Answered step by step

Verified Expert Solution

Question

1 Approved Answer

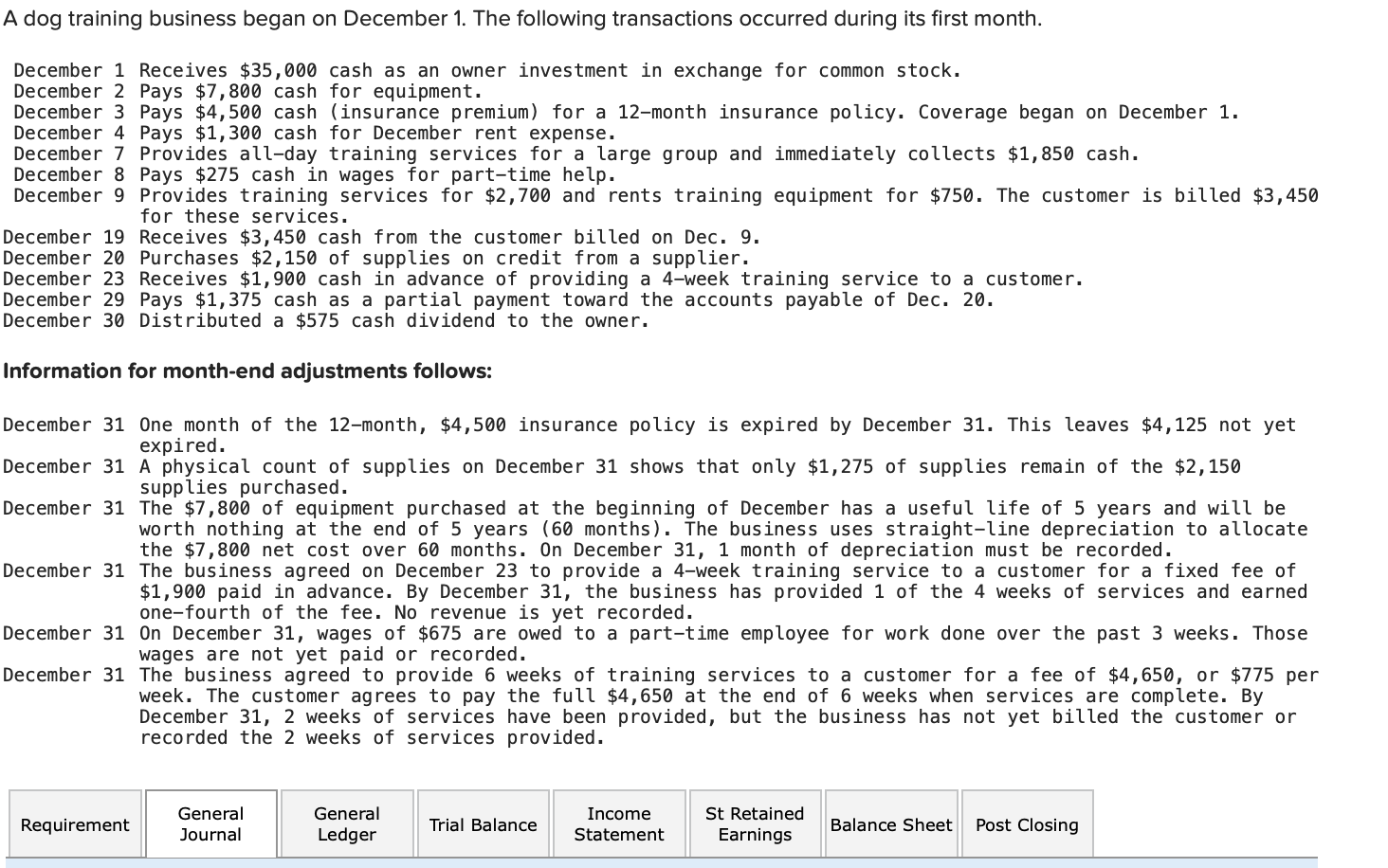

A dog training business began on December 1 . The following transactions occurred during its first month. December 1 Receives $ 3 5 , 0

A dog training business began on December The following transactions occurred during its first month.

December Receives $ cash as an owner investment in exchange for common stock.

December Pays $ cash for equipment.

December Pays $ cash insurance premium for a month insurance policy. Coverage began on December

December Pays $ cash for December rent expense.

December Provides allday training services for a large group and immediately collects $ cash.

December Pays $ cash in wages for parttime help.

December Provides training services for $ and rents training equipment for $ The customer is billed $

for these services.

December Receives $ cash from the customer billed on Dec.

December Purchases $ of supplies on credit from a supplier.

December Receives $ cash in advance of providing a week training service to a customer.

December Pays $ cash as a partial payment toward the accounts payable of Dec.

December Distributed a $ cash dividend to the owner.

Information for monthend adjustments follows:

December One month of the month, $ insurance policy is expired by December This leaves $ not yet

expired.

December A physical count of supplies on December shows that only $ of supplies remain of the $

supplies purchased.

December The $ of equipment purchased at the beginning of December has a useful life of years and will be

worth nothing at the end of years months The business uses straightline depreciation to allocate

the $ net cost over months. On December month of depreciation must be recorded.

December The business agreed on December to provide a week training service to a customer for a fixed fee of

$ paid in advance. By December the business has provided of the weeks of services and earned

onefourth of the fee. No revenue is yet recorded.

December On December wages of $ are owed to a parttime employee for work done over the past weeks. Those

wages are not yet paid or recorded.

December The business agreed to provide weeks of training services to a customer for a fee of $ or $ per

week. The customer agrees to pay the full $ at the end of weeks when services are complete. By

December weeks of services have been provided, but the business has not yet billed the customer or

recorded the weeks of services provided.

Need help:

Close revenue accounts. Hint: Prepare financial statements before recording closing entries.

Close expense accounts. Hint: Prepare financial statements before recording closing entries.

Close Income Summary account.

Close Dividends account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started