Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A European put on a share traded in an overseas market has one month to expiry and an exercise price of $2.00. It is

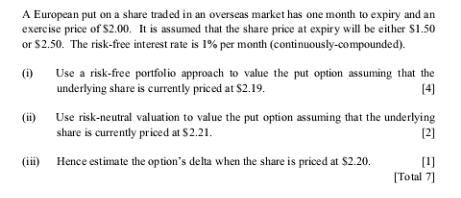

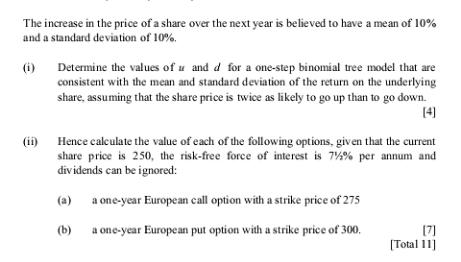

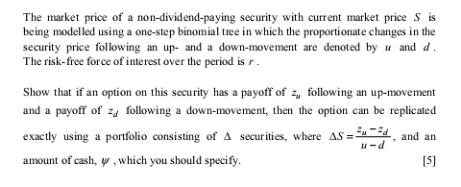

A European put on a share traded in an overseas market has one month to expiry and an exercise price of $2.00. It is assumed that the share price at expiry will be either $1.50 or $2.50. The risk-free interest rate is 1% per month (continuously-compounded). (1) Use a risk-free portfolio approach to value the put option assuming that the underlying share is currently priced at $2.19. [4] Use risk-neutral valuation to value the put option assuming that the underlying share is currently priced at $2.21. [2] (iii) Hence estimate the option's delta when the share is priced at $2.20. [1] [Total 7] The increase in the price of a share over the next year is believed to have a mean of 10% and a standard deviation of 10%. (i) Determine the values of u and d for a one-step binomial tree model that are consistent with the mean and standard deviation of the return on the underlying share, assuming that the share price is twice as likely to go up than to go down. (4) Hence calculate the value of each of the following options, given that the current share price is 250, the risk-free force of interest is 7% % per annum and dividends can be ignored: a one-year European call option with a strike price of 275 (b) a one-year European put option with a strike price of 300. [Total 11] The market price of a non-dividend-paying security with current market price Sis being modelled using a one-step binomial tree in which the proportionate changes in the security price following an up- and a down-movement are denoted by u and d. The risk-free force of interest over the period is r. Show that if an option on this security has a payoff of z, following an up-movement and a payoff of z following a down-movement, then the option can be replicated exactly using a portfolio consisting of A securities, where AS, and an amount of cash, y, which you should specify. [5] u-d

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

There are several questions across these images so Ill address each one in order Image 1 i Use a riskfree portfolio approach to value the put option assuming that the underlying share is currently pri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started