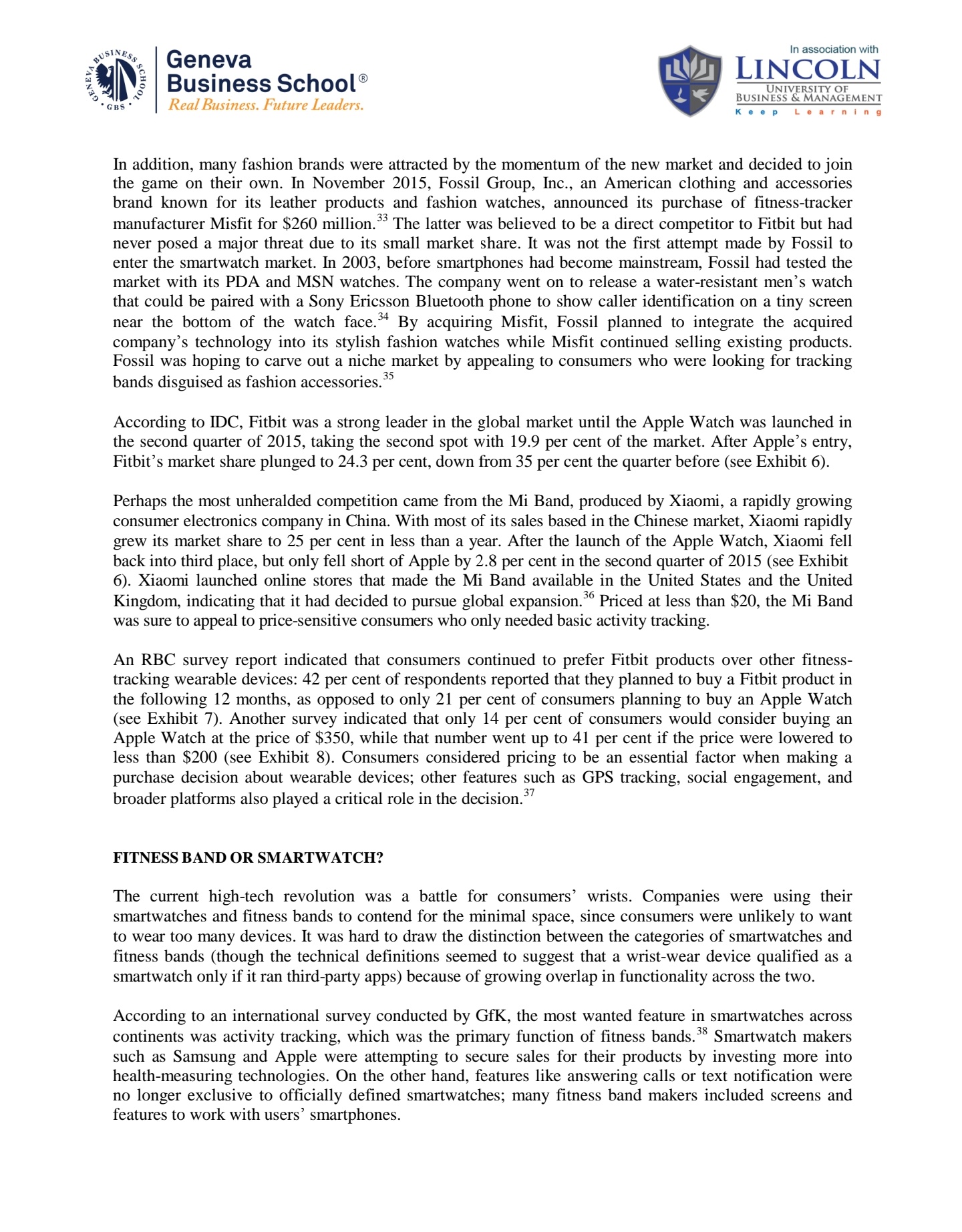

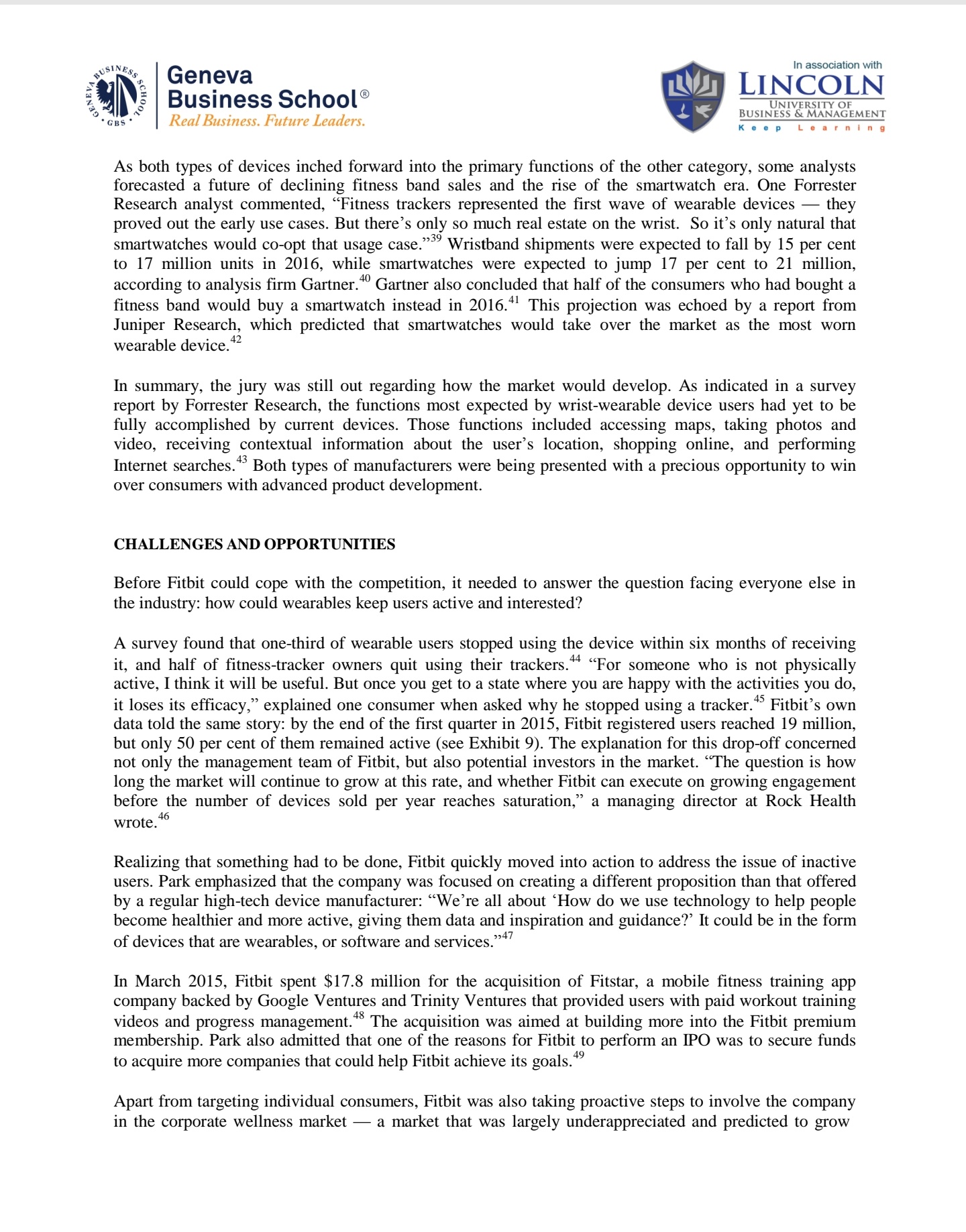

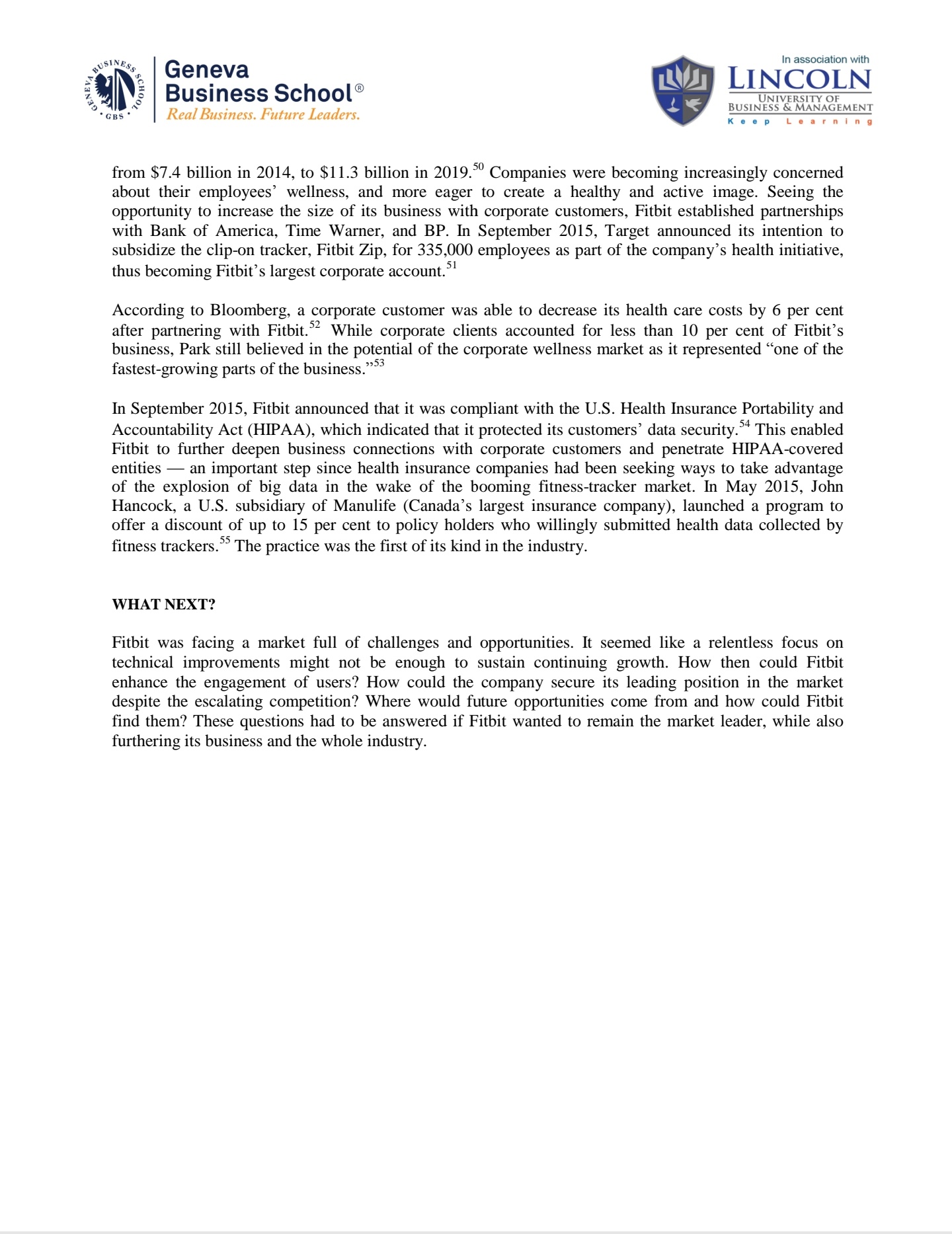

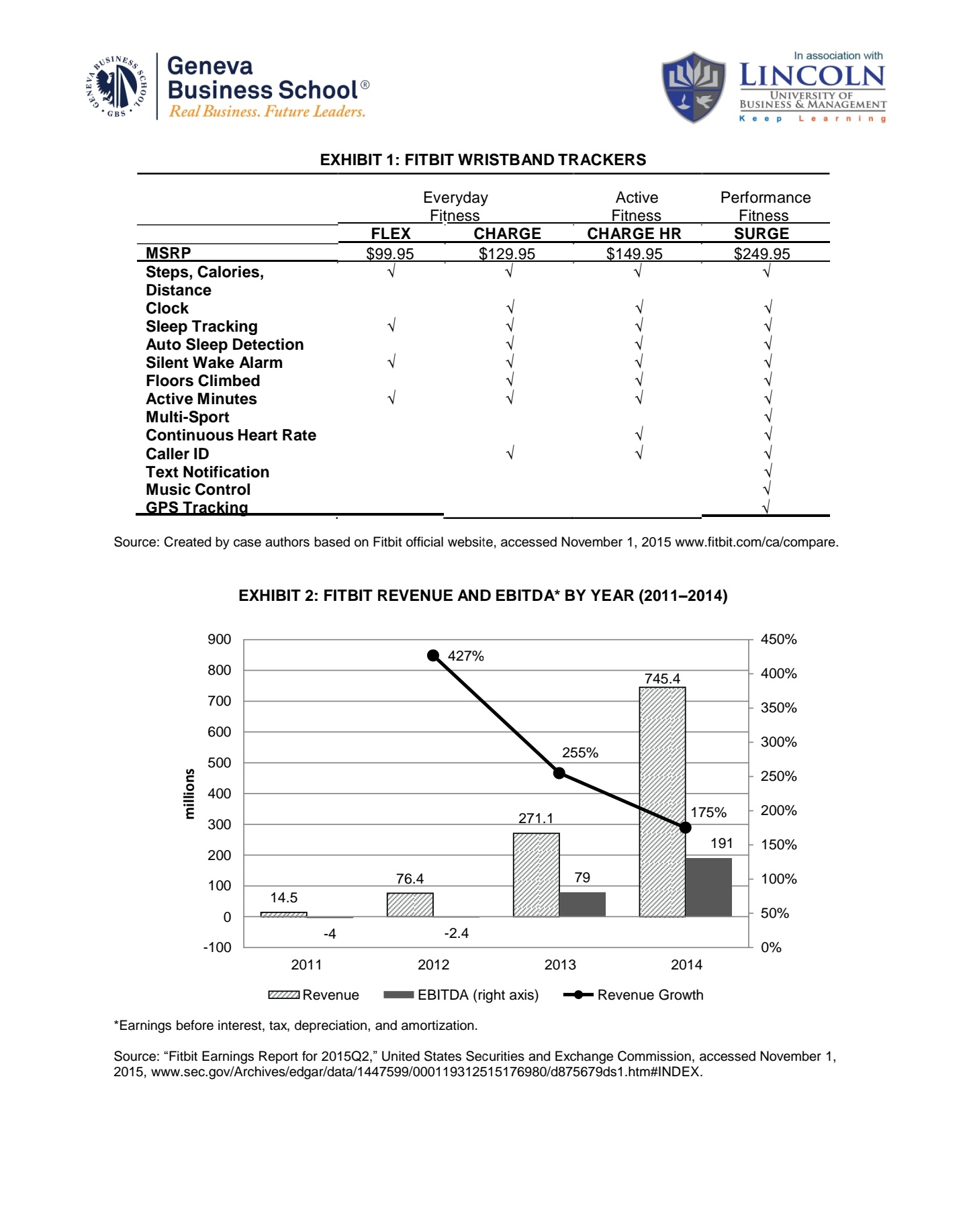

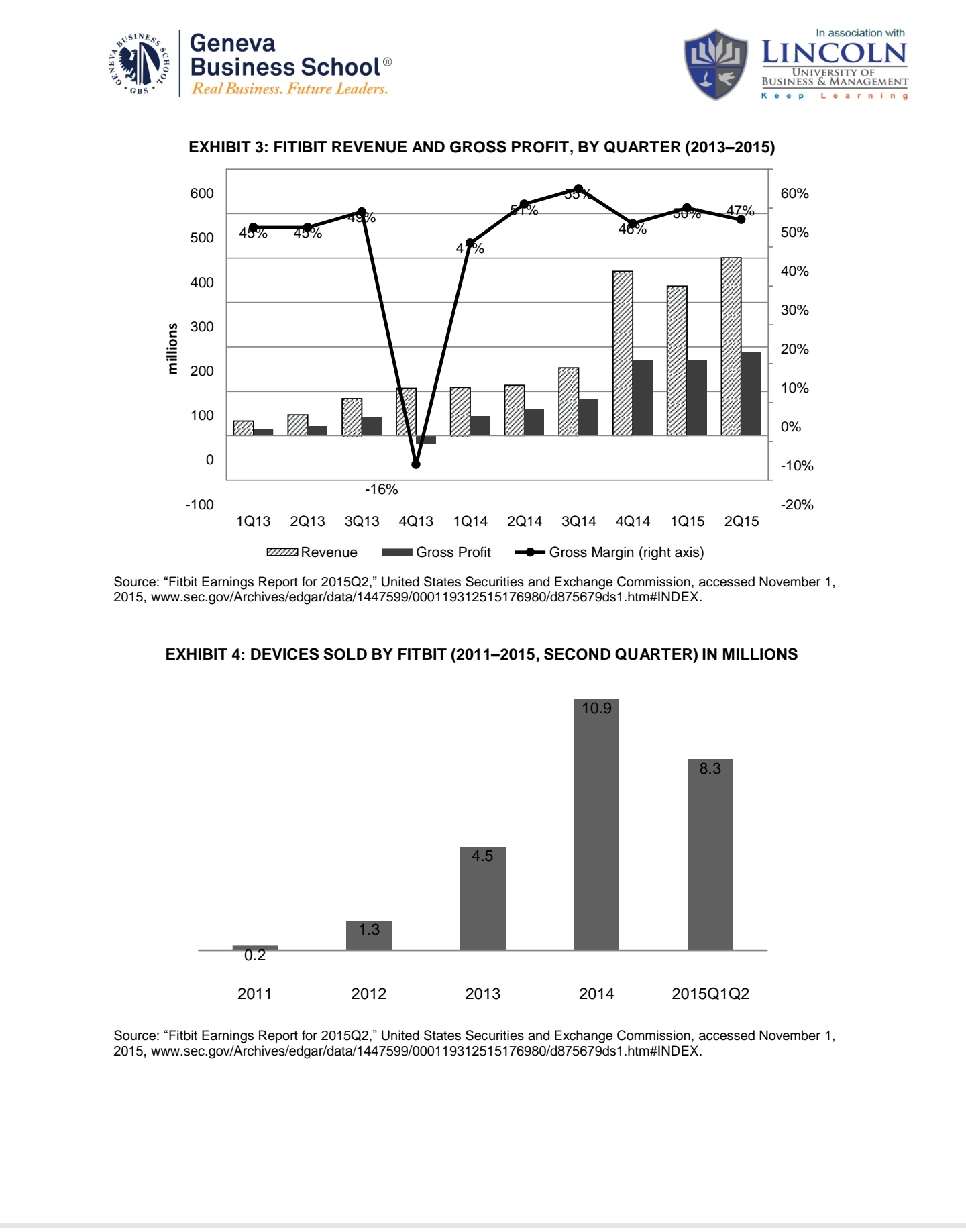

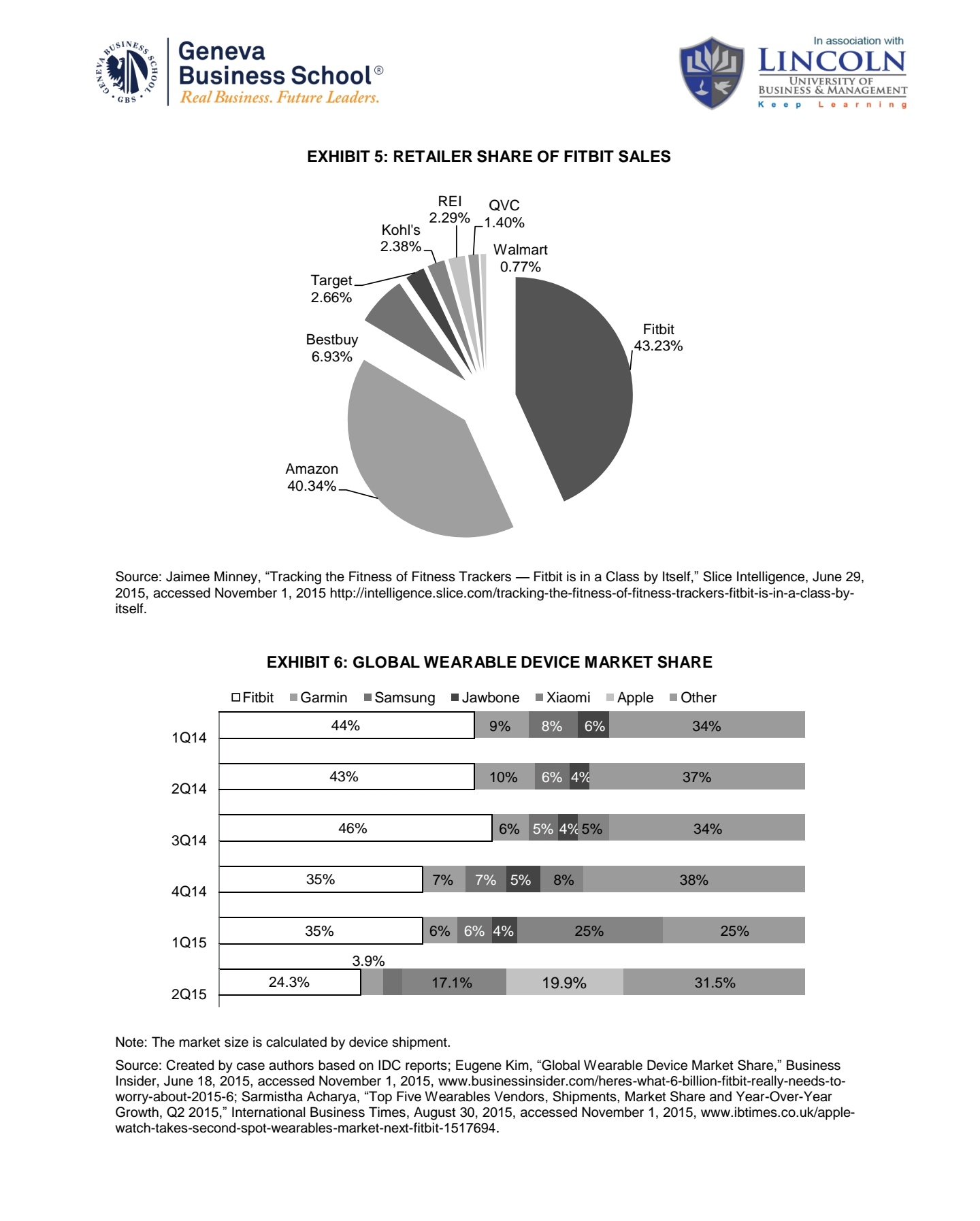

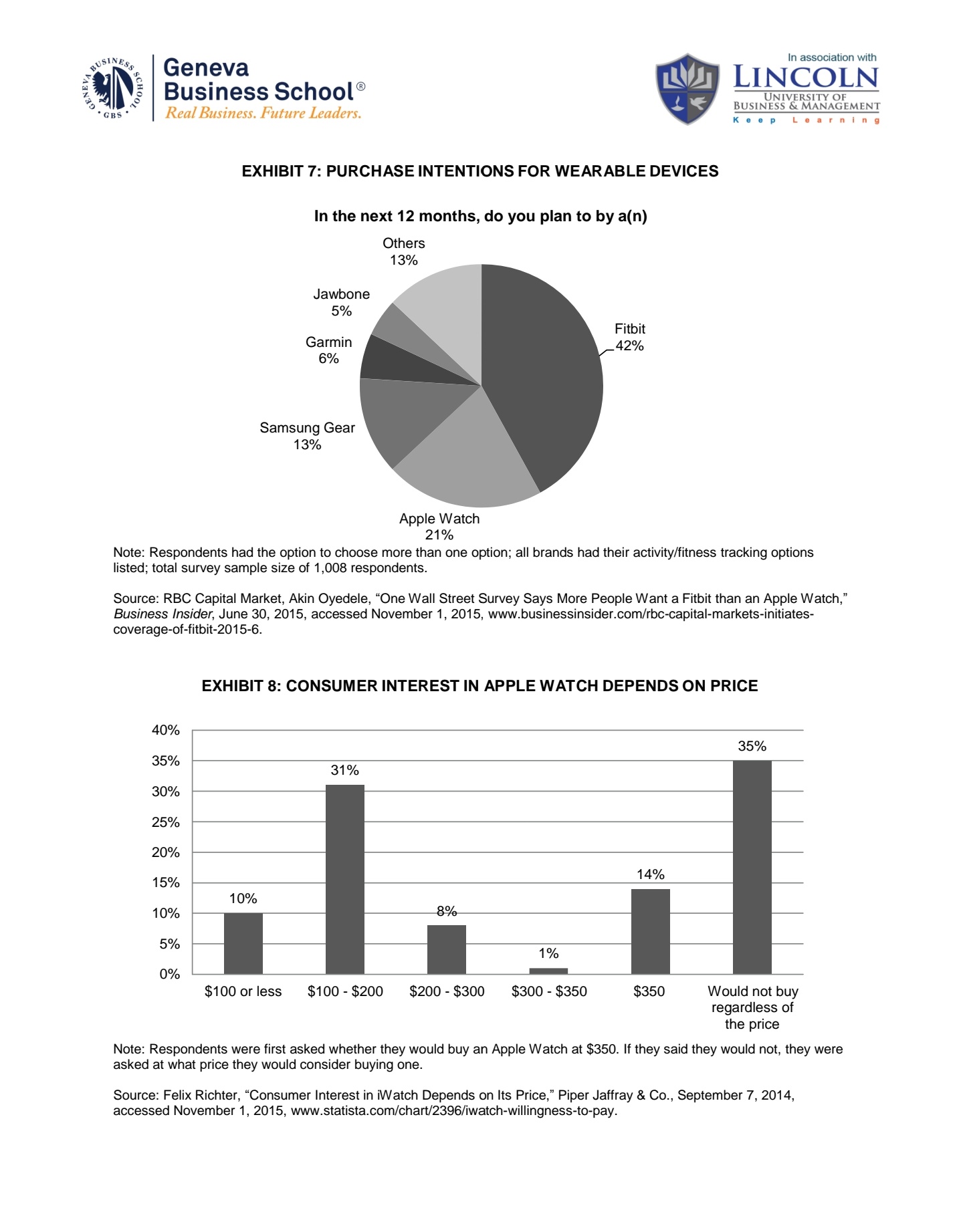

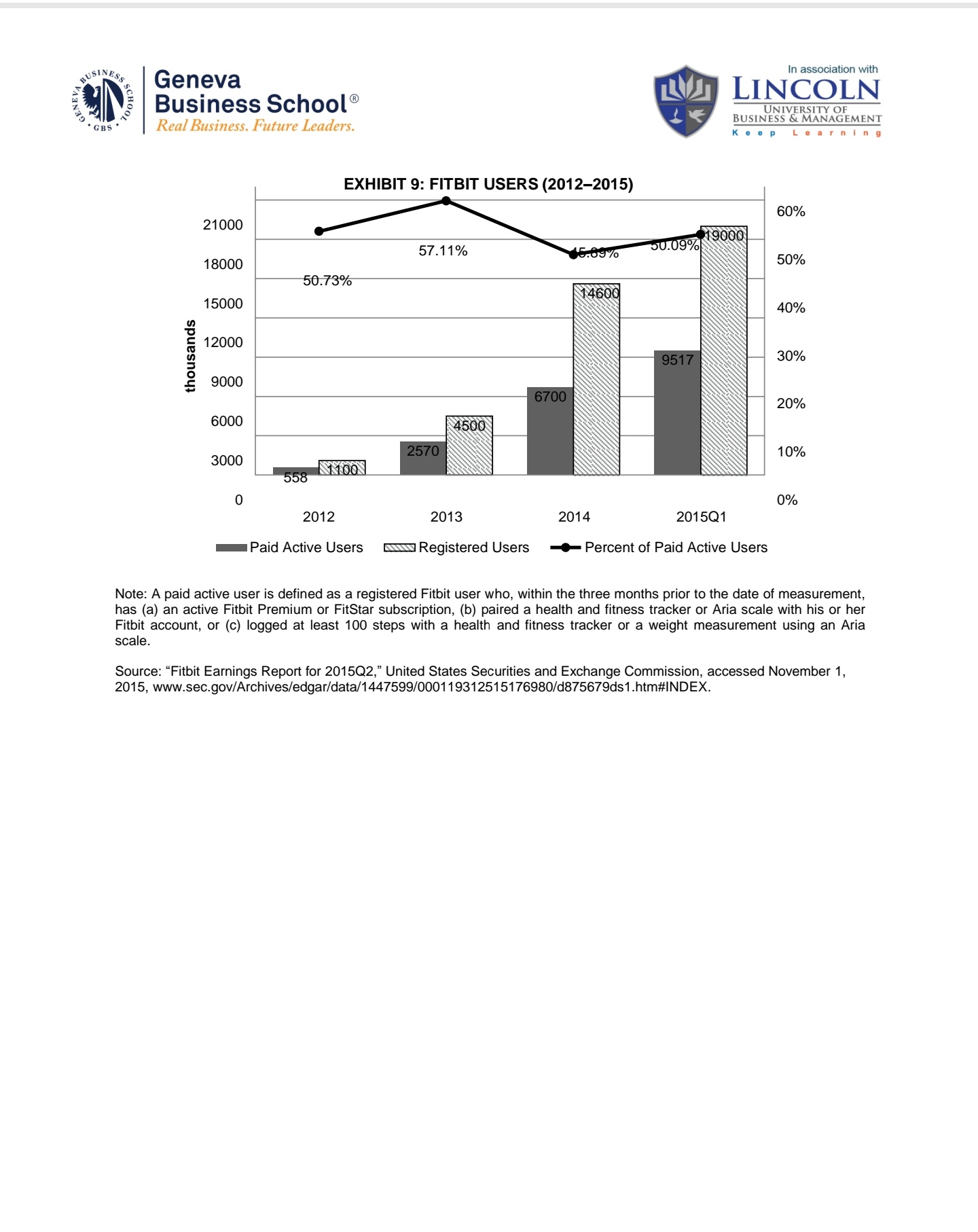

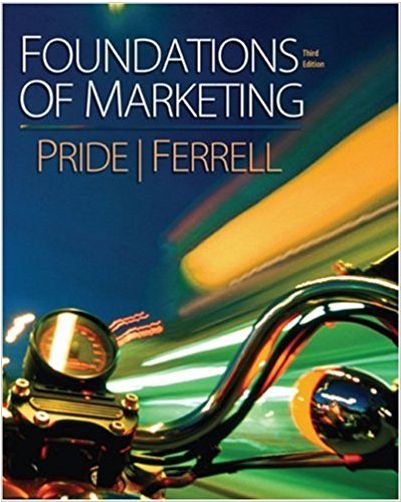

ENEVA BUSINESSS Geneva In association with Business School LINCOLN UNIVERSITY OF Real Business. Future Leaders. BUSINESS & MANAGEMENT Keep Learning FITBIT: THE BUSINESS ABOUT WRIST' Xiaoke (Coco) Xu and Professor Xin (Shane) Wang wrote this case solely to provide material for class discussion. The authors do not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western University, London, Ontario, Canada, N6G ON1; (t) 519.661.3208; (e) cases@ivey.ca; www.iveycases.com. Copyright @ 2016, Richard Ivey School of Business Foundation Version: 2016-06-03 On August 3, 2015, two days before its second-quarter earnings report came out, Fitbit, Inc.'s stock price hit an all-time high of $50.99." A few months earlier, when Fitbit went public on June 18, it opened on its first day of trading at a price of $30.40, 52 per cent higher than its initial public offering (IPO) price. As what appeared to be the most successful IPO so far in 2015, Fitbit attracted significant attention and inevitably drew controversy as well. Investors with favourable impressions of the new public company anticipated great potential and a promising future for Fitbit. Others were less positive, calling it a fad without any real opportunity for future development. What was Fitbit, and what could it become? The question concerned not only potential investors but also James Park, chief executive officer (CEO) of the high-tech company.' FITBIT Fitbit was founded as Healthy Metrics Research, Inc. in the U.S. state of Delaware in March 2007, and later adopted its current name. In 2015, the company started to appear frequently in mainstream news due to its eye-catching IPO, but Fitbit had made its name among consumers before that as a wearable fitness- tracking device maker. It started with clip-on activity trackers that were able to record the number of steps taken and calories burned on a daily basis, before graduating to its well-known wristband-style fitness tracker, which integrated more features and functions. By August 2015, Fitbit had seven products in the market: two clippable activity trackers, four wristband- style trackers, and a smart scale. The collection of wristband trackers was designed to serve users with different levels of demand. The basic model, Fitbit Flex, was aimed at those with simple needs tracking only steps, calories, and sleeping cycles. The high-end model, Fitbit Surge, covered a much broader range of functions typically found on smartwatches and similar devices, such as text notification and music control. Fitbit grouped its wristband products into three categories by level of "smartness" and available functions. The manufacturer's suggested retail price of these wristbands ranged from $99.95 to $249.95 (see Exhibit 1). The Fitbit scale, Aria, priced at $129.95, was a smart device that tracked weight, body mass index, and body fat percentage. It synced wirelessly with Fitbit trackers and apps to record weight stats to help users monitor workout progress.Geneva - ens - Real Business. Future Leaders. In association with LINCOLN UNIVERSITY OF BUSINESS 8r. MANAGEMENT Klop Lnarning a\"? Business School In an effort to add a sense of fashion to its tracking products, Fitbit worked with American fashion designer Tory Burch to offer an exclusive accessory collection that Fitbit hoped would \"transform Fitbit Flex tracker into a super chic accessory.\"4 The tracker part of the Fitbit Flex could be removed from the wristband and inserted into a Tory Burch bracelet or pendant so the tracker had a fashionable appearance that t better with the wearer's clothes. Depending on the material used (leather, metal, or silicon), the bracelet accessories cost $175, $195, and $38, respectively. Pendant necklaces cost $175. Park saw his company not merely as a hardware manufacturer, but as an integrated wellness platform that provided information and assistance to help users achieve their tness and health goals. \"While press and analysts focus on Fitbit as a wearables company, the mission of the company is actually a lot broader,\" he said.5 The Fitbit app was introduced for users to easily access the data recorded on their trackers in order to review their workout progress. The app also connected all users to an online conununity, so they could create their tness social network by sharing and comparing tness goals and achievements with friends via the app. For $49.99 per year, an upgrade option, Fitbit Premium, was offered to registered users to provide digital training and health consulting services. The upgraded service explored tness data and produced activity reports, which could be used to develop or modify tness plans for its users. The idea of a tness app was not exclusive to Fitbit and the company sought to embrace this fact. To promote a better user experience, Fitbit made its trackers compatible with other tness apps. Users could upload their data to certain widely used apps like Lose It! and Microsoft HealthVault (though Fitbit had not allowed its trackers to be linked to Apple Health so far). Apart from tness apps, Fitbit also made it possible for users to turn their daily activity records into reward points. Furthermore, the trackers could be linked to retailers' apps like Walgreens' Balance Rewards, which allotted 20 points for every mile walked or run, and 20 points for a daily weigh-in.6 Meanwhile, Fitbit had not stopped enhancing its core technology to make the device smarter and more useful. A major update was introduced to Charge HR and Surge users in November 2015. The new system, called SmartTrack1 enabled the devices to identify a variety of tness activities through continuous body movements, which meant that users no longer needed to manually log in what exercises they were engaged in. The update also delivered more accurate heart-rate tracking during high-intensity workouts.7 In many ways, Fitbit's performance had been outstanding. As of 2014, it led the US tness-tracker market with a share of 68 per cent.'3 The company's revenue had shown continual growth since 2011 (see Exhibit 2), and a tremendous surge in revenue in the fourth quarter of 2014 (see Exhibit 3). In the rst two quarters of 2015, Fitbit generated revenue of $737 million nearly as much as its entire year's revenue in 2014 ($745 million).9 Indeed, Fitbit had sold 8.3 million of its devices during the rst two quarters of 2015, compared to 10.9 million for the whole year of 2014 (see Exhibit 4). The total amount of units sold in 2015 was expected to reach 16 million according to one analysis.lo More than 80 per cent of Fitbit orders were placed on Amazon or Fitbit's official online shop (see Exhibit 5). Fitbit Flex and Charge HR were reported to be the two best-selling wrist-worn devices sold online by Amazon, Bestbuy, Target, and Walmart.ll Despite this dramatic growth, the quarterly gross margin had remained above 40 per cent since 2013. The exception was the fourth quarter of 2013 when Fitbit recalled Fitbit Force due to a number of complaints about skin irritation. Further good news came from research indicating that overseas sales contributed to only one-quarter of Fitbit's total revenue in 2014; this implied plenty of potential for international expansion. 12 In association wilh Geneva HIRE BusinessSchool W . . BUSINESS 8?. MANAGEMENT Gas Rialh'nsmm. fritmchaderr. K . . P L . . r n i .. 9 WEARABLE DEVICE MARKET Technological development enabled the emergence of various wearable devices like Google Glass and smartwatches. Although Apple was not the rst company to introduce a smartwatch product, it brought the wearable device market into the spotlight with the release of its Apple Watch. As of 2015, almost all of the major companies in the consumer electronics industry had launched smartwatch products, including Samsung, Motorola, and LG, further suggesting that the market for wearable devices was growing. According to global market research company Ipsos, eight out of 10 American adults had at least heard of wearable devices, while more than four out of 10 were very familiar with or owned a wearable device. 13 One study into purchase intentions for electronic devices showed that about 18 per cent of Americans planned to buy a wearable device in the next 12 months (although the number planning to buy wearable devices was still far below those planning to buy a smartphone, tablet, or laptop). '4 American market research rm International Data Corporation (IDC) reported that the wearable devices market was growing faster than any other consumer electronics segment between 2010 and 2014. Sales in the wearable devices market tripled from 2013 to 2014,ls and analysts predicted that they would grow at a compound rate of 35 per cent from 2015 to 2020. 16 By 2018, the number of wearable devices shipped would reach 114 million units, representing a $33.7 billion revenue opportunity globally. 17 While \"wearable device\" (or 'vearable'? was a general term that could be applied to many gadgets such as eyewear or smart clothing, the market was predominantly fueled by wrist-worn devices like wristband trackers and smartwatches. In fact, wrist-worn devices accounted for 90 per cent of wearable products shipped in 2015. 18 ]DC revealed that the number of wrist-wom devices shipped jumped from 17.7 million units in 2013, to 40.7 million units in 2014, and was expected to reach 101.4 million by 2019, when the units sold in the entire wearable market would reach 126.1 million.19 Within the wrist-worn device sector, smartwatches represented a signicant share of the market. Smartwatch shipments were expected to rise at an annual rate of 41 per cent and to account for over 70 per cent of wearables shipped by 2019.20 As an example, the newly-released Apple Watch was projected to account for 40 per cent of smartwatches shipped in 2015, and to reach a peak at 48 per cent of smartwatches shipped in 201')'.21 The booming market in wearables could be attributed to consumers\" desire for mobile devices, growing attention to personal well-being, and technological advances in hardware development. More consumers were turning to mobile devices as their preferred platform for accessing information. Changing behaviours were also evident in the way that individuals seemed to be increasingly concerned about health and tness issues. In 2014, consumers spent over $200 billion on health and tness services.22 More people were tracking and managing their health directly on mobile devices, with more than 25 per cent of US. consumers using a tness app on a smartphone.\" Moreover, more accurate sensors and efcient batteries made it possible for wearable devices to recognize a broader range of biometric signals and stay powered for a longer time compared to the rst generation of stepcounting devices. All of these factors worked together to push the industry forward and ensure it gathered more attention. COMPETITION By the time Fitbit went public in 2015, its market share in the U.S. wearable devices market had already reached 76 per cent.24 However, this leading position in the market did not guarantee the company's long- term success; it still had to deal with considerable competition from other wearable device makers. Competitors joined the market, including both well-known electronic manufacturers and global sports outt brands (e.g., Samsung, Gar-min, and Nike). Each brand had a different focus and vision for the emerging market. In association wilh Geneva 3'1'EBusinessSchoolG' 1% BUSINESS Sr. MANAGEMENT 'Gns' Realli'nrim'rs. Future Leaders. K . . p L . . r n i n g Apple's major entry to the market came with the introduction of the Apple Watch. In this entry, Apple followed its long-time rival in the smartphone industry, Samsung. Both companies had made the smartwatch segment the focus of their wristoriented business. The Apple Watch and Samsung Gear series both included activity-tr'acldng and heart-ratemonitoring features. These devices dazzled consumers with comprehensive apps and functions that worked like miniatures of the respective smartphones of the two companies. When Apple released its smartwatch in April 2015, Fitbit's initial concern was that its sales would be undermined by competition from the hugely popular Apple brand. Yet the sales record afterwards told otherwise: The new Apple Watch did not have a clear negative impact on the sales of Fitbit products, which remained at their regular level during and after the Apple release.\" In September 2015, Apple increased competition by introducing a new Apple Watch collection in partnership with Hermes, the world-famous luxury leather manufacturer, to appeal to consumers concerned with fashion. Further, not everyone was competing in the same way as Apple. Withings, a consumer electronics company based in France, concentrated most of its products on the needs of health and lifestyle management. The company seemed to be emphasizing the \"watch\" part of a smartwatch: its device appeared to be a regular watch with real analog display. The campaign slogan for the Withings watch (\"French design, Swiss made\") highlighted the product's elegant design and careful crafting, suggesting a very different focus from the prototypes promoted by Samsung and Apple.26 Withings' CEO, Cedric Hutchings, said the company aimed to design a device that was primarily a watch, so people would want to wear it regardless of its tracking capabilities.27 The watch did have basic tracking functions but the data readout was available only on a smartphone that had been connected to the watch. Prompted by Apple's entry, Hutchings revealed a plan to introduce a pricier watch to compete in the premium market. He stressed, \"It's not about wrapping a piece of technology with highly desirable and super expensive goldy stuff . . . [but rather . . . about] making an honest and genuine watch that integrates these benefits and features.\"28 Swiss rm Garmin and U.S.-based Jawbone also developed distinct positioning strategies. Garmin elected to pursue the extreme of professionalism with its technologically-advanced devices that could track activities other than running and set alerts for heart rate. Divergent from the major trend of packing more features into the wristband, Jawbone was trying to keep its trackers' appearance and functions as simple as possible. While Garrnin included screens even for its entry-level model, Jawbone's newly released tracker, UP3, was, like its predecessors, still screenless. Jawbone chose to position itself as a \"lifestyle tracker\" that could be worn with other wearables at the same time. Aside from providing daily tracking, Jawbonc's yet to be released new model, UP4, was expected to be the rst fitness band to support near- eld communication payments in partnership with American Express.29 Jawbone's manager, Andrew Rosenthal, explained that Jawbone chose to take an alternative route from the majority because building a smartwatch \"is not where we'll win.\"30 However, this unique outlook did not seem to help Jawbone gain steam On the contrary, its market share kept shrinking in the face of steep competition. In November 2015, Jawbone laid off 60 employees (15 per cent of its overall workforce). It was the second time that year that the company had cut its labour, but this time it also shut down its New York City ofce and downsized a few others.31 Fitness giant Nike clung to a different view of the market. The rm disbanded the hardware team responsible for its own wearable tracker, FuelBand, in 2014. The company's CEO, Mark Parker, explained that Nike was \"focusing more on the software side of the experience," suggesting that the company would keep running the Nike+ tness platform on other wearable devices.32 - ens - Real Business. Future Leaders. In association wi1h Geneva HI\"? BusinessSchool 1% BUSINESS SLMANAGEMENT K I a p L n a r n i n 9 In addition, many fashion brands were attracted by the momentum of the new market and decided to join the game on their own. In November 2015, Fossil Group, Inc., an American clothing and accessories brand known for its leather products and fashion watches, announced its purchase of tness-tracker manufacturer Mist for $260 million.33 The latter was believed to be a direct competitor to Fitbit but had never posed a major threat due to its small market share. It was not the rst attempt made by Fossil to enter the smartwatch market. In 2003, before smartphones had become mainstream, Fossil had tested the market with its PDA and MSN watches. The company went on to release a water-resistant men's watch that could be paired with a Sony Ericsson Bluetooth phone to show caller identification on a tiny screen near the bottom of the watch face.34 By acquiring Mist, Fossil planned to integrate the acquired company's technology into its stylish fashion watches while Mist continued selling existing products. Fossil was hoping to carve out a niche market by appealing to consumers who were looking for tracking . . . - 35 bands d1sgu1sed as fashion accessorles. According to IDC, Fitbit was a strong leader in the global market until the Apple Watch was launched in the second quarter of 2015, taking the second spot with 19.9 per cent of the market. After Apple's entry, Fitbit's market share plunged to 24.3 per cent, down from 35 per cent the quarter before (see Exhibit 6). Perhaps the most unheralded competition came from the Mi Band, produced by Xiaomi, a rapidly growing consumer electronics company in China. With most of its sales based in the Chinese market, Xiaomi rapidly grew its market share to 25 per cent in less than a year. After the launch of the Apple Watch, Xiaomi fell back into third place, but only fell short of Apple by 2.8 per cent in the second quarter of 2015 (see Exhibit 6). Xiaomi launched online stores that made the Mi Band available in the United States and the United Kingdom, indicating that it had decided to pursue global expansiond'S Priced at less than $20, the Mi Band was sure to appeal to price-sensitive consumers who only needed basic activity tracking. An RBC survey report indicated that consumers continued to prefer Fitbit products over other tness- tracking wearable devices: 42 per cent of respondents reported that they planned to buy a Fitbit product in the following 12 months, as opposed to only 21 per cent of consumers planning to buy an Apple Watch (see Exhibit 7). Another survey indicated that only 14 per cent of consumers would consider buying an Apple Watch at the price of $350, while that number went up to 41 per cent if the price were lowered to less than $200 (see Exhibit 8). Consumers considered pricing to be an essential factor when making a purchase decision about wearable devices; other features such as GPS tracking, social engagement, and broader platforms also played a critical role in the decision.37 FITNESS BAND OR SMARTWATCH? The current high-tech revolution was a battle for consumers' wrists. Companies were using their smartwatches and tness bands to contend for the minimal space, since consumers were unlikely to want to wear too many devices. It was hard to draw the distinction between the categories of smartwatches and tness bands (though the technical denitions seemed to suggest that a wrist-wear device qualied as a smartwatch only if it ran third-party apps) because of growing overlap in functionality across the two. According to an international survey conducted by GfK, the most wanted feature in smartwatches across continents was activity tracking, which was the primary function of tness bands.38 Smartwatch makers such as Samsung and Apple were attempting to secure sales for their products by investing more into health-measuring technologies. 0n the other hand, features like answering calls or text notication were no longer exclusive to ofcially dened smartwatches; many tness band makers included screens and features to work with users' smartphones. In association with LINCOLN UNIVERSITY OF BUSINESS Sr. MANAGEMENT Kuup Llarnlng Geneva HIP; BusmessSchool - ens - Real Business. Future Leaders. As both types of devices inched forward into the primary functions of the other category, some analysts forecasted a future of declining tness band sales and the rise of the smartwatch era. One Forrester Research analyst commented, \"Fitness trackers represented the rst wave of wearable devices they proved out the early use cases. But there's only so much real estate on the wrist. So it's only natural that smartwatches would coopt that usage case.\"'l9 Wristband shipments were expected to fall by 15 per cent to 17 million units in 2016, while smartwatches were expected to jump 17 per cent to 21 million, according to analysis rm Gartner."0 Gartner also concluded that half of the consumers who had bought a tness band would buy a smartwatch instead in 2016.41 This projection was echoed by a report from Juniper Research, which predicted that smartwatches would take over the market as the most worn wearable device.42 In summary, the jury was still out regarding how the market would develop. As indicated in a survey report by Forrester Research, the functions most expected by mist-wearable device users had yet to be fully accomplished by current devices. Those functions included accessing maps, taking photos and video, receiving contextual information about the user's location, shopping online, and performing Internet searches.43 Both types of manufacturers were being presented with a precious opportunity to win over consumers with advanced product development. CHALLENGES AND OPPORTUNITIES Before Fitbit could cope with the competition, it needed to answer the question facing everyone else in the industry: how could wearables keep users active and interested? A survey found that one-third of wearable users stopped using the device within six months of receiving it, and half of tness-tracker owners quit using their trackers.M \"For someone who is not physically active, 1 think it will be useful. But once you get to a state where you are happy with the activities you do, it loses its efcacy,\" explained one consumer when asked why he stopped using a tracker.45 Fitbit's own data told the same story: by the end of the rst quarter in 2015, Fitbit registered users reached 19 million, but only 50 per cent of them remained active (see Exhibit 9). The explanation for this dropoff concerned not only the management team of Fitbit, but also potential investors in the market. \"The question is how long the market will continue to grow at this rate, and whether Fitbit can execute on growing engagement before the number of devices sold per year reaches saturation,\" a managing director at Rock Health wrote.46 Realizing that something had to be done, Fitbit quickly moved into action to address the issue of inactive users. Park emphasized that the company was focused on creating a different proposition than that offered by a regular high-tech device manufacturer: \"We're all about 'How do we use technology to help people become healthier and more active, giving them data and inspiration and guidance?' It could be in the form - - 47 of dev1ces that are wearables, or software and servrces.\" In March 2015, Fitbit spent $17.3 million for the acquisition of Fitstar, a mobile fitness training app company backed by Google Ventures and Trinity Ventures that provided users with paid workout training videos and progress management.\"3 The acquisition was aimed at building more into the Fitbit premium membership. Park also admitted that one of the reasons for Fitbit to perform an [PC was to secure funds to acquire more companies that could help Fitbit achieve its goals.49 Apart from targeting individual consumers, Fitbit was also taking proactive steps to involve the company in the corporate wellness market a market that was largely underappreciated and predicted to grow In association with Geneva HID? BusinessSchool 1% BUSINESS 8:. MANAGEMENT 'cns' Realh'rttincrs. Future Leaders. K . . p L . a r n i n 9 from $7.4 billion in 2014, to $11.3 billion in 2019.50 Companies were becoming increasingly concerned about their employees' wellness, and more eager to create a healthy and active image. Seeing the opportunity to increase the size of its business with corporate customers, Fitbit established partnerships with Bank of America, Time Warner, and BP. In September 2015, Target announced its intention to subsidize the clip-on tracker, Fitbit Zip, for 335,000 employees as part of the company's health initiative, thus becoming Fitbit's largest corporate account.51 According to Bloomberg, a corporate customer was able to decrease its health care costs by 6 per cent after partnering with Fitbit.52 While corporate clients accounted for less than 10 per cent of Fitbit's business, Park still believed in the potential of the corporate wellness market as it represented \"one of the fastest-growing parts of the business.\"53 In September 2015, Fitbit announced that it was compliant with the US. Health Insurance Portability and Accountability Act (HIPAA), which indicated that it protected its customers' data security.54 This enabled Fitbit to further deepen business connections with corporate customers and penetrate HIPAAcovered entities an important step since health insurance companies had been seeking ways to take advantage of the explosion of big data in the wake of the booming tness-tracker market. In May 2015, John Hancock, 3 U.S. subsidiary of Manulife (Canada's largest insurance company), launched a program to offer a discount of up to 15 per cent to policy holders who willingly submitted health data collected by tness trackers.\" The practice was the rst of its kind in the industry. WHAT NEXT? Fitbit was facing a market full of challenges and opportunities. It seemed like a relentless focus on technical improvements might not be enough to sustain continuing growth. How then could Fitbit enhance the engagement of users? How could the company secure its leading position in the market despite the escalating competition? Where would future opportunities come from and how could Fitbit nd them? These questions had to be answered if Fitbit wanted to remain the market leader, while also furthering its business and the whole industry. BUSINESS S Geneva In association with GENEV UNIVERSITY 20 . CBS . TOO HOS Business School LINCOLN Real Business. Future Leaders. BUSINESS & MANAGEMENT Keep Learning EXHIBIT 1: FITBIT WRISTBAND TRACKERS Everyday Active Performance Fitness Fitness Fitness FLEX CHARGE CHARGE HR SURGE MSRP $99.95 $129.95 $149.95 $249.95 Steps, Calories, Distance Clock Sleep Tracking Auto Sleep Detection