Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. During January, the company provided services for $43,000 on credit. b. On January 31, the company estimated bad debts using 2 percent of credit

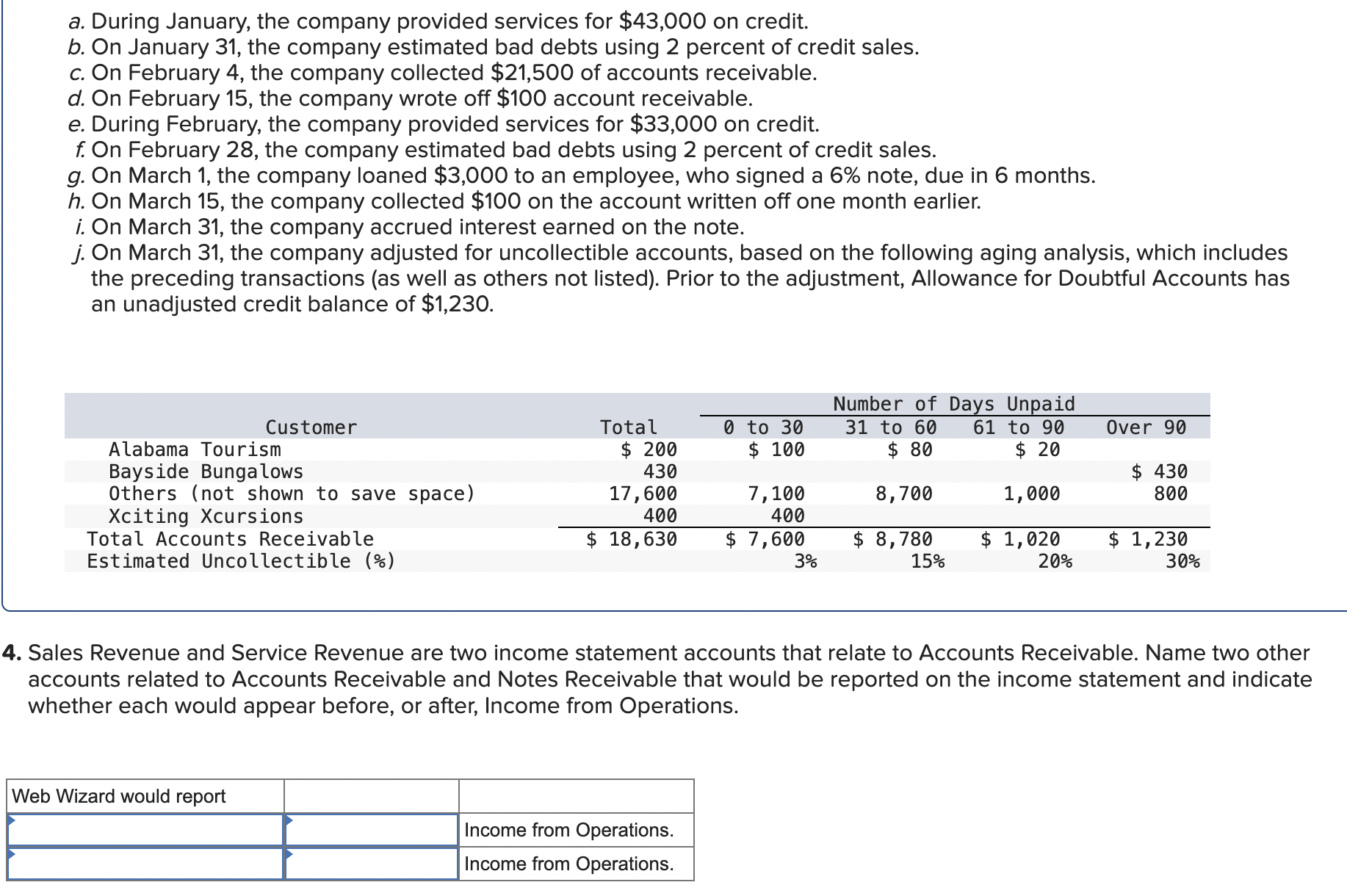

a. During January, the company provided services for $43,000 on credit. b. On January 31, the company estimated bad debts using 2 percent of credit sales. c. On February 4 , the company collected $21,500 of accounts receivable. d. On February 15 , the company wrote off $100 account receivable. e. During February, the company provided services for $33,000 on credit. f. On February 28, the company estimated bad debts using 2 percent of credit sales. g. On March 1, the company loaned $3,000 to an employee, who signed a 6% note, due in 6 months. h. On March 15, the company collected $100 on the account written off one month earlier. i. On March 31, the company accrued interest earned on the note. j. On March 31, the company adjusted for uncollectible accounts, based on the following aging analysis, which includes the preceding transactions (as well as others not listed). Prior to the adjustment, Allowance for Doubtful Accounts has an unadjusted credit balance of $1,230. Sales Revenue and Service Revenue are two income statement accounts that relate to Accounts Receivable. Name two other accounts related to Accounts Receivable and Notes Receivable that would be reported on the income statement and indicate whether each would appear before, or after, Income from Operations

a. During January, the company provided services for $43,000 on credit. b. On January 31, the company estimated bad debts using 2 percent of credit sales. c. On February 4 , the company collected $21,500 of accounts receivable. d. On February 15 , the company wrote off $100 account receivable. e. During February, the company provided services for $33,000 on credit. f. On February 28, the company estimated bad debts using 2 percent of credit sales. g. On March 1, the company loaned $3,000 to an employee, who signed a 6% note, due in 6 months. h. On March 15, the company collected $100 on the account written off one month earlier. i. On March 31, the company accrued interest earned on the note. j. On March 31, the company adjusted for uncollectible accounts, based on the following aging analysis, which includes the preceding transactions (as well as others not listed). Prior to the adjustment, Allowance for Doubtful Accounts has an unadjusted credit balance of $1,230. Sales Revenue and Service Revenue are two income statement accounts that relate to Accounts Receivable. Name two other accounts related to Accounts Receivable and Notes Receivable that would be reported on the income statement and indicate whether each would appear before, or after, Income from Operations Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started