Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A European call option on a stock with a strike price of $50 and expiring in six months is trading at $14. A European

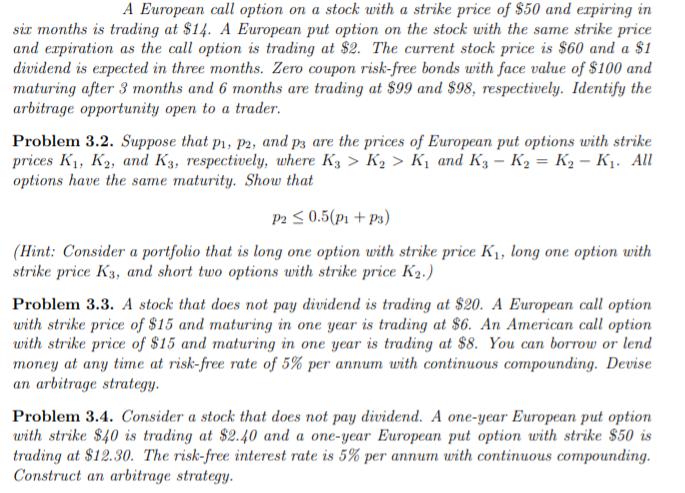

A European call option on a stock with a strike price of $50 and expiring in six months is trading at $14. A European put option on the stock with the same strike price and expiration as the call option is trading at $2. The current stock price is $60 and a $1 dividend is expected in three months. Zero coupon risk-free bonds with face value of $100 and maturing after 3 months and 6 months are trading at $99 and $98, respectively. Identify the arbitrage opportunity open to a trader. Problem 3.2. Suppose that p, p2, and p3 are the prices of European put options with strike prices K1, K2, and K3, respectively, where K3 > K> K and K3 - K = K- K. All options have the same maturity. Show that P2 0.5(p1 + P3) (Hint: Consider a portfolio that is long one option with strike price K, long one option with strike price K3, and short two options with strike price K2.) Problem 3.3. A stock that does not pay dividend is trading at $20. A European call option with strike price of $15 and maturing in one year is trading at $6. An American call option with strike price of $15 and maturing in one year is trading at $8. You can borrow or lend money at any time at risk-free rate of 5% per annum with continuous compounding. Devise an arbitrage strategy. Problem 3.4. Consider a stock that does not pay dividend. A one-year European put option with strike $40 is trading at $2.40 and a one-year European put option with strike $50 is trading at $12.30. The risk-free interest rate is 5% per annum with continuous compounding. Construct an arbitrage strategy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started