Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A) Determine the range of stock prices in 3 months for which straddle outperforms strangle. B) Draw profit diagram of both straddle and strangle spread

A) Determine the range of stock prices in 3 months for which straddle outperforms strangle.

B) Draw profit diagram of both straddle and strangle spread on the same graph. Carefully label the levels and turning points such as maximum profit, maximum loss, and break-even prices on the graph.

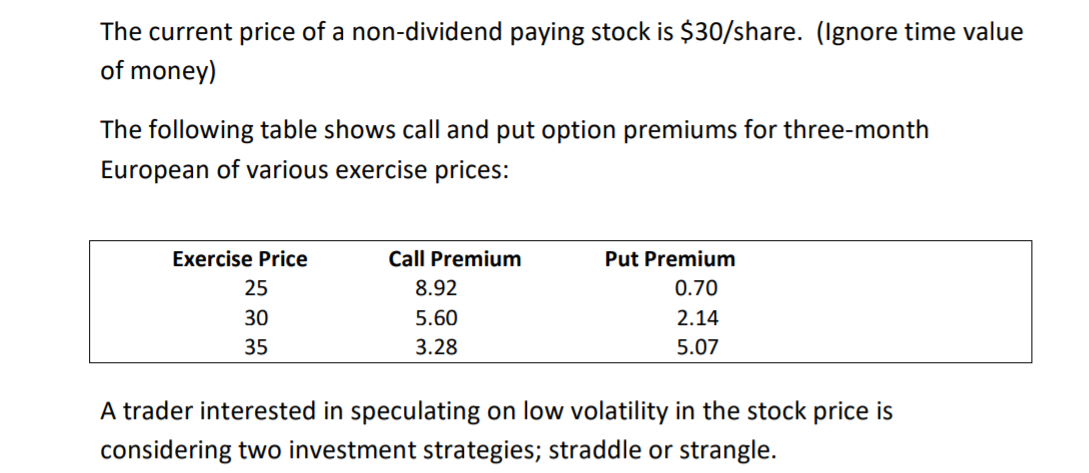

The current price of a non-dividend paying stock is $30/share. (Ignore time value of money) The following table shows call and put option premiums for three-month European of various exercise prices: Exercise Price 25 30 35 Call Premium 8.92 5.60 3.28 Put Premium 0.70 2.14 5.07 A trader interested in speculating on low volatility in the stock price is considering two investment strategies; straddle or strangleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started